Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

- Demystifying Jargon: Gain a solid understanding of the most impactful fundamental financial terms.

- Practical Applications: Discover how essential financial terms are not just theoretical concepts but practical tools in every day through a neighborly case study.

- Avoiding Financial Missteps: Learn to sidestep common pitfalls associated with financial terms like debt and tax, enhancing your ability to make more informed and beneficial financial decisions.

- Navigating the Modern Financial Landscape: Explore the evolving world of finance including digital currencies, fintech, and sustainable investing.

- Expert Insight and Personal Experience: Embrace financial literacy as a powerful tool for making intelligent decisions, with real-world examples and personal insights that demonstrate the transformative impact of understanding and applying financial knowledge.

Welcome back to our Wealth Intelligence Academy, for another attempt of mine to turn the drab world of finance into a theme park of thrills and spills.

Today's focus is on demystifying financial jargon and building an understanding of those essential terms that are the very foundation of the financial journey that you wish they taught you in school so you could be wealthy by this stage of your life.

You'll recall Financial Fluency pillar is the cornerstone of the Nexus Framework, and being literate in this space is the cornerstone of building your fluency. If this all sounds like gibberish to you, kindly take some time and follow those links and get up to speed before continuing on (you'll thank me later).

Now if you are one of my regulars, you'll recall my tales of my early days, stumbling through the financial wilderness with a financial compass that spun like a hyperactive top.

Yeah, I've been there, done that, and bought the T-shirt.

I've been in those confusing shoes, trying to make sense of terms that sounded like alien code. Trust me, understanding these terms is less about filling your head with fancy words and more about unlocking the secret doors to the world of wise wealth-building.

Now, don't stress! I'm not about to drown you in a sea of boring finance terminology akin to a school lecture. We're going to have some fun with this!

Because why should learning about finance feel like eating a bowl of plain oatmeal when it can be a sundae with all the toppings?

What to Expect:

- Jargon, Decoded: We’ll be slicing and dicing through finance terms everyone should know, serving it up more palatable than pineapple on pizza (controversial, I know).

- Real-Life Relevance: Discover how these terms are more than just fancy fluff. They're practical tools in your everyday finance toolkit.

- Myth-Busting: We’ll tackle some common misunderstandings head-on, saving you from potential facepalm moments.

- Peek into Tomorrow’s Terms: Stay tuned for a sneak peek at some shiny, new terms that are making waves in the modern financial world.

So, lace up your learning shoes and put on your thinking caps (or party hats, if you prefer), and let's get you jargon-ready for your next street event, where you're going to be absolutely flooring people with your newfound Wolf of insert name of your street here persona.

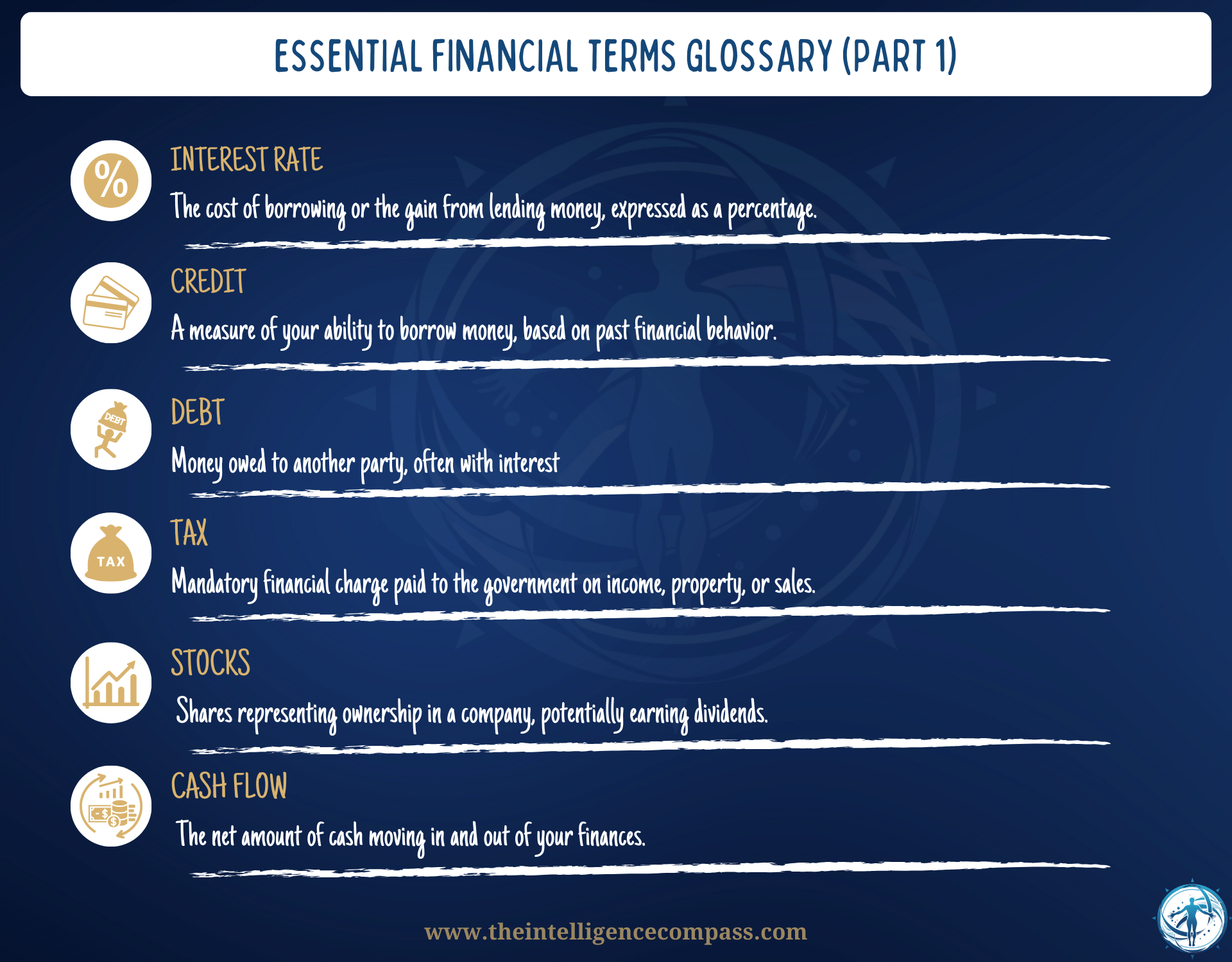

I. Essential Financial Terms for Wealth-Building

So hopefully now you're thinking: What financial terms do I need to know to impress my pesky neighbor Bob, and really get one over him at the next street BBQ event?

Or perhaps, your driver is less about getting one over your fellow humans, and more about intrinsic growth (it's the first one, isn't it?).

Let's dissect some essential terms for you that are more than just linguistic showpieces.

There are thousands of these terms in existence and you will encounter many more of them in my article, but these are the ones I feel are a little bit more essential than others and give a great grounding to start with - this is based on the frequency at which I encounter these terms in my wealth building experience and more importantly, the impact they have on your goals.

Interest Rate: The Pulse of Your Money

The interest rate is the heartbeat of your finances. It determines how much extra cash (or interest) you earn on savings or, conversely, how much more you pay back on loans.

Imagine it as a financial thermostat, controlling how hot (profitable) or cold (costly) your money ventures can be. For wealth-building, understanding interest rates is crucial for smart investing and borrowing decisions.

Think of it as the drummer in your financial band - when it hits the right beat, your savings and investments jive like rockstars. Get it wrong, and you're in a mosh pit of debt. It's the pulse that decides if your money's taking a leisurely stroll or sprinting for gains.

There are also two types of interest you should be aware of: simple and compound. Simple interest is your basic interest calculated on the principal (initial amount invested, or loan amount), whereas compound interest is calculated on the initial amount and the accumulated interest of previous periods.

You can see the advantage of compound interest, which is why it gets its own definition below and has a special place in my heart.

Credit: More Than Just a Score

Credit is your financial street cred. It whispers tales of your past financial escapades to potential lenders and how good you are at playing the money game.

Good credit history can open doors to better loan terms and interest rates, and perhaps a greater credit limit, which means more money stays in your pocket. Neglect it, and well, Bob wins!

I acknowledge in a lot of countries, a credit score is not a thing per se, but your bank or credit union will rely on the same principles as described here to assess your ability to take on debt.

Debt: The Balancing Act

Debt is a double-edged sword. Managed well, it can help you build wealth (like taking a loan to buy a property). But, let it spiral out of control, and you're looking at a financial sinkhole. It's all about balance.

Think of debt as a tool, not a burden. Use it wisely to leverage opportunities, not as an excuse for a spending spree.

The topic of debt has always been an interesting one to me. One corner of the finance fraternity does not like it and constantly advises to get rid of it as fast as possible (and there is merit in that for some), while others encourage it and see it as a necessity for wealth growth - both are right!

For a lot of you, borrowing money to build wealth is unavoidable (unless you're a secret member of a Royal family somewhere). What matters is your strategy and risk management, and this is something I will unravel in detail in future articles.

Tax: The Unavoidable Truth

Taxes are the financial dues we pay for society's benefits (think federal income tax, and capital gains tax to name a few examples). Understanding taxes means not only staying on the right side of the law but also finding ways to maximize deductions and credits.

It's a pain, no one likes playing it, and it always feels like a government-sponsored game of 'Guess Who's Getting Less Money This Month'. It's easy to view it as an obligatory surrender of your hard-earned money, a sentiment echoed by many.

However, let's pivot our perspective for a moment.

Consider this: do you think the rich lords that roam our planet just grudgingly pay their taxes and go back to their day jobs (if they have a job!)?

No, they dissect the tax system into its smallest components to understand how to turn it to their advantage.

By mastering strategic tax planning, they play the game to win.

And that's exactly what I aim to teach you. You'll learn to level the playing field, mastering the essentials of tax strategy so effectively that you won't need to shell out for an expensive, 'creative' accountant.

With the right knowledge, 80% of the work is already in your hands

It's easy to hate on these people in the clouds, but I advise against it (it's not the right mindset) - learn from them instead. It's about playing smarter, not harder.

Stocks: The Ownership Game

Stocks represent ownership in a company and should be one of the key asset classes in your strategy. When you buy stocks, you're buying a slice of that company's future – for better or worse.

Choose the right slice, and you're on your way to shareholder stardom, reaping dividends and watching your slice grow.

But remember, the stock market is like a gourmet food fair – tantalizing but unpredictable (and some can give you gastro). Choose wisely.

Cash Flow: Your Financial Lifeline

Cash flow is the lifeblood of your finances, representing the inflow and outflow of your hard-earned money. Positive cash flow means you're earning more than you're spending (i.e. the amount of money in your account is increasing) – a key to building wealth. It's like ensuring your financial ship is sailing smoothly without taking on water.

The use case for this term for me is in my real estate investing. No spoilers for the time being, but it is an absolutely crucial factor when deciding on what a good deal is when choosing your property investment.

It must deliver you a positive cash flow, otherwise forget about it (no matter how much you like the cute 17th-century porch!)

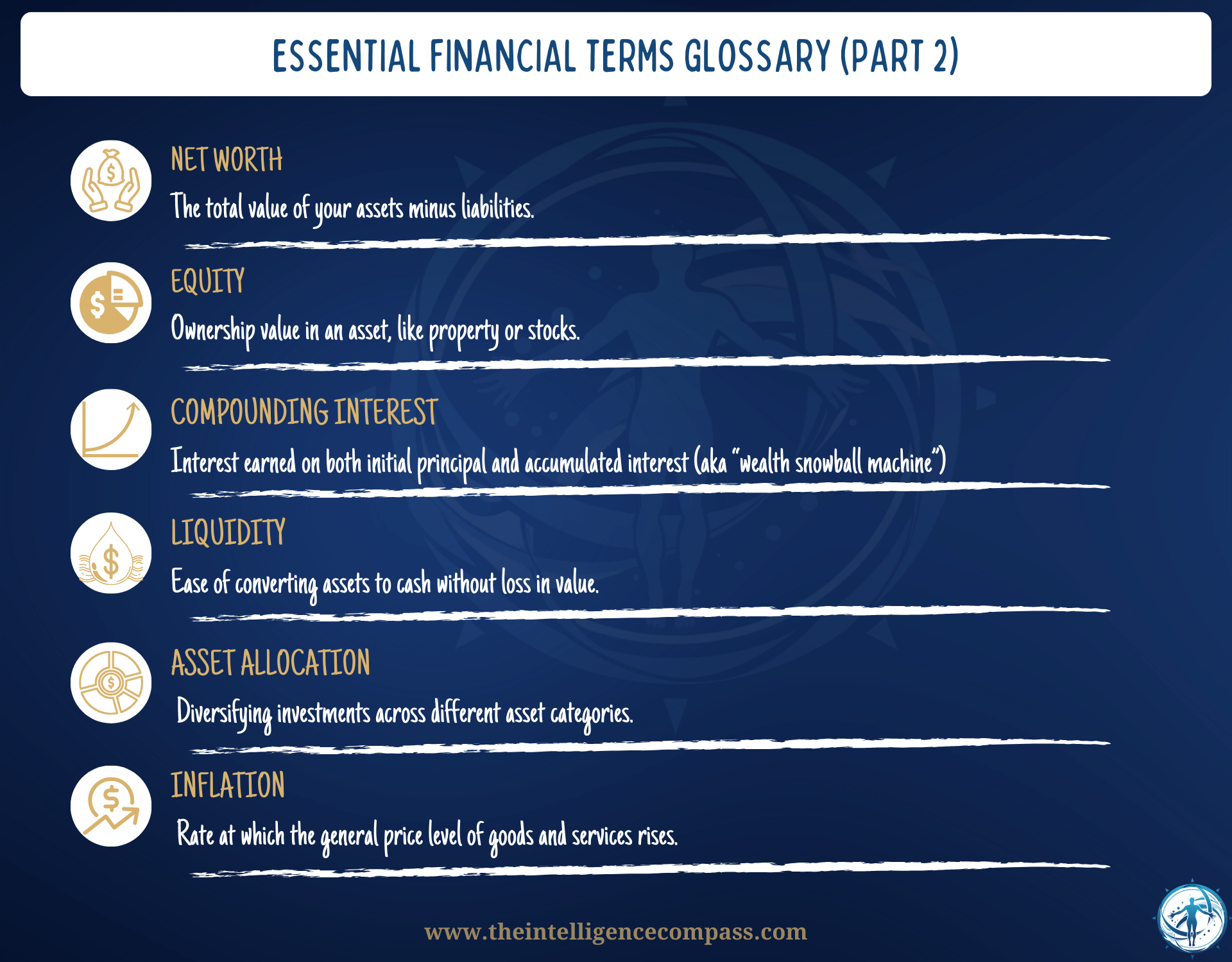

Net Worth: Your Financial Health Check

Net worth is your financial report card, and it is beyond just your net income. This number is your financial health's pulse.

It is like stepping on the financial scale – it tells you how healthy your wealth is. It’s everything you own minus everything you owe.

Every asset adds to your weight, every liability makes you lighter. Aim to be the heavyweight champion of your finances.

In my life, I've encountered several 'Bobs,' ever eager to flaunt their property values yet conveniently silent about their debt. If you have outright ownership of a property, then you can claim its full value as your net worth.

But if you're saddled with debt, it's a different story. You need to deduct that debt to get a real picture of your financial standing, otherwise, my sentiment is summed up well by the great Shania Twain - "that don't impress me much".

Equity: Owning, not Owing

That was a great segue onto our next term - equity! Equity is about ownership and value.

Let's break it down, shall we?

In the world of real estate, equity is what you truly own in your home, beyond the looming shadow of your mortgage. It's your slice of the real estate cake, and the more you pay off, the bigger and tastier your slice gets.

But wait, there's more! In stocks, equity is your VIP pass to the company's fortunes (or misfortunes, but let's stay optimistic). Owning stocks means you've got a stake in the company – a claim to a part of its assets and earnings.

So, yes if you own Google stock (and better yet if you bought it in the 2000s), you can march right in there and demand your 0.000000000035% cut of their profits (disclaimer: please don't do this).

Growing equity should be one of your key strategic plays. It's about layering up your financial cake so each layer – be it real estate, stocks, or other investments – adds depth and flavor to your overall wealth.

Your goal then should be a deliciously rich financial feast, where each slice of equity adds a burst of flavor to your wealth-building journey and your financial cake is the envy of the neighborhood (take that, Bob!).

Compounding Interest: The Snowball Effect

Now we come to one of my absolute favorite financial terms. And one that truly shows how little financial IQ some people have (again, not their fault, it's the education system).

Seriously, if compounding interest had an Instagram account, it would rack up likes faster than a Kardashian at the Met Gala.

Compounding interest is like your money getting its own reality show and then spawning a whole franchise.

It’s money-making its own money, and then that money making more money. It's not just a snowball, it's an avalanche of financial growth that can turn a modest investment into a mountain of cash.

Think of it as the Beyoncé of your financial portfolio - it starts great and just keeps getting better and more fabulous with time.

You can compound your savings, your dividends (reinvestment), real estate scaling, you name it - the opportunities and the rewards are truly limitless.

Liquidity: Quick Cash Access

Liquidity, in the financial world, is all about how swiftly you can transform your assets into cold, hard cash without diminishing their value.

Picture this: you're on a financial tightrope, and suddenly, life throws you a curveball - an emergency or a can't-miss investment opportunity.

What's your safety net? Liquidity.

It's the difference between a graceful pivot and a face-plant in the high-wire act of financial management.

Here's a page from my own experience: once, I leaned heavily into non-liquid assets (real estate), thinking I was playing the long game. But when an unexpected opportunity knocked, I was like a deer in headlights – assets galore, but cash-poor, and couldn't convert quickly.

Not ideal.

That was a lesson for me as you can imagine. Thankfully I learned it because a few years later when a family member needed major surgery, I was ready – my portfolio was more diversified and liquid, and I was able to provide for my family when they needed me.

High liquidity is like having a financial Swiss Army knife in your pocket. It's being ready to jump on opportunities or navigate emergencies without the dreaded 'asset liquidation' quagmire.

Asset Allocation: The Finance Symphony Conductor

Asset allocation – think of it as the maestro of your financial symphony. You've got different instruments in your orchestra: stocks strumming the high notes like violins, bonds bringing the steady rhythm like cellos, and real estate booming out the deep, resonant tones of the brass section.

Each has its role, its moment in the spotlight, contributing to the harmonious melody of your financial success.

But here's the catch: you can't let the violins (stocks) overpower the cellos (bonds), or else your symphony turns into a cacophony. And nobody wants a financial strategy that sounds like a beginner's band practice, right?

Mastering asset allocation is about striking the perfect chord, ensuring each investment plays its part without drowning out the others.

It's becoming the Beethoven of budgeting or the Mozart of money management – orchestrating a portfolio that sings with returns.

Pay attention to the Strategy pillar for all my wisdom (I promise it's wisdom) in this space. There is plenty to say.

Inflation: That Pesky Pocket Pickpocket

Inflation, is the financial world's version of a sneaky pocket pickpocket. It's always there, lurking in the shadows of the economy, stealthily nibbling away at the value of your money.

You know the drill – today, a dollar buys a candy bar, but fast forward, and suddenly it only gets you half an M&M. Inflation is the artful dodger of economics, making your money worth less than it used to be. And in today's world (circa 2023), its celebrity status is unmatched.

We're seeing it everywhere – from the grocery store to the gas pump. It's like an unwanted guest at your budgeting party, eating away more than its fair share of that financial cake you were baking up earlier.

But there's a way to outwit this sly thief. It's all about smart investing – putting your money in places where it can grow faster than inflation can steal because you can't rely on your boss raising your wages from the goodness of his heart.

Or those friendly banks not frothing at the earliest opportunity to raise those interest rates so their directors can buy a spare yacht.

With the right strategy, you can turn the tables on inflation, ensuring your purchasing power stays strong, and your financial pantry remains well-stocked - and yes you guessed it - I will teach you this.

II. The Real-World Impact of Financial Savvy

Let's get creative for a second to explain why knowing your credit from your debit could impact your future wealth prospects.

Imagine you're at a community BBQ, the kind where our mate Bob from next door never misses a chance to brag about his latest financial ventures. You're flipping burgers, and Bob's going on about his latest investment 'triumphs.

You're just a regular person, not a Wall Street whiz, and normally you're just nodding along, but today you've got a secret weapon: your newfound financial literacy since you graduated from the WIA - and you're about to school Bob on the art of smart finance.

Interest Rates and Savings

Bob's boasting about his new savings account with a 'fantastic' simple interest rate. You casually mention how you opted for a different investment option with your cash that's offering a compound interest rate, subtly explaining how compounding is the key to accelerating the addition of those zeroes to your bank balance. Bob's rate win suddenly seems less impressive.

The Art of Asset Allocation

Next, Bob tries to impress with his all-in-stock investment in a 'sure-fire' AI company (we all have this "Bob" type in our life, right?). You steer the conversation to asset allocation, explaining how you've diversified your portfolio to balance the risks.

You liken it to a well-composed symphony where each instrument plays its role. Bob's one-instrument investment strategy suddenly hits a flat note.

Cash Flow – The Real Estate Revelation

Bob moves on to bragging about the economic value of his latest property investment, but you quickly realize he's overlooked a critical aspect: cash flow. You share how you evaluated the cash flow potential of your real estate investments, ensuring they generate more income than expenses after factoring in all costs of running an investment property.

Your approach illustrates a sustainable and profitable property investment strategy, while Bob's lack of cash flow understanding could lead to financial strain, especially if interest rates skyrocket or additional inventory hits the market.

Tax Tactics – Unearthing Hidden Gems

Finally, Bob grumbles about taxes and government thievery. You don't disagree, but chime in with how you've leveraged tax deductions and credits, turning a grudge payment into an opportunity for savings, resulting from a complete financial mindset shift. You talk about tax like it's a game of strategy, where knowing the rules can turn liabilities into advantages.

Bob's tax tirade turns into a contemplative silence, as he mumbles something about the Cayman Islands.

As the evening cools, Bob's financial bragging has quieted down. You, on the other hand, have sparked an interest among your neighbors, who are now keen to learn more.

Now this isn't just about getting one up on your nosey neighbour. Your deeper understanding of each financial term allowed you to engage confidently in these discussions and helped you make wiser choices in your wealth journey, avoiding the pitfalls that Bob unknowingly stumbled into.

And who knows, you might help another person or two gain an advantage in life.

III. Clarifying Common Misconceptions

So, we've been through the financial term wringer, and we've schooled Bob, so you're probably feeling a bit like a Wall Street whiz and bulletproof (or at least not totally clueless). But hold your stocks (puns are my specialty!)

There are some common myths and misconceptions surrounding some of these terms that we need to discuss, and we have hinted at a few already.

Debunking the Debt Myth

Debt. Just saying it can make some folks shiver.

It’s often seen as the villain in your financial story, but let's spin the narrative. Not all debt is bad if you manage it well.

Used strategically, it can be a powerful ally. I've seen people fear it so much they miss out on leveraging opportunities that could have skyrocketed their wealth.

Our friendly neighbor Bob viewed debt as a straight path to ruin, only to watch opportunities pass him by.

Me? Once I got my mindset right (mainly thanks to wifey), I used debt as a stepping stone to acquire assets that appreciated in value.

The lesson here is to respect the power of debt, and understand your risk, but don't fear it.

The Interest Rate Riddle

Interest rates – a term tossed around like a hot potato. Most people glance at them and think, "Higher bad, lower good." (yes, these people speak like Frankenstein).

It's true, the rates are very important, but understanding their context is key. They’re not just numbers bank managers pluck out on the golf course (I strongly suspect this is what they actually do, but I have to toe the professional line here), they're indicators of economic health.

When they rise, it’s not just your loans that get affected, but your savings and investments too. Higher rates can be great for savers and investors, while lower rates can make loans more affordable.

When a rise or decrease is announced, think about the broader picture, and ask yourself how these rates affect your overall financial strategy, not just your one investment.

What is the portfolio effect for you, including any tax benefits?

Inflation: The Hidden Culprit

Inflation – that thieving bastard that can slowly erode your purchasing power. It's easy to overlook, but wise investors keep a close eye on it.

Why?

Because understanding inflation can guide you to make more informed investment choices. Diversifying your asset allocation is a necessity.

Inflation can be a silent portfolio killer, but with the right mix of assets, you can shield yourself from its impact. Instead of stashing all your cash under the mattress (or burying it like one of my uncles), diversify instead.

Get some stocks in your portfolio, consider bonds, or real estate – assets that can potentially outpace inflation.

As we uncover specific strategies later in the series, this will start to make more sense.

Stocks: Beyond the Ticker

Stocks – you know, those random letters scrolling at the bottom of a news channel.

They represent ownership in real companies. When you buy stocks, you're essentially betting on a company's future. So, treat them with the seriousness they deserve. Study the companies, understand their business models, and invest in those you believe have a solid future.

So, don't just chase the 'hot' stocks, like the guy who cuts your lawn and tells you about the latest cobalt prospect in the middle of the African continent. That "get rich quick" mentality is the key misconception a lot of people have about stock investing, but that is not how I want you to think.

Stock investing is the long game for a three-legged wealth race – you want someone who can keep up with you, not trip you up.

Your thoughts might wander to day trading, but I don't consider that as a wealth-building strategy as you're in the advanced stage and have cash to burn. Leave that one to the professionals for the time being.

Tax: Not Just a Necessary Evil

You should've already got a feel for tax being one of the most misunderstood financial elements from my earlier spiel.

It's not just something to grumble about during tax season, and harbor thoughts about summoning the dark lord, Cthulhu, to exact revenge on those who take your hard-earned money.

Most people view tax as a financial black hole, an unyielding drain on their hard-earned income, and fail to see it as a key strategic element in financial planning.

From my experience, the real trick with taxes isn't just about paying them, but understanding how they work in your favor.

Savvy investors use tax laws as a roadmap to navigate their financial decisions. They leverage deductions, understand tax-efficient investments, and plan their financial moves with tax implications in mind.

By mastering these tax pathways, you can not only fulfill your legal obligations but also enhance your financial growth. It's like finding a designer outfit at an unbelievable discount – it's all about knowing where to look and how to seize the deal. You don't just save, you score big on the financial runway!

As we tie up this section, remember that each of these terms – debt, interest rates, inflation, stocks, and tax – are like unique tools in your financial toolbox. Used wisely, they can build a stable and prosperous financial future.

But the key lies in understanding and applying them correctly, not just knowing their textbook definitions.

IV. Keeping Up with Modern Financial Trends

These terms we've just covered are like timeless classic hits in your financial playlist - they will never go out of style and will always play a role in your journey.

But, just like in music, there's always a new beat hitting the charts. In finance, this means keeping a keen eye on emerging trends and terms.

We're living in a fast-paced financial world where digital currencies, fintech innovations, and sustainable investing are not just buzzwords but potentially important elements in modern investment strategies.

Cryptocurrency: The Digital Gold Rush

For those who read the first module on money, you should already be familiar with the concept of cryptocurrency. You will recall that cryptocurrency is a whole new way of thinking about transactions, investments, and even the concept of money itself, confined to the digital space.

And with such a seismic shift in approach, it inherently comes with a whole list of new terminology to get familiar with. The crypto "dudes" often sound like they're from another planet, so let's get started with some basic terms to boost your digital street cred:

- Blockchain: The heart of cryptocurrency. A digital ledger so transparent and secure, it could give Fort Knox a run for its money. The ledger is spread across a network, transparent and tamper-proof, and not controlled by any single entity (a breath of fresh air from the usual financial gatekeepers). It's the technological wizardry that makes digital currencies like Bitcoin not just possible, but reliable [5]

- Digital Wallet: Your digital treasure chest. It's where you store your cryptocurrencies, be it Bitcoin, Ethereum, or any of the myriad of digital coins. These can be online or completely offline, and are incredibly secure - the downside of that security is that you have to keep the access password/phrase somewhere safe. Because if you lose it or forget, you lose your assets with no chance of recovery.

- Crypto Exchange: Think of it as the cryptocurrency marketplace. Here, you can trade various digital currencies, much like how you'd exchange stocks. It's where the digital buying, selling, and heart-pounding action happens. A number of these exchanges have been in the news recently as the US regulators crack down on some of the practices being employed, which can only be good news for the long-term future of these assets as it weeds out a lot of the "dodgy stuff" [7].

- Decentralized Finance (DeFi): This term is like the rebel of the finance world. DeFi takes financial services out of traditional institutions' hands and puts them on the blockchain. It's finance without the middleman, offering more freedom, but also requiring more savvy navigation [6].

A great explanation of the blockchain concept (source: simplilearn)

Fintech: Your Financial Tech Savvy Friend

Fintech, short for financial technology, is like the Silicon Valley of the finance world. It’s revolutionizing the way we handle our money, offering sleek, user-friendly apps and services that make managing money feel less like a chore and more like a breeze.

Think of it as finance meeting technology at a speed-dating event and really hitting it off.

- Mobile Banking: This is your bank living in your smartphone. Deposits, transfers, payments – all at the tap of a finger. It's like having a bank branch in your pocket, minus the long queues and stale coffee smell.

- Robo-Advisors: These are the R2-D2s of personal investing. They use algorithms to manage your investments, making it feel less like rocket science and more like a smart, automated personal finance assistant [1].

- Peer-to-Peer (P2P) Lending: Imagine lending money to a friend, but on a global scale. P2P platforms connect borrowers with individual lenders, bypassing traditional banks. It's like a financial matchmaker for loans [2]

Sustainable Investing: The Eco-Friendly Finance

Gone are the days when investing was just about the greenbacks. Now, it's also about being green. Sustainable investing is for those who want their investments to reflect their ecological and social values.

It's the finance world’s way of saying, "Hey, we care about the planet and society, too."

- Socially Responsible Investing (SRI): This is all about investing in companies that align with your personal values. Think of it as swiping right only on companies that match your ethical profile [3].

- Environmental, Social, and Governance (ESG) Criteria: These are the factors used to evaluate a company’s ethical impact and sustainability practices. It's like a report card for how well a company plays with the planet and society [4].

A simple explanation of the ESG criteria and its importance (source: corporate finance institute)

Understanding these terms isn't just about sounding smart at your next Zoom party (though that’s a bonus). It's about being equipped to make informed decisions in a world where finance and technology are becoming increasingly intertwined.

V. The Power of Knowledge – Personal Insights

Now that we've covered the theory, I just wanted to share some of my personal thoughts and experiences on the subject.

Let me take you back a few years (ok a lot of years): post-university, I was armed with a corporate finance and engineering degree, I thought I was bulletproof.

Money was flowing in from my first real job (sorry Baskins), and I was ready to invest (aka spend). I hadn't yet realized my financial literacy was as thin as the plot in a reality TV show.

Then I met this older dude, who with time I would consider my mentor. Let's call him Mr. Moneywise. He was like the Yoda of finance, except less green and more into spreadsheets and talking coherently.

One fine day, with the wisdom of a sage and the subtlety of a sledgehammer, he drops this gem: "Financial literacy isn't just about knowledge; it's about weaving it into the fabric of your life."

That hit me harder than a caffeine withdrawal on a Monday morning.

As a freshly graduated young adult, I had arrogantly thought I had mastered the financial universe, only to discover I was naively looking at it through a distorted lens.

It was a profound awakening because I had begun to see financial terms not as isolated concepts but as interwoven elements in a larger tapestry of wealth building. Each term, each concept took on a new meaning, revealing its role in a broader, more holistic financial landscape.

It was a fundamental shift in perspective, reshaping how I approached and valued the power of financial literacy.

The Lessons

Prior to this enlightenment, I had learned some harsh lessons. The first was in real estate, where my first dive into it was... let's say, less than stellar. I was like a kid in a candy store, but I forgot to check the prices.

I bought an inner city apartment (as all young bachelors love to do), and I didn't bother with in-depth market research (talking to a real estate agent and checking other prices in the market at one point in time doesn't constitute "in-depth research"), nor did I bother with checking the cashflow in case I wanted to use this place as an investment property one day.

Why bother, when real estate prices always go up - that's "cash flow positive" right?

Wrong.

That's capital gain for starters, and even that is not guaranteed, despite what your potentially gambling-addicted family member tells you.

It wasn't until I truly grasped the concept of positive cash flow that I stopped seeing properties as just buildings and started seeing them as wealth-building blocks.

And then there were stocks. Oh, the allure of quick riches! Like many, I was drawn to the 'next big thing,' chasing after stock market unicorns only to end up with donkeys - that cobalt in Africa story earlier in the article. Yeah, that's a true story.

It took a hard lesson in strategy and understanding market dynamics to turn my stock follies into savvy investments. Thankfully, this wasn't as expensive a lesson as the apartment, but that was down to luck more than anything else.

I share these stories not to re-live my financial faceplants but to stress how crucial financial literacy is. It's not just about sounding smart at your next street BBQ or outwitting your neighbor Bob (though that's a bonus). It's about making informed, intelligent decisions that propel you toward your financial goals.

So, as you delve into the world of finance, remember: knowledge is power, but applied knowledge is superpower. It's one thing to know the terms, it's another to let them guide your financial journey. This is why it's one of the key pillars behind my Intelligence Vision.

Closing Thoughts

And that, my friends, wraps up our whirlwind tour through the labyrinth of financial jargon. From debunking myths to embracing the nuances of modern financial trends, we've navigated a sea of terms that could make or break your wealth-building journey.

Remember, it's not enough to just memorize the definitions. You need to wield them as tools in your financial arsenal.

Key Takeaways:

- The Basics Matter: Know your basic terms like 'interest rate,' 'debt,' 'stocks' and 'tax'. They're the building blocks of your financial strategy.

- Knowledge is Power: Understanding these terms can save you from potential pitfalls, like Bob's investment mishaps.

- Stay Current: Embracing emerging trends like cryptocurrency and fintech ensures your financial strategy remains relevant in a rapidly evolving world. You don't have to buy into crypto, but knowing about it keeps you informed.

Your journey doesn’t end here. Continue exploring, questioning, and expanding your financial vocabulary. Engage with us – ask questions, share feedback, or sign up for our newsletter for more insights that can help illuminate your path to financial success.

Or perhaps check out what our Nexus friends are up to in the latest episode of everyone's favourite* financial series (*not able to be verified).

Otherwise join us for the next adventure in the Wealth Intelligence Academy, where we'll delve deeper into the sexy world of budgeting! (alright it's boring, but you know I'll do my best to make it exciting).

Until then, stay curious, stay informed, and most importantly, stay empowered on your journey to financial mastery.

The world of finance is dynamic, ever-evolving, and filled with opportunities for those willing to learn and apply their knowledge.

Please note: The information provided in this article is intended for educational and informational purposes only. It does not constitute professional financial advice. Financial decisions should be made based on your individual circumstances and goals. We recommend consulting with a qualified financial advisor to obtain advice tailored to your specific situation

References:

- Investopedia. “Robo-Advisor (Robo-Adviser).” Investopedia.

- Investopedia. “Peer-to-Peer (P2P) Lending.” Investopedia.

- The Motley Fool Australia. “What is Socially Responsible Investing (SRI)?” The Fool.

- TechTarget. “What is Environmental, Social, and Governance (ESG)?” TechTarget.

- IBM. “Blockchain.” IBM.

- Coinbase. “What is Decentralized Finance (DeFi)?” Coinbase.

- PCMag. “Crypto Exchange.” PCMag.

the Nexus Saga