Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

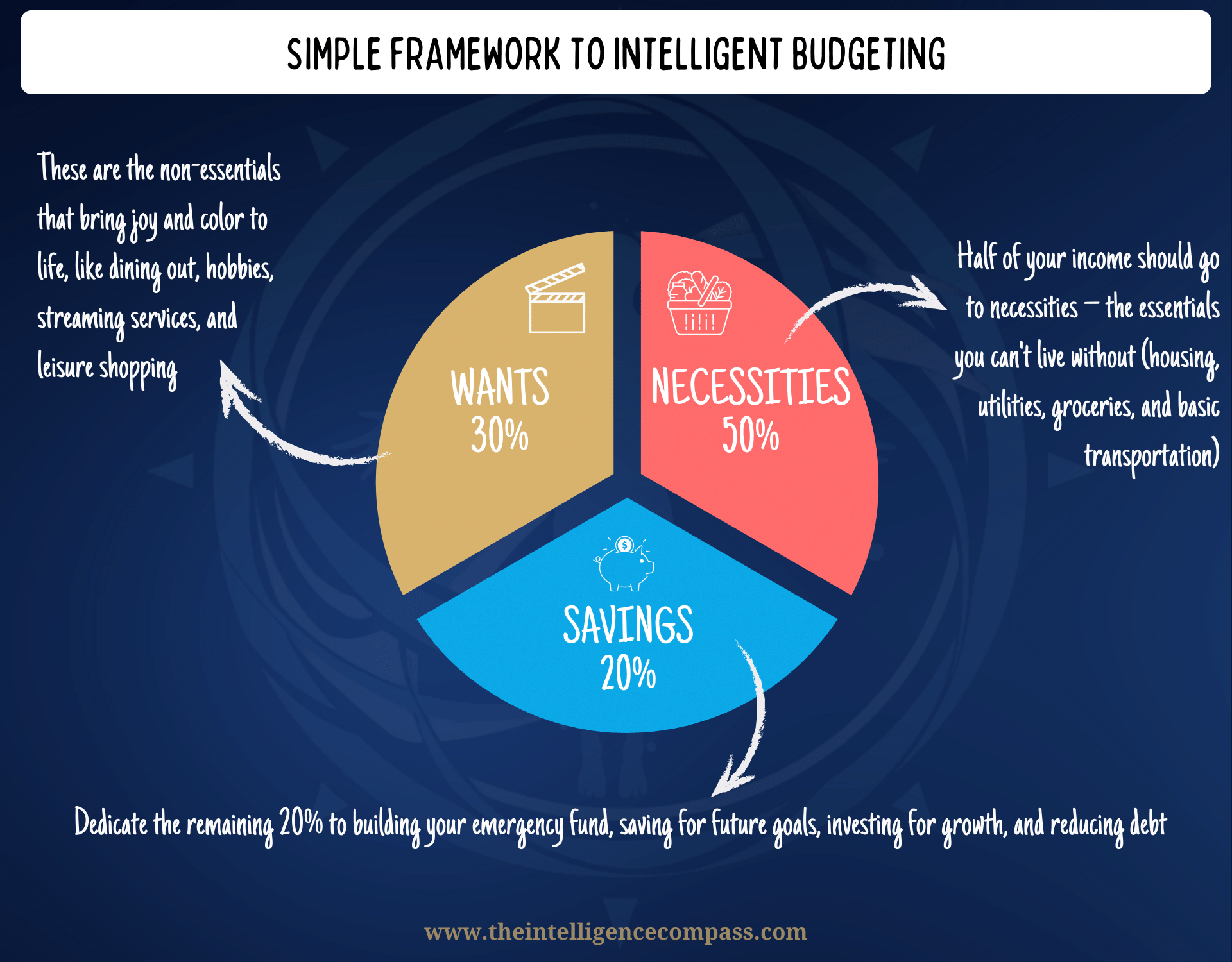

- The 50/30/20 Rule as a Foundation: Start with a simple, effective framework for budgeting – allocate 50% of income to necessities, 30% to wants, and 20% to savings and debt repayment.

- Customization is Crucial: Tailor your budget to reflect your personal goals, lifestyle, and values. Remember, your budget is a tool to achieve your dreams, not a constraint.

- Adaptability in Budgeting: Embrace flexibility in your budget to handle life's unpredictability. Regularly adjust and review your budget to adapt to changes in income or unexpected expenses.

- Prioritizing Essentials, Savings, and Debt: Balance your budget by ensuring essentials are covered, prioritize saving as a non-negotiable, and strategically tackle debts, especially high-interest ones.

- Tools and Techniques for Effective Budgeting: Utilize a mix of traditional (like spreadsheets) and modern digital tools (like budgeting apps) to keep track of your finances and stay on course with your financial goals.

Welcome back to the Wealth Intelligence Academy, where we tackle the world of finance with the seriousness of a cat chasing a laser pointer. As we delve into our third topic in the Basic Level module, I hope you've been soaking in the knowledge from our lessons on learning about money and getting fluent in financial jargon.

If you found navigating those as exciting as a kid in a candy store, brace yourself for the rollercoaster ride of Budgeting Basics.

Let's face it, the word 'budgeting' often brings to mind the same excitement as watching paint dry. But here at the WIA, I add a dash of spice to everything, even to the seemingly mundane task of managing your cash flow.

Budgeting isn't just about pinching pennies or living frugally, or knowing where your latte is coming from - whilst I appreciate a lot of people are in this situation (and the lessons here will definitely help), it is not the mindset we will approach this with.

I consider it the backbone of building and managing wealth – a skill set that's essential for anyone looking to secure a comfortable lifestyle.

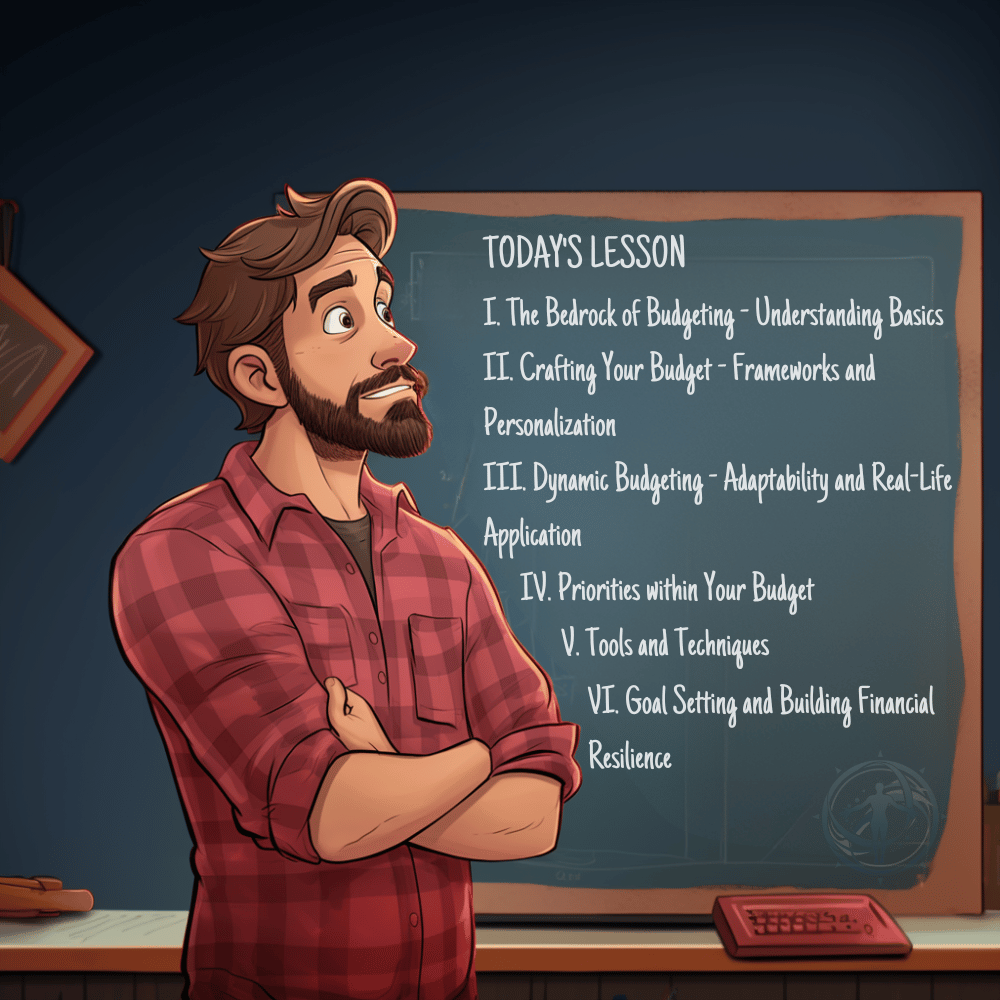

Here, we will focus on building up on your fluency in the budgeting space. The real practical strategies will come later as we tackle the strategic pillar. Here's a quick preview of what we'll cover:

- Understanding the Basics: Getting to grips with the fundamental principles of effective budgeting and continuing to build your financial literacy. I will make them as digestible as Grandma's apple pie

- Expense Management: Learn to categorize expenses like a pro – because not all spending is created equal (some are more equal than others). Choose your frequency (e.g. monthly spending).

- Setting and Achieving Goals: Linking your budgeting efforts to your financial planning and goal setting that make up your personal finances and wealth building journey. You're not getting anywhere without clear goals

- Tools of the Trade: Demystifying budgeting tools and techniques for beginners.

- Adapting to Changes: Learn to adjust your budget with the grace of a ballerina, because life loves throwing curveballs

- Lifestyle Alignment: Customizing your budget to fit your lifestyle because a one-size-fits-all approach to money is about as effective as a screen door on a submarine.

At the end of this article, I want you to start seeing budgeting as your financial compass, not your financial straightjacket. It helps you pinpoint the lifestyle you crave, chart the course to your goals, and keep you fueled and on track.

Imagine living life where every dollar spent is a step towards a goal, not away from it. That's the power of a well-crafted budget

I. The Bedrock of Budgeting - Understanding Basics

Let's break down the basics, shall we?

Here's a simple framework.

In the financial community, there's a well-known starting point for budgeting - the 50/30/20 rule. It's not my brainchild, but I swear by it.

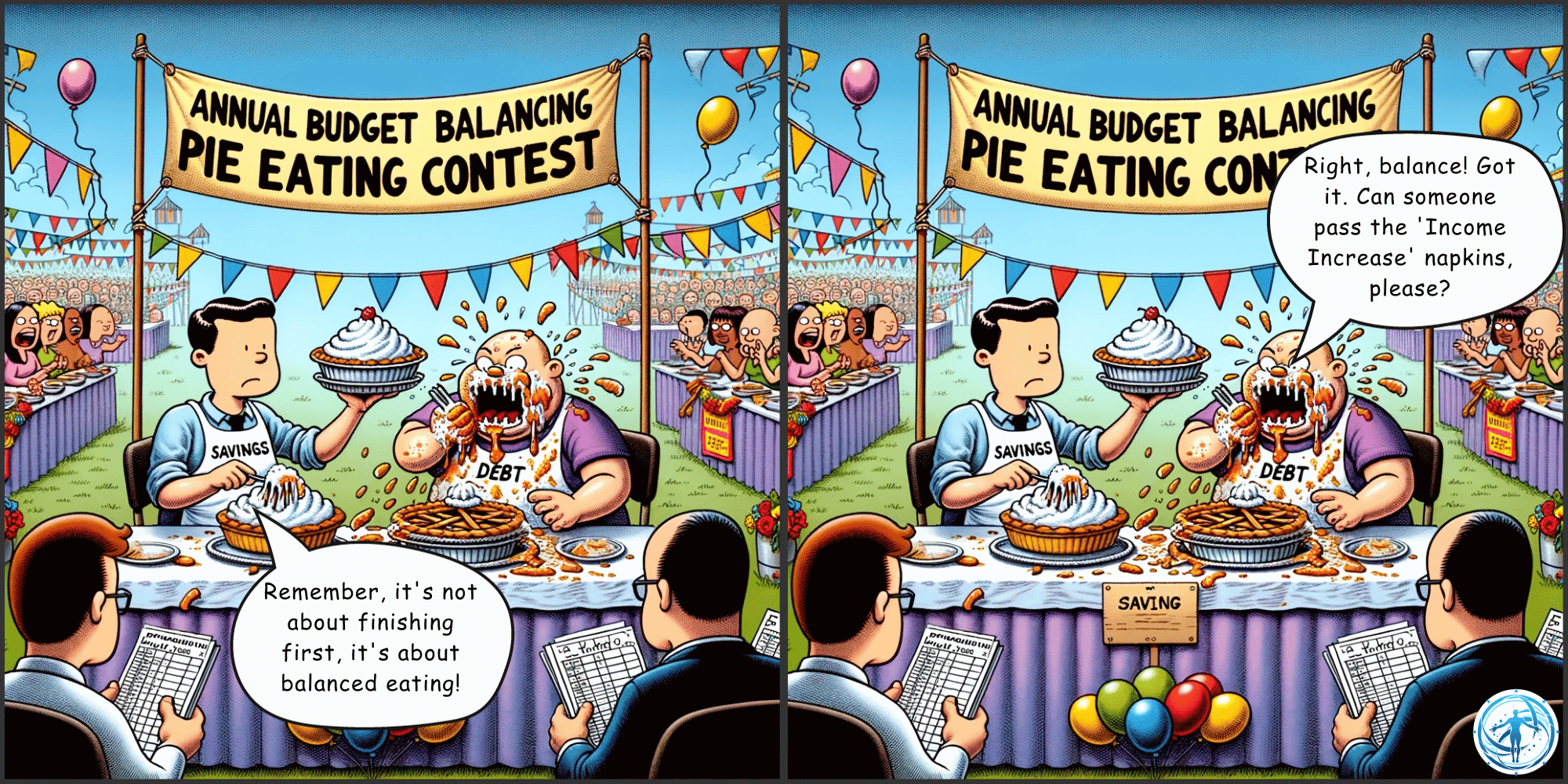

Here's how it works: 50% of your income goes to necessities, 30% to wants, and 20% to savings and debt repayment. This isn't just a random concoction, it's a tried-and-true formula that helps keep your budget balanced.

It's like financial training wheels, helping you maintain balance as you pedal towards fiscal responsibility [1].

It's simple, elegant, and versatile. But, is this framework the be-all and end-all of budgeting?

Not quite.

That framework is a fantastic starting point for you, but to truly master the art of budgeting, you need to embrace the following set of principles that form the unshakable bedrock of your financial structure.

Budgeting Principles

- Regular Review and Adjustment - Your budget is a living, breathing entity, much like a houseplant. It needs regular attention and adjustments, especially when your financial life blooms or wilts. Keep it aligned with your changing financial circumstances, and it will thrive.

- Start with Essentials - Before you splurge on those concert tickets, let's talk essentials. As one of my favorite financial celebrities, Dave Ramsey likes to point out, allocate your funds to must-haves like housing, food, and healthcare first. These are your budget's non-negotiables - the equivalent of water and sunlight for your financial green thumb. Once these are comfortably covered, then you can consider other categories [2]

- Understanding Income and Expenses - To master budgeting, you need to be a detective in your financial life. Uncover all income sources and track every expense, no matter how small. This is the Sherlock Holmes approach to understanding where every penny comes from and where it goes.

- Setting Realistic Goals - Set goals that are as realistic as expecting to find a parking spot at the mall on a Saturday. Whether saving for a dream vacation or paying off debt, make your financial targets achievable and specific.

- Prioritizing Savings - In the financial kitchen, savings are the main ingredient. Treat it as a non-negotiable part of your budget - like salt in your meal. Even a pinch can make a significant difference over time.

- Regular Monitoring - Your budget needs regular check-ups, like a car needing an oil change. Consistently track how you spend money and save money and adjust your budget to avoid financial breakdowns.

- Contingency Planning - Life loves surprises, and not all are pleasant. Prepare for unexpected expenses like a squirrel hoards nuts for winter. This way, when life throws a curveball, you're ready to catch it. This could involve setting aside a portion of your income for an emergency fund or unexpected costs like car repairs or medical expenses [3]

- Debt Management - Another favorite focus item of Mr Ramsey's, is effectively managing and prioritizing debt repayment within your budget - it requires balance and focus and can significantly impact your financial health. Integrate debt repayment strategies like the debt snowball method, where you start small and build momentum [2]. As you would've seen in the last lesson, debt can be your friend, if you can manage it effectively.

- Flexibility in Budgeting - A rigid budget is like a stiff dance move - not very effective. Keep your budget flexible to adapt to life's rhythms, be it a pay raise or a sudden expense.

- Financial Education - Continuously educate yourself about personal finance. It's like sharpening your kitchen knives - the more you sharpen, the better you cut through the complexities of financial planning.

So, now that we've laid the groundwork with these budgeting basics, you might be wondering how all this ties into your unique lifestyle.

Well, that's where the real art of budgeting begins.

II. Crafting Your Budget - Frameworks and Personalization

Remember how we demystified the 50/30/20 budgeting framework? It's an excellent starting strategy, but let's not treat it like some sacred text written on stone tablets.

It's more like a recipe for grandma's secret sauce: it's got the basics, but the real magic happens when you add your personal touch.

Flexibility: The Budgeting Salsa Dance

The beauty of the 50/30/20 rule lies in its adaptability.

Think of the 50/30/20 rule as the basic steps of a salsa dance. You've got the rhythm, but it's the flair you add that makes it dazzle. If life throws you a bonus or a side hustle blooms, why not shimmy a little more into the savings part?

Or, if you're feeling the beat and life's about enjoying the here and now, perhaps you up the ante on the 30% for wants. The point is, your budget should move with you, not pin you down like a bad dance partner.

Tailoring to Your Lifestyle

Budgets should be personal, like your playlist or your Netflix recommendations. What works for your colleague or your neighbor might not be your jam.

So, how do you customize your budget to fit your unique style?

- Income and Goals Harmony: Match your budget to your income streams and goals. Got a side hustle? Factor it in. Saving for a Tesla? That's a goal to aim for.

- Spending with Purpose: Aligning spending with your values. This means ensuring each dollar spent echoes your life's priorities. Are you a family person, an adventure-seeker, or a homebody? Let your budget reflect that.

- The Joy of Budgeting: Yes, you read that right. Joy and budgeting can coexist. It's about finding that sweet spot where you're meeting your needs, enjoying your wants, and still saving for the future. It's like having your cake, eating it, and still saving a slice for later. It's possible, trust me!

A Few Thought-Provokers

- Ever thought about how your budget reflects your personality?

- If your budget were a character in a movie, who would it be? The savvy saver, the wise investor, or the carefree spender?

- How does your budget empower you to live the life you dream of? Does it lift you up or feel like a ball and chain?

As you ponder these questions, remember, that your budget is your financial selfie – it's personal, adaptable, and an expression of who you are and what you value.

For me, my budget is a reflection of my family's dreams. We're all about grabbing life by the horns – travel, flexibility, and savoring the moment. So, yes, our budget might lean a bit more towards the 'wants' now, but we're not throwing caution to the wind – retirement savings are still on the deck.

It's about striking that balance between saving for a rainy day and dancing in the rain while it pours. My budget mirrors this philosophy – a healthy dose of adventure, sprinkled with the practicality of savings.

Now, the real question for you is, what's your flavor? Are you the save-it-all-for-later type or the live-in-the-moment maestro?

III. Dynamic Budgeting - Adaptability and Real-Life Application

We've talked about tailoring your budget to fit your fabulous lifestyle and the nifty 50/30/20 rule. But now, let's get into the real magic: making your budget dance to the ever-changing tune of your life.

How do we turn this budget of ours from a static list of numbers into a dynamic, life-adapting superhero?

The Art of Budgetary Gymnastics

Consider the agility of your budget, able to adjust quickly and efficiently. That's what it feels like when you master the art of adaptability in budgeting. Life's a rollercoaster, with ups like pay raises and windfalls, and downs like unexpected expenses or income dips.

Your budget needs to be an acrobat, gracefully adjusting to these highs and lows. One suggestion is to keep a portion of your budget labeled as 'flexible' for unforeseen changes. This small buffer can help you manage without overhauling your entire budget.

When Life Throws a Curveball

So, your budget's all set, but then life decides to throw you a curveball. Maybe your car decides to impersonate a lawn ornament rather than a vehicle.

Or perhaps your teeth choose now to stage their own rebellion, requiring an unplanned visit to the dentist, or an impromptu reunion trip with old college buddies.

Do you panic?

No. You adapt.

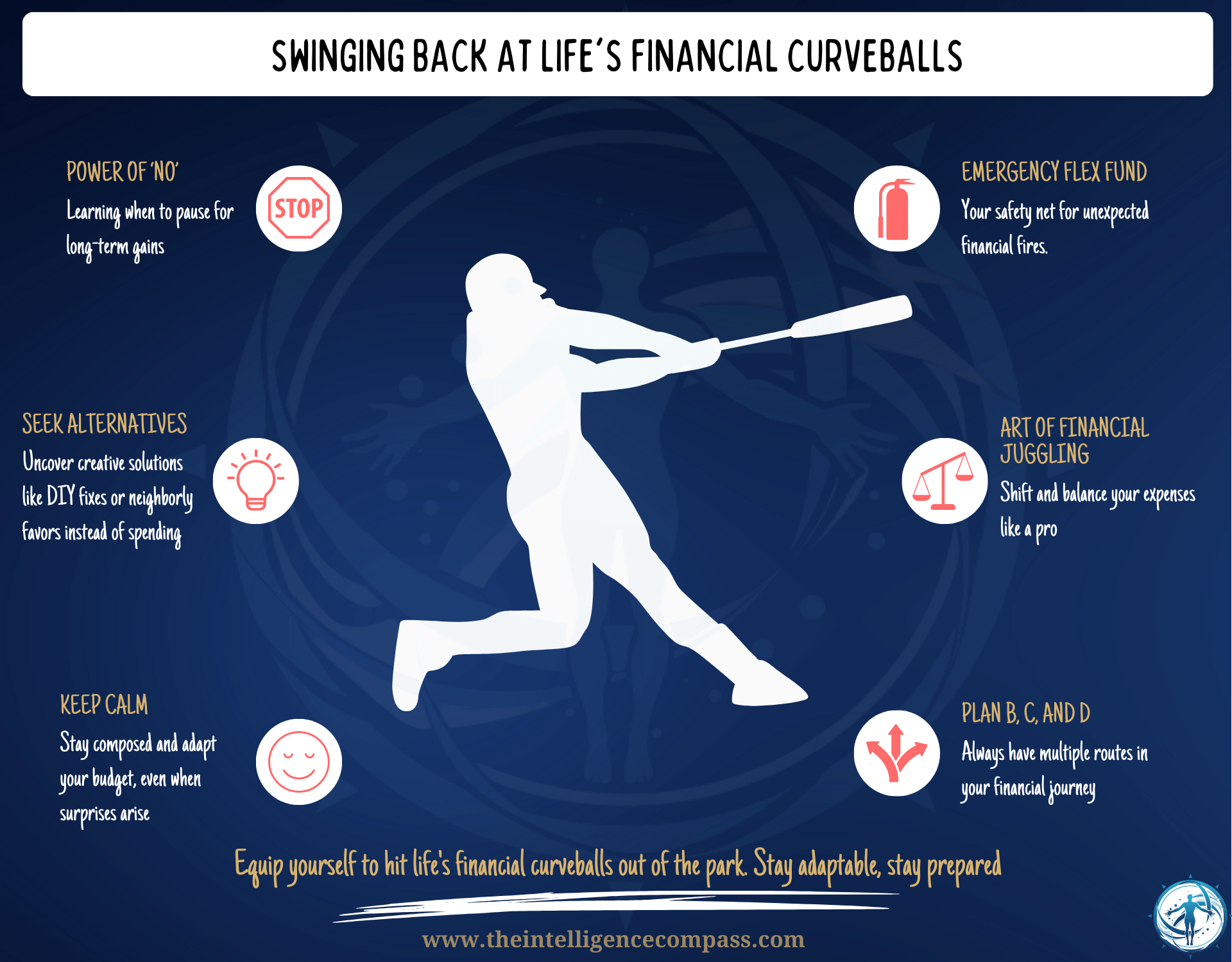

Here are some ways to swing back with the finesse of a seasoned baseball player.

- The Emergency Flex Fund - we touched on this in section I, and it's the stash you’ve been building for ‘just in case’ moments. The trick is to keep it for actual emergencies, not for those ‘oh, that dress is on sale’ moments. Think of it like a fire extinguisher: you hope never to use it, but boy, are you glad it’s there when things heat up.

- The Art of Financial Juggling - To effectively adjust your budget during financial ups and downs, prioritize essential expenses, reduce discretionary spending temporarily, and explore ways to increase income, like a side job. So, your car broke down? Let's temporarily ease up on the takeout dinners or pause the subscription to that llama-themed knitting magazine. It’s all about prioritizing – keeping the balls in the air without dropping any.

- Plan B, C, and D - Life's curveballs love to test your backup plans. So, have a few. If Plan A was a straight ride, Plan B could be taking a small detour, Plan C might involve a U-turn, and Plan D? Well, that’s where you might have to hitchhike financially for a bit (metaphorically speaking). For instance, if your regular income is disrupted, identify non-essential expenses you can cut or look into temporary income sources. The point is, be ready to pivot.

- Embrace the Power of ‘No’ – or ‘Not Now’ - Sometimes, dealing with life's surprises means learning to say ‘no’ – or at least ‘not now’. It’s okay to delay upgrading your phone or to skip a few movie nights. It’s not about depriving yourself. It’s about intelligent decision-making and deferring immediate pleasures for long-term financial stability, like turning down a marshmallow now for a whole bag later.

- Seek and You Shall Find – Alternatives, That Is - There's always an alternative. Can't afford a repair? Maybe it's time for some DIY magic or calling in a favor from mechanically-inclined Neighbour Bob (remember him). Every problem has a solution that doesn’t necessarily involve throwing money at it.

- Keep Calm and Carry On Budgeting - Lastly, keep your cool. A curveball doesn't mean your entire financial plan is kaput. It’s just a reminder that life is, well, life. Unexpected, and unpredictable, but definitely navigable with a well-prepared budget.

The Budget Monthly Bootcamp

Here's where regular check-ins with your budget come into play. It's like a monthly coffee date with your finances – a chance to chat about what's new, what's changed, and how your budget can support you (you'll need your monthly income, monthly expenses, etc).

For my wife and I, one date night a month is dedicated to financials and budget check-ins (yes, I'm a true Casanova...get in line ladies).

Maybe this month, you divert a little from the 'wants' to cover an unexpected 'need.' Or perhaps you give your savings a little extra love in anticipation of future plans.

Don't feel guilty, trust in the process and yourself - but have a clear strategy (yes, that pillar) when you do!

Your Financial BFF

Imagine your budget as your most reliable BFF - always there to back you up, no matter what. It's your safety net, your cheerleader, and sometimes, the wise sage who tells you, "Maybe buying that life-sized alpaca statue isn't the best use of your funds right now."

But remember, a safety net is not just about catching falls, but also about giving you the confidence to perform life's high-wire acts, knowing you're covered if things don't go as planned.

A Few Thought-Provokers

- How can your budget flex to accommodate both the expected and the unexpected in your life?

- When was the last time your budget had a makeover to reflect your current life stage?

- Can your budget handle the occasional financial leap of faith?

Remember, a flexible budget is your financial shock absorber – it's there to smooth out the bumps, not to cause you headaches.

IV. Priorities within Your Budget - Necessities, Savings, and Debts

You've asked yourself the big questions - how to make your budget bend without breaking when to remodel it, and if it's ready for a spontaneous financial leap.

Now, it's time to delve deeper into the heart of your budget, into the murky waters of prioritizing necessities, savings, and debts.

This is your turn to become a financial chef - you've got to know what ingredients to use, when to simmer, and when to bring the heat.

The Great Divide: Mandatory vs. Discretionary Expenses

Imagine your expenses as two rival soccer teams. In the red jerseys, we have the Mandatory Mavericks – the non-negotiables like rent, utilities, and food. These are the expenses that, if you ignore them, will lead to a very, very bad day (like sleeping in your car bad).

In the blue jerseys, meet the Discretionary Dynamos – these are your wants. That fancy coffee, the spontaneous weekend getaways, and yes, even the premium streaming service subscriptions. They're great, but they won't leave you out in the cold if you skip them.

Balancing between these two is crucial. It’s about ensuring the Mavericks always have what they need to win the game, while occasionally letting the Dynamos score a goal or two.

Across both "teams", there will be variable and fixed expenses. Estimating the variable expenses can be challenging, but it's crucial for setting spending limits and identifying potential savings. If any of them are ad hoc or yearly, get your calculus book out and break it down into monthly budget proportions if that's your budget period to make it easier [5]

Savings: The Non-Negotiable Power Play

Now, let's talk about your savings account – think of it as your team's star player. This player needs to be in every game, no matter what. Whether it’s 5% or 20% of your income, treat savings like a mandatory expense. It's your financial safety net, your future vacation fund, or even your 'I want to retire before I'm 90' fund.

Debt: The Good, the Bad, and the Ugly

Debt – it’s a word that can send shivers down your spine. But not all debt wears a villain’s mask as we discovered in our second lesson.

There's 'investment debt' – like a mortgage or a student loan, potentially leading to increased value over time. Then there’s the 'toxic debt', the kind that's about as helpful as a chocolate teapot – yes, I’m looking at you, credit cards with sky-high interest rates.

Your budget should focus on aggressively tackling this toxic debt. Why? Because it's a financial ball and chain, dragging down your wealth-building efforts. Think of it like weeding a garden, the sooner you get rid of the weeds, the healthier your financial garden will be.

A Balancing Act: Essentials, Savings, and Debt

It’s all about balance.

To maintain a balanced budget, allocate a fixed percentage of your income to essentials, determine a consistent savings rate, and create a debt repayment plan focusing on high-interest toxic debts first.

Imagine your budget as a pie. You wouldn’t eat a pie that’s all crust and no filling, right? So, make sure your budget pie has the right proportions of essentials, savings, and smart debt management.

What are the right proportions you may ask?

That's a whole other lesson in itself, but for now I will share the crucial consideration of the simple strategy I implemented early on in my journey that served me well:

- Essentials First: Always prioritize necessary expenses - housing, food, and utilities. This ensures your basic needs are always met.

- Savings Strategy: Aim to save a consistent percentage of your income. Even starting small, like 5%, can build a strong safety net over time. Pick a proportion and stick to it.

- Debt Repayment: Focus on eliminating high-interest debts first, such as credit card balances (this is the Debt Avalanche method that I favoured). The alternative is to consider using methods like the 'Debt Snowball' for tackling smaller debts first. The goal is to reduce financial strain and interest accrual [2]

V. Tools and Techniques - Empowering Your Budgeting Journey

After navigating the labyrinth of prioritizing necessities, savings, and debts, let's step into the armory of budgeting tools and techniques.

Goodbye, ancient scrolls of paper budgets, and hello, spreadsheet sorcery and app alchemy. Fair warning, spreadsheets are my jam, so forgive me if I struggle to maintain the excitement here.

The Good Old Spreadsheet: A Classic Never Dies

For those who enjoy the scent of fresh spreadsheets in the morning (like me) – you can't beat a classic. And you should just skip the few paragraphs and settle for a winner.

There's something timeless about Excel or Google Sheets. It's like being the artist of your financial canvas, where every color (or number) matters. Spreadsheets offer flexibility, a bird's-eye view, and the satisfaction of manually entering data.

But let's face it, it can be as daunting as teaching your grandma to use Snapchat. If you get spreadsheets, then this is the app for you. If you don't quite get it, there are countless templates online you can download and use, and personalize it to whatever level makes sense to you (yes, even hot pink!)

The Digital Arsenal: Budgeting in the 21st Century

Now I can appreciate not everyone loves spreadsheets (my wife included), so let's dabble a bit more into the newer digital age, where budgeting apps like Mint, YNAB (You Need A Budget) are purpose-built for budgeting, which is their advantage.

They track your spending, categorize your expenses, and even give you a pat on the back or a gentle nudge when you stray off course.

These tools do promise to navigate the choppy waters of personal finance, but let's be real: sometimes they're about as reliable as a weather forecast in the Bermuda Triangle.

Having gotten that off my chest, I encourage you to use whatever makes the most sense to you to help you achieve your journey because it is truly the outcome that matters.

The tools and techniques are merely instruments, and each has its charm and challenges - the real music comes from how you use them to orchestrate your wealth goals.

The trick is to find what resonates with your style. Are you the set-it-and-forget-it type, or do you relish the thrill of manual control?

VI. Beyond the Numbers - Goal Setting and Building Financial Resilience

So, we've talked about tweaking and tailoring budgets like a master chef perfecting a recipe.

Alright, let's cut to the chase. We've been talking about budgeting like it's some kind of culinary art or theatrical performance.

But let's step out of the kitchen and look at the big picture, because, let's be honest, sometimes the biggest barrier isn't the lack of tools, but our own mindset and our game plans (or lack thereof).

Strategy: The Brain Behind the Budget

Your budget is the brain of your financial operation. Without a strategy, it's like having a supercomputer and using it to play solitaire.

Your budget needs to be more than a monthly routine. It's your master plan to build wealth, avoid financial pitfalls, and achieve those big-ticket dreams. It is the tool that enables you to make smart, strategic choices, not just penny-pinching and wishful thinking.

Remember, a strategy without a budget is like trying to drive in the dark without headlights. You might feel like you're moving, but chances are you're heading towards a financial cliff.

Goal Setting: Your Financial Target Practice

Now, about those goals. If your budgeting strategy were a dartboard, your goals would be the bullseye. You're not throwing darts in the dark here, but you're aiming with purpose.

If you recall from Section I, identifying your goals is a core principle and your goals need to clearly inform your strategy. This could be a dream vacation, buying a home, or preparing for a comfortable retirement, each goal is a target waiting to be hit.

And let's be honest, hitting a bullseye feels pretty darn good.

Ultimately, you need to tailor your budget to fit your lifestyle, income, and financial goals. This includes considering all income streams and adjusting expenses to align with your personal priorities and values [2]

Mindset and Resilience

Here's where mindset plays a starring role (and remember, it's one of three core pillars of the Nexus Framework).

Budgeting with resilience is like being a financial ninja – you're prepared, adaptable, and unfazed by economic shurikens thrown your way.

This mindset isn't just about surviving, but about thriving. Your budget needs to be an extension of this mindset.

When the unexpected happens (and it will), your budget flexes and adapts as we covered in section III. It's not set in stone, it's more like water, flowing around obstacles.

I'll leave you with some questions to ponder over to close out this section:

- How well does your budget align with your long-term life strategy? Are you playing checkers while planning a chess game?

- Are your financial goals sharpshooters or are they firing blanks? Time to load up and aim with precision.

- When it comes to resilience, is your budget more of a sturdy oak or a fragile twig in the winds of economic change?

In the grand scheme of things, a budget is about building a resilient, adaptable approach to money management that stands the test of time and life's surprises.

Closing Thoughts

And there you have it, fellow adventurers of the Wealth Intelligence Academy – your comprehensive guide to mastering the art of budgeting.

We've traversed through the basics, danced around flexibility, dabbled with tools and techniques, and even touched on the grander scheme of financial resilience.

Remember, the key takeaways. Budgeting is about:

- flexibility,

- prioritizing what matters,

- using the right tools to stay on track,

- setting goals,

- building resilience, and

- aligning your finances with your life’s ambitions.

So, what’s next?

Digest this wealth of knowledge, apply it to your life, and share your experiences. Your insights fuel this community. And don’t stop here – join me for our next WIA adventure into 'Saving Basics.'

In the end, folks, budgeting is your financial compass in the journey to financial freedom. It’s not a ball and chain, but a liberation tool. We've touched on the basics here, but future articles will focus on more strategic practical aspects - for now it's important we get your literacy up to scratch.

Are you ready for the next chapter?

Please note: The information provided in this article is intended for educational and informational purposes only. It does not constitute professional financial advice. Financial decisions should be made based on your individual circumstances and goals. We recommend consulting with a qualified financial advisor to obtain advice tailored to your specific situation

References

- NerdWallet. (2023). How to Budget. NerdWallet. https://www.nerdwallet.com/article/finance/how-to-budget

- Ramsey Solutions. (2023). The Truth About Budgeting. Ramsey Solutions. https://www.ramseysolutions.com/budgeting/the-truth-about-budgeting

- Money Crashers. (2023). How to Make a Budget. Money Crashers. https://www.moneycrashers.com/how-to-make-a-budget/

- Fortunly. (2023). Personal Finance Statistics. Fortunly. https://fortunly.com/statistics/personal-finance-statistics/

- Mint. (2023). Budgeting 101. Mint. https://mint.intuit.com/blog/budgeting/budgeting-101/

- Ramsey Solutions. (2023). State of Personal Finance. Ramsey Solutions. https://www.ramseysolutions.com/budgeting/state-of-personal-finance

- SpendMeNot. (2023). Personal Finance Statistics. SpendMeNot. https://spendmenot.com/blog/personal-finance-statistics/

the Nexus Saga