Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

- Unlock Your Savings Superpower: Learn how to transform your everyday earnings into a growing financial force, making your savings work harder for you

- Family Finances Made Fun: Discover engaging and practical strategies for family savings, turning budgeting from a chore into a collaborative and rewarding family game.

- Compound Interest: Your Secret Wealth Accelerator: Unravel the magic of compound interest and see how it can exponentially increase your savings over time, turning small amounts into significant wealth.

- Emergency Fund: Your Financial Lifeguard: Understand the critical role of an emergency fund in safeguarding your financial future and learn how to build one that can weather any storm.

- Adapt and Thrive: Master the art of adjusting your saving strategies to life's ever-changing circumstances, ensuring your financial plan is as dynamic and resilient as you are.

"Think of your savings like a superhero's secret power – it might seem ordinary at first glance, but it has the potential to transform your world." - Compass Guy, 2003

So what are your thoughts on that quote at the start (by yours truly)? Do you believe that the concept of "saving" is "sexy enough" to transform your financial world?

Why don't you let me know at the end of this article.

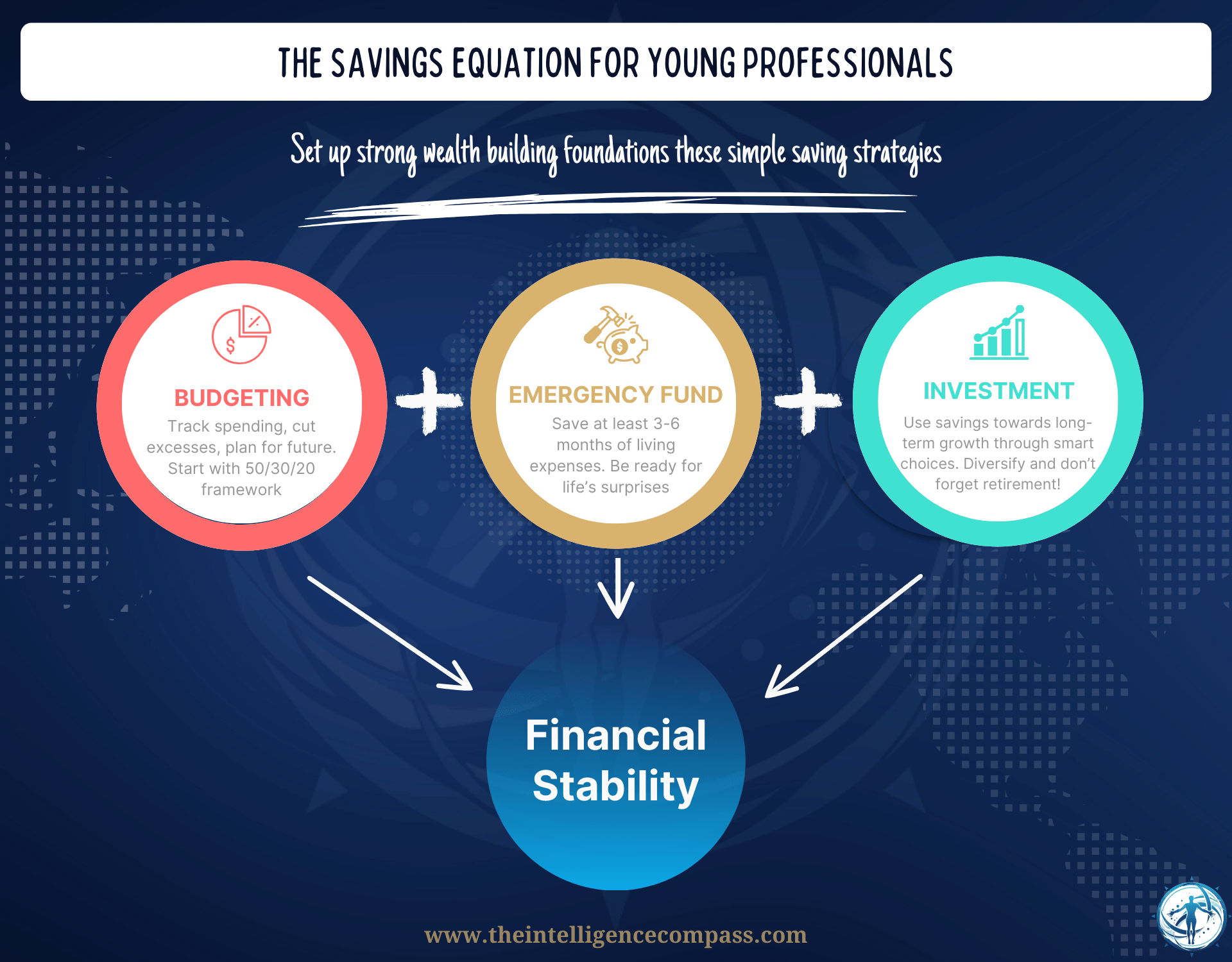

In the meantime, welcome back to our Wealth Intelligence Academy's riveting journey. We've navigated the realms of money basics and budgeting, and now, we're at the doorstep of our fourth Basic Level module, focusing on the pivotal art of saving money.

Mastering ways to save money isn't just a neat trick to boost your bank balance, but a cornerstone of building substantial wealth. After all, what's the point of crafting a meticulous budget if you're not channeling those funds into a growing pile of savings?

In this exciting installment, we'll tackle some crucial questions:

- What are practical and effective saving techniques for young professionals?

- How can young families create a sustainable saving plan that grows with them?

- Unraveling the mystery and might of compound interest – what is it and why does it matter? PS. My long-time followers will understand my love of the compound

- The undeniable importance of an emergency fund in securing your financial future.

- Adapting saving strategies to match life's ever-evolving financial landscape.

We'll explore techniques that are more than just "saving for a rainy day" – they're about creating a downpour of opportunities. From understanding how small changes can lead to significant savings, to uncovering the secrets behind the magic of compound interest, we're covering it all.

It's about weaving financial security into the fabric of your life, ensuring that each step you take is on solid, financially stable ground.

Are you ready to uncover the secrets to turning your savings into your strongest financial ally?

I. Effective Money Saving Techniques for Young Professionals

So you're a young professional and you want to step into the world of savings?

You're at the crossroads of 'Making Money' and 'What Now?' streets, aren't you? Let's face it – saving money while juggling the nuances of adulting can feel like trying to solve a Rubik's Cube blindfolded.

Sure, saving might feel like choosing a library over that Europe trip at first, but with the right techniques, you’ll soon see it's like finding hidden cheat codes for your bank account.

The Art of Financial Equilibrium

Finding the sweet spot between splurging today and saving for tomorrow is like walking a tightrope while juggling avocados – tricky but not impossible.

It's all about mastering the art of moderation.

Indulge in the now, but keep an eye on that glittering future. I don't want you living on breadcrumbs today so you can feast tomorrow, because that tomorrow might be decades away and you don't want to be that person driving a Ferrari in your 80s. I want you to enjoy a steady diet of financial satisfaction.

Let's get into some basics that you can follow when you're getting started.

Budgeting and Expense Tracking: Navigating Your Financial Maze

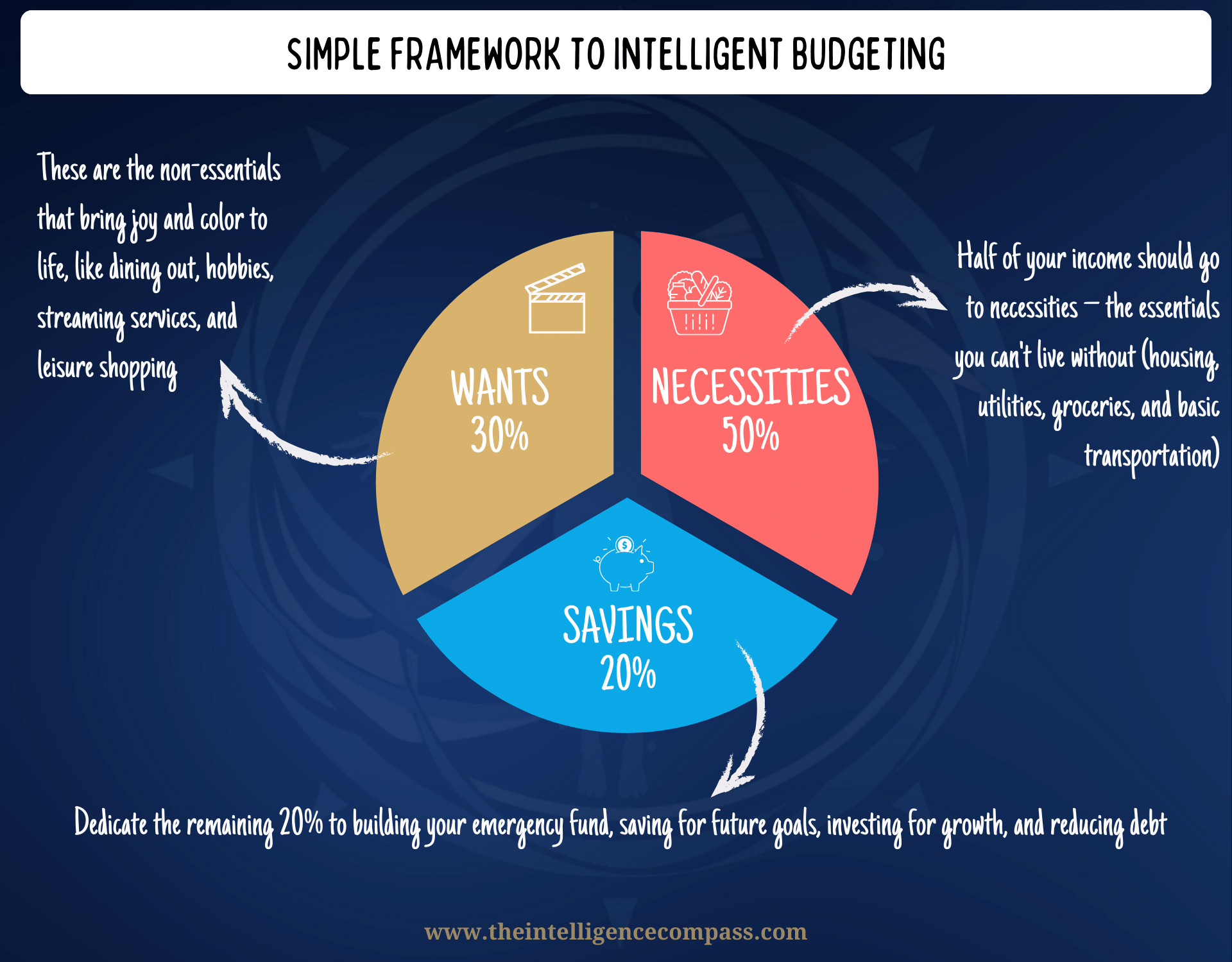

We covered budgeting extensively in Basic Module 2, so we're not going to rehash too much of the detail here.

You will recall that one of the purposes of the budget is to stop you from making wrong turns into 'Impulse Buy' alley or 'Forgot to Save' street. Creating and sticking to a budget is fundamental.

Here's how to navigate your budget successfully to support your savings goals:

- Embrace Technology: Use budgeting apps like Mint or YNAB to track your spending habits in real-time. This will help you identify areas where you're overstepping and adjust accordingly.

- Customize the 50/30/20 Rule: The 50/30/20 rule should sound familiar. If your rent is low but you’re big on travel, maybe tweak the numbers to 40/40/20. Tailor the rule so it syncs with your lifestyle while keeping savings on track. Setting up dedicated savings accounts is a good way to delineate the categories

- Monthly Reviews: Dedicate time each month to review your monthly budget and check on your savings journey. It's like a monthly financial health check-up. Are you overspending on dining out? Time to adjust your allocations.

Consistently sticking to your budget helps build a strong financial foundation, paving the way for you to beef up your savings account number and enhance your investment opportunities, as well as reducing stress over money.

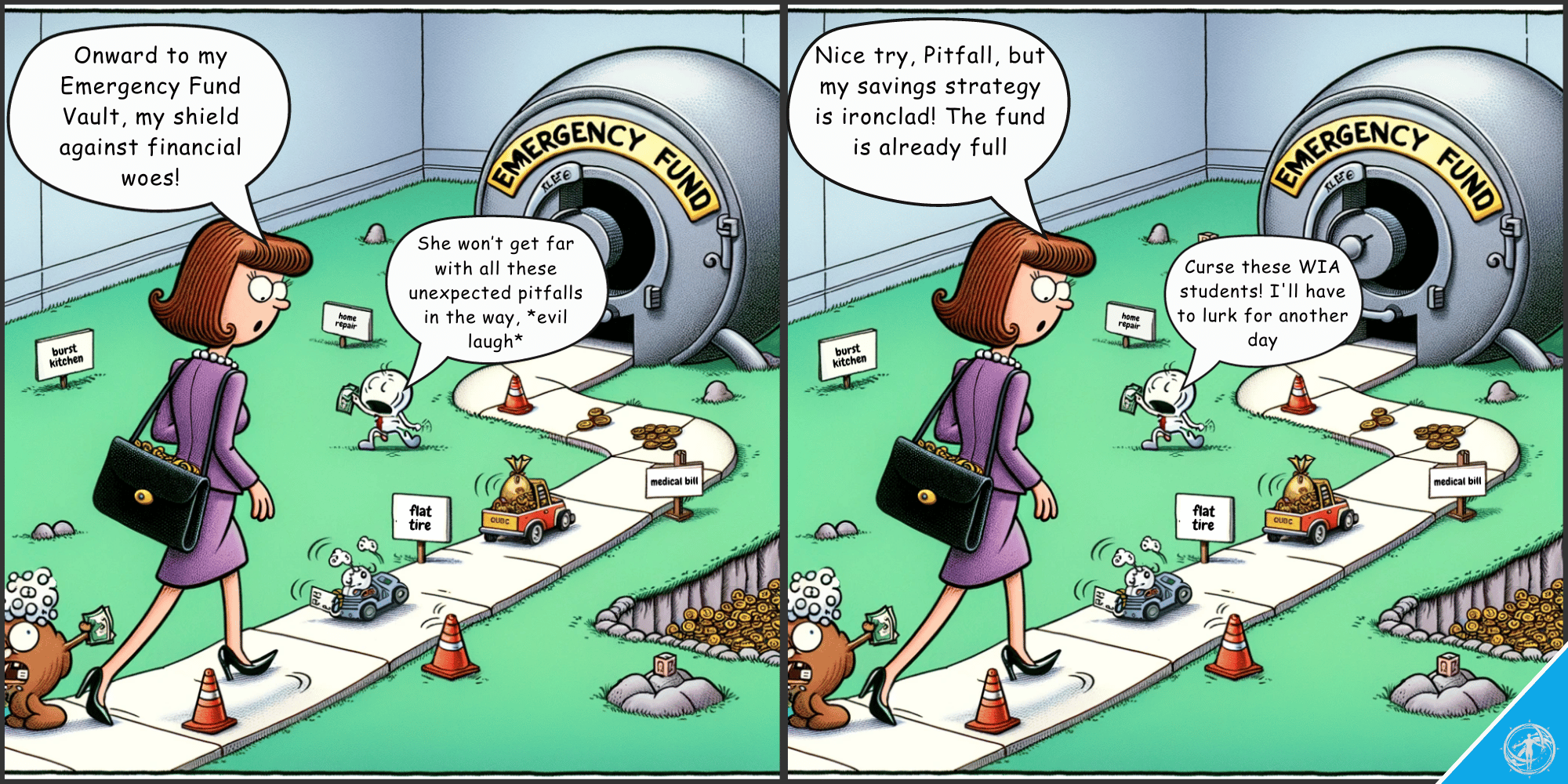

Emergency Fund: Your Financial Parachute

For whatever reason, people hate the poor old emergency fund. Especially young people who have just started earning money and desperately want that new Dyson hair curler thingy (my wife has one, she loves it, I don't get it, but apparently I don't have to).

Building an emergency fund is like packing a parachute before skydiving – you hope you won't need it, but you'll be glad it's there if you do.

It's the intelligent thing to do with your finances.

Aim to squirrel away enough to cover a few months of living expenses (aim for 3 months minimum [1]). It's your buffer against life's unexpected plot twists, ensuring they're mere hiccups, not full-blown sagas.

Here are some potential options to consider to build and maintain your emergency fund:

- Start Small: Begin by setting aside a small percentage of your income each month. Even $50 or $100 can add up over time.

- High-Yield Savings Account: Look at storing your emergency fund in a high-yield separate savings account. It should be liquid (accessible when you need it) while earning more interest than a regular checking account.

- Gradual Increment: As your salary increases, incrementally increase your contributions.

This will give you peace of mind in your journey. An emergency fund provides a cushion against unexpected job loss or medical emergencies, ensuring your long-term financial plans remain uninterrupted.

Debt Management: Dodging Financial Potholes

Debt can feel like a heavyweight, but it doesn't have to be. Think of repaying them as leveling up in the game of financial freedom. Each debt cleared is a boss defeated, paving your way to savings glory.

With the right strategies, you can unlock significant savings potential. Here are some specific, actionable steps that I would recommend for your consideration:

- Tackle High-Interest Debts First: Consider prioritizing paying off debts with the highest interest rates, typically credit cards or personal loans [2]. This strategy is akin to plugging the biggest leaks in your financial boat first, preventing your hard-earned money from draining away in paying interest. By focusing on high-interest debts first, you're minimizing the amount of money wasted on interest payments.

- Utilize Debt Strategies: Implement either the snowball method (targeting smaller debts for early psychological wins) or the avalanche method (focusing on high-interest debts for greater financial impact). Both methods can provide a structured path to debt freedom, allowing you to redirect funds being paid towards debts into a savings account.

- Negotiate Terms: Try reaching out to your creditors or banks to negotiate better terms. You might be surprised how many are willing to work with you for a reduced interest rate or a more manageable payment plan. I do this every year, especially right now with the interest rates being high - just managed to drop ours by a whole percentage point.

- Find Extra Money: Look for ways to increase your income, whether it's a side hustle or selling unused items. Use this extra income to supplement your debt management strategy (or to boost your savings directly). This business started as my side hustle!

- Consider Debt Consolidation: If you're juggling multiple debts, consolidating them into a single loan with a lower interest rate can simplify your payments and reduce the total amount of interest you pay over time. This not only streamlines your financial management but can also free up additional funds for saving.

The other bonus of managing your debt effectively is improving your credit score. A higher credit score can lead to better terms on future loans and credit options, translating into long-term savings on interest costs.

By focusing on these debt-wrangling tactics, you'll find yourself not only breaking free from the chains of debt but also sashaying towards a future where your bank account does more than just nod approvingly but gives you a standing ovation.

Investing: Casting Your Savings in a Starring Role

Once you have the snowball rolling on your savings, eventually you will reach a point where you can start considering where to invest those "millions" (aka thousands...ok fine, hundreds)where your savings get a chance to shine in the spotlight.

Consider it the dress rehearsal before the grand opening. The earlier you let your savings take the investment stage, the more applause (that sweet compound interest) they'll earn.

Here are some recommendations that I have had great success with:

- Start with Index Funds: They’re a low-risk way to start as they track major stock market indices and require less active management. There are many options out there that you can research yourself or speak to an investment advisor about. I will of course cover this in detail in future WIA articles.

- Set up Regular Contributions: Depending on your investment strategy, consider implementing regular monthly contributions that can help take advantage of dollar-cost averaging, potentially reducing the impact of market volatility.

- Use a Robo-Advisor: Platforms like Betterment or Wealthfront can be great for beginners. They automatically manage your investments based on your risk tolerance.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Ensure your investments are spread across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk. Read the WIA article on investment for further details on this

- Long-Term Compounding: The earlier you start, the longer your investment has to grow through compounding, significantly increasing your returns over time. More on compounding in section III below.

- Seek Professional Advice: Most importantly, if you're unsure, consult a financial advisor. A professional can provide tailored advice based on your individual financial situation and goals.

Check out this great comparison between the two robo-advisor options (source: The Savvy Professor)

Always ensure your investment strategies align with your long-term goals, whether it’s buying a home, starting a business, or traveling. Align each stroke with purpose, and watch your canvas of goals turn into masterpieces.

Retirement Savings: The Grand Finale Prep

Retirement planning is like tuning in for the longest-running show on Earth – it seems endless, but boy, does it have a grand finale. It's the ultimate slow-burn narrative, but it's worth it - aka the opposite of the series 'Lost'.

- To ensure a comfortable retirement:

- Start Yesterday: The earlier you start, the more you benefit from compounding interest. Even if it's a small amount, start contributing to a 401(k) or IRA, or whatever the superannuation equivalent is in your country.

- Employer Match: Take full advantage of any employer matching programs – it’s essentially free money towards your retirement.

- Increase Contributions Over Time: Got a pay rise? Turn up that retirement savings volume. As your salary grows, incrementally increase your retirement savings rate. More money put away today means more mojitos on the beach tomorrow.

- Diverse Portfolio: If you have control over it, ensure your retirement portfolio is as diversified as your grandma's spice rack to minimize risk and maximize potential gains.

Incorporating these techniques into your financial strategy sets a strong foundation for a secure and prosperous future, turning the act of saving from a chore into an empowering habit.

As you digest the above information, ponder on these questions for me:

- How do you juggle your desire for immediate gratification with the need for future stability?

- Are your saving strategies in harmony with the life goals you’re strumming?

- In the symphony of your financial life, are your investments hitting the right notes for a grand future finale?

II. Sustainable Saving Plan for Young Families

So that's all well and good but how about those of us with a family? Or perhaps you're a young professional who also has a family?

The good news is that the techniques we discussed for young professionals in Section I are just as relevant here. The twist is that you're now applying them through the lens of a family.

In the world of family finances, the stakes are higher, but so are the rewards. It's one thing to manage money for yourself, but when you're steering the financial ship for a whole crew, it's a whole new ballgame.

Let's dive into how you can create a sustainable saving plan that caters to your young family's unique needs, from the joyous chaos of raising kids to the dream of owning your first home.

Creating a Family-Oriented Savings Plan

Embracing family finance means evolving from solo financial savvy to a team-based approach. It's time to move from 'me' to 'we' in your financial playbook.

This journey starts with crafting a savings plan that’s about dreams, goals, and the collective future of your family. Here, every dollar saved is a step towards a shared dream, be it a new home or your child's education.

Let’s break down how you can steer your family towards a sustainable and fulfilling financial future.

- Budgeting as a Team Sport: Think of budgeting in a family as a team huddle. It's about gathering the squad, setting realistic goals that don't sound like a mission to Mars, and making sure everyone sticks to their role. And yes, this can include children too. It's never too early to inculcate the habit of saving.

- The Balancing Act: Balancing long-term goals like retirement or children's education with immediate needs like that family vacation to Barbados requires a juggler's finesse. It's about prioritizing what matters most at different stages of your family life.

- Meal Planning and Grocery Shopping: Your kitchen can be a surprising money pit, and if you fall into it, there's every chance Gorgon Ramsay will turn up and turn on his "unique" charm. By planning meals and shopping with a list (and maybe some coupon magic), you can turn your grocery trips from a budget buster into a savings builder [3]. My family and I use a meal planning app that generates the list for us, which I then use to shop online - shopping online allows me to keep tabs on the total cost before I pay for it (hot tip that one!).

- Impulse Purchase? Put it on Ice: Impulse buying is like a siren's call – alluring but dangerous. You must hit the pause button on impulse buys like you're waiting for the next season of Stranger Things. A family-focused approach might mean holding off on that instant purchase and discussing it as a family, turning impulse buys into collective decisions. This one is the cause of many a marital rift (believe me), but good teams need to work together people!

Key Strategies for Family Savings

Family savings strategies are like assembling the Infinity Stones – each one powerful on its own, but together, they're unstoppable. Ok, maybe not unstoppable, but it's powerful!

Let's take a closer look at some common family-specific strategies that can help with that savings goal:

- Insurance Investment: Investing in insurance, be it health, life, or home, isn't just a safety measure – it's a bona fide financial strategy. It protects your family and your assets from unexpected setbacks that can derail your savings goals [4].

- The Education Fund Dilemma: Saving for your child's education is like planting a tree – the best time was yesterday, the second-best time is now. Start small, but start soon (are you sensing a theme yet?). We have set up dedicated investment accounts for each of our little minions, so they each have their version of the compound effect.

- Homeownership Dreams: Saving for a home is a marathon, not a sprint. It's about steady, consistent saving, possibly aided by schemes like first-time homeowner programs. Every little bit gets you closer to your dream home. And make sure that home purchase is in line with the overall strategy. That impulse-buying mantra applies here more than anywhere, because you might think you need that pool with the auburn decking, but you don't!

As you navigate these family financial waters, ponder this:

- How does your family's savings strategy align with your long-term strategy?

- What legacy of financial wisdom are you imparting to your children?

- How do your family values shape your approach to money and savings?

Your saving habits and financial plans have a ripple effect on both your personal well-being and family life. For young families, instilling the value of saving and financial planning can be a legacy passed down, laying the foundation for generational financial literacy and security.

Imagine a future where financial uncertainties don't overshadow your family's daily life, where you can make decisions not out of financial desperation but from a place of informed confidence. This future is attainable through the disciplined application of the savings techniques and principles we've explored.

Remember, when it comes to family finances, every decision, big or small, weaves into the tapestry of your family's future. So make it a masterpiece.

III. Understanding Compound Interest - The Magic Ingredient in Your Savings Potion

As we transition from the group focus of money-saving tips for young professionals and families, let’s delve into what I like to refer to as the 'magic show' of finance - compound interest.

Often hailed as the eighth wonder of the world, compound interest is the secret fairy godmother in your savings arsenal. This section is all about demystifying this magic trick of finance and showing you how it can dramatically amplify your wealth over time.

Compound Interest Unveiled

As we defined in our jargon module (B02), Compound interest works like that one friend who always brings more friends to your party. You start with a bit of cash, and as it earns interest, that interest starts earning its own interest.

Beyond the initial excitement of watching your savings grow exponentially over time, compound interest represents a powerful force in securing a comfortable future

Let's break this down further with some numbers (because nothing says 'party' like a good ol’ math session, right?)

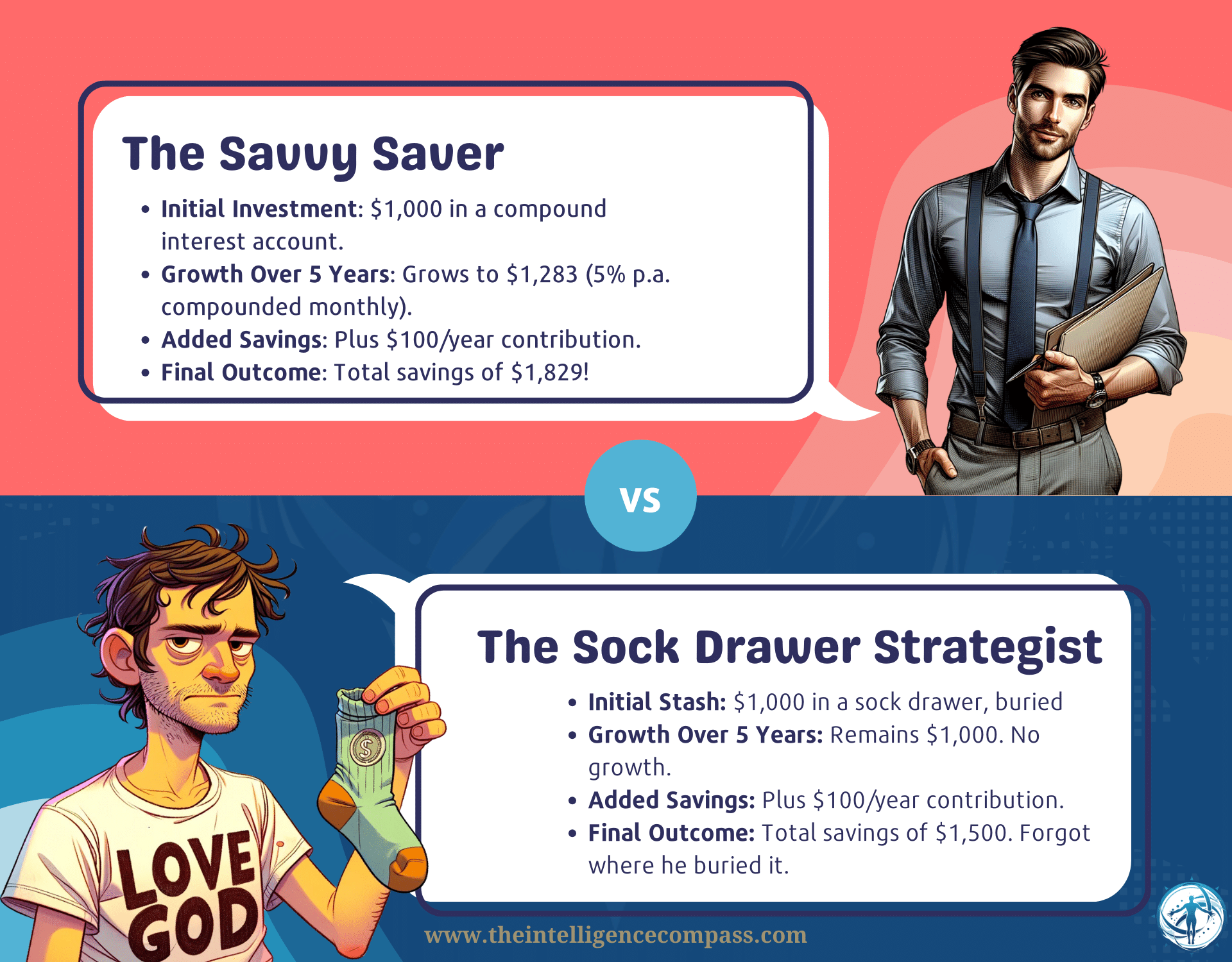

I'll spin you the tale of two cousins: you, a savvy saver, and your dear cousin Carl who visits on Christmas each year, and thinks compound interest is a new brand of toothpaste.

Let's take a look into how compound interest turned your modest savings into a mountain, while Carl's cash sat in his sock drawer, gathering more dust than dollars.

Here's the scoop: You both start with $1,000. You, being the financial wizard you are thanks to religiously reading the Intelligence Compass, decide to put yours into an account with a sweet 5% compound interest.

Carl, on the other hand, decides his sock drawer buried in the backyard is the safest bet. Why is he burying it in the backyard? Because that's a Carl thing (and maybe Ray can shed some light ;-)).

Five years later, your money's been partying hard, while Carl's cash is still nursing its first drink.

Thanks to compound interest, your $1,000 turned into $1,283 (5%pa compounding monthly with no regular deposits), growing bigger each year as the interest earned interest on itself. It's like your money had its own little money babies.

To break it down further, in the first year, you earn $50 in interest, making your total $1,050. In the second year, you earn interest not just on your initial $1,000, but also on the $50 interest from the first year. So, instead of earning another $50, you earn $52.50, bringing your total to $1,102.50. This pattern continues year after year, and the growth accelerates.

Meanwhile, Carl's grand savings plan has earned him... well, nothing. Turns out burying your cash, does nothing. Who knew?

Let's now say that because you have followed all the savings tips here, and have set up an awesome budget that has resulted in you saving an extra $100 each year that you want to direct deposit into your compound interest account. And miraculously, Carl does the same.

Now after, five years, your total savings have exploded to $1,829 (earning an additional $329 in interest!), whereas Carl only has $1,500 (basically just his deposits).

This keeps going, like a Netflix series you didn’t plan to binge-watch but now can’t stop. Before you know it, your $1,000 has morphed into a much bigger number, and you’re the financial equivalent of a couch potato winning a marathon.

The moral of the story? Compound interest is your unsung hero that works tirelessly behind the scenes, turning each dollar you save into an army of wealth-building soldiers.

As for Carl? Well, let's just say he's still waiting for his ship to come in, not realizing he never sent it sailing.

The true power of compound interest lies in its long-term impact. It’s a marathon, not a sprint. The longer you let your savings marinate in the compound interest sauce, the more flavorful your financial future becomes. This is why starting early, even with small amounts, can lead to significant growth over time. It’s not about the amount you start with, but the time you give it to grow.

If you want to have some maths fun (yes, it's possible) with different amounts and frequencies to see what your savings future might look like, you can try this simple compound interest calculator.

In conclusion, embrace the power of compound interest, and don't be like Carl, who is left to ponder his life choices.

IV. The Role of an Emergency Fund in Financial Stability

Now we come to the lifesaver of the financial world: the emergency fund.

Remember that sneak peek in Section I? Well, now we're diving deep.

Building Your Financial Safety Net

The emergency fund is your financial fire extinguisher. It's a hard one for the mindset because you're constantly questioning whether it is better to put that money towards a house, stock, African safari or the latest Elon Musk-backed dog coin, but it's a good exercise for you in adjusting that mindset.

I first learned about the emergency fund from the Barefoot Investor (absolutely great book he has written, highly recommend it). This is how I got my emergency fund journey started based on my learnings from Barefoot [5]:

- Starting Point: Begin small, but be consistent. Saving a little from each paycheck can snowball into a substantial fund over time. I automated this process with a monthly transfer to my fund (most banks offer this service)

- The Ideal Size: Aim for 3-6 months of covering critical living expenses (no, that almond latte is not critical Joyce!)

- Where to Stash It: Opt for a savings account or a money market account. You want this fund to be easily accessible (aka liquid), not locked away in long-term investments that you can't access when you need it.

Visual Book Summary of The Barefoot Investor, love this! (Source: Whiteboard LifeBits)

A Real-Life Lifesaver

Let's take a closer look at why an emergency fund is not just a good idea, but a cornerstone of financial stability, especially through my friend's compelling story from the Australian bushfires.

My friend, let's call him Jake, lived in a quaint town in the hills of Western Australia, a place where the community was tight-knit and the threat of bushfires was always lurking. Jake, a proactive planner, had set up an emergency fund, diligently saving a portion of his income over the years. He aimed for a target amount that could cover six months of his family's critical living expenses, including mortgage payments, groceries, and utilities.

When the bushfires struck, Jake's house was unfortunately one of many that fell victim to the flames. While the loss was emotionally devastating, the financial impact was cushioned by his foresight in building that emergency fund. Here’s how it played a crucial role:

- Immediate Relief: In the aftermath of the fire, Jake’s family (including two children) needed immediate funds for essentials – temporary accommodation, clothing, and daily necessities. The emergency fund allowed them to secure a rental property without the pressure of immediate financial strain.

- Ongoing Expenses: With their primary residence gone, the fund covered their mortgage payments, utility bills, and other recurring expenses while they navigated insurance claims and rebuilding plans. This financial buffer meant they could focus on rebuilding their lives without the added stress of looming debts.

- Flexibility in Decision Making: The fund gave Jake the flexibility to make important decisions without financial desperation dictating his choices. This included negotiating with contractors for the rebuild and making essential purchases to replace what was lost.

The Power of Preparedness

Jake’s story underscores the importance of an emergency fund as a lifeline in times of crisis. His family's experience highlights several key insights:

- Proactive Savings: As mentioned already, start building your fund now, even if it's with small amounts. Consistent savings over time can build a significant safety net.

- Accessibility is Key: Keep your emergency fund in an account that offers a balance of growth and accessibility. You never know when you might need to tap into it quickly.

- Regular Reviews: As your life situation changes, so should your emergency fund. Reassess and adjust it periodically to ensure it aligns with your current living expenses and lifestyle. Paid off a loan? Redirect some of that money to your emergency fund.

Your emergency fund is the unsung hero of your financial saga - it's not about if you'll need it, but when. And when that moment comes, you'll be ready – not just with funds, but with a plan and peace of mind.

V. Adapting Saving Techniques to Changing Financial Circumstances

Remember how in our B03 module on dynamic budgeting, we learned how to make our budget increase its batting average by swinging at life's curveballs?

Now we're going to apply that same dynamic skillset to our saving habits. Life's a bit like a shapeshifter, and our saving techniques need to be just as adaptable (that shapeshifter reference reminds me of Supernatural - any fans out there of this legendary show?)

From Static to Dynamic: The Saving Edition

- Saving Strategies in Flux: Just like our dynamic budgets, our saving techniques need to be fluid. If you've got a raise (high-five!), it might be time to beef up that emergency fund or increase your retirement contributions. Conversely, if you're navigating a financial rough patch, it might be time to dial back on certain savings goals temporarily.

- The Art of Saving Adjustment: Think of your savings plan as a living entity, not a set-in-stone monument. It needs to breathe and grow with you. This might mean reallocating funds from one goal to another as priorities shift. Remember, it's okay to change the game plan as long as you're still playing the game.

- Using the Budgeting Blueprint: Let’s recall the budgetary gymnastics from our B03 module. That same agility is crucial here. When unexpected expenses pop up, like a surprise visit from the in-laws (the joy!), having a bit of wiggle room in your savings can be a lifesaver.

- Embrace Flexibility, Reject Rigidity: Being too rigid with your savings can be just as harmful as not saving at all. Your savings strategy should be as flexible as a yoga instructor. It's about finding that sweet spot where you’re saving effectively without strangling your current lifestyle. It's a balancing act worthy of a circus performance.

When I started climbing the corporate ladder, I pumped up my emergency and home loan savings, but when life decided to remodel my kitchen without asking (thanks, burst pipes!), I had to temporarily redirect funds to cover those costs. It wasn't derailing my plan, just taking a scenic detour.

I didn't freak out because my strategy and my mindset allowed for this. It's essential to keep the momentum going. If you’ve had to tap into your savings for an emergency, focus on rebuilding it once the crisis is over.

Mindset and Savings: The Unseen Connection

Let's delve deeper into something that is often overlooked, but what I consider to be crucial in any financial endeavor - the role of mindset. This is the keystone of your entire financial structure (and a key pillar of my Nexus framework).

Here's how mindset intertwines with your savings journey, particularly in trying to be adaptable and resilient:

- The Power of Intentionality: Saving money is a deliberate act of prioritizing your future over immediate gratification. Cultivate a mindset of intentionality where every dollar saved is a step toward your larger life goals, be it retirement, a dream vacation, or your child’s education. Ask yourself, "What am I saving for?" This clarity transforms saving from a mundane task into a purposeful journey.

- Adopting a Growth Mindset: Embrace the belief that your financial capabilities can expand and improve. A growth mindset enables you to view challenges, like sticking to a budget or cutting down expenses, as opportunities to advance your financial knowledge and skills, rather than insurmountable obstacles.

- Resilience in the Face of Setbacks: Cultivating resilience helps you bounce back from setbacks like sudden expenses or income dips without derailing your savings goals. Resilience turns "I can't save anymore" into "How can I adjust my savings strategy to stay on track?"

- Mindful Spending Aligns with Savings: Develop a habit of mindful spending – a conscious awareness of where your money goes. This isn't about penny-pinching but making spending choices that align with your values and savings objectives. Before a purchase, pause and ask, "Does this align with my financial goals?"

- Visualization as a Motivational Tool: Regularly visualize your financial goals and the lifestyle they will enable. This mental imagery is a powerful motivator, making the abstract concept of 'saving' tangible and directly linked to your future aspirations.

- Celebrating Milestones: Recognize and celebrate your savings milestones, no matter how small. This positive reinforcement strengthens your savings habit and keeps you motivated.

The Bottom Line

Saving is an art and a science. It’s about being as adaptable as water, flowing through the ever-changing landscape of your financial life.

A rigid saving plan is a brittle one.

So, as you continue to navigate through the unpredictable journey of life, keep your savings flexible, be ready to adapt, and above all, remember to enjoy the ride – it’s all part of the wealth-building adventure.

Now here's another edition of those thought provokers for you to meditate on:

- How can you adjust your saving techniques to match your current financial situation without compromising your long-term goals?

- When was the last time you reassessed your savings plan to ensure it still aligns with your life’s current chapter?

- In what ways can you cultivate a more flexible approach to saving, so it becomes a natural and stress-free part of your financial routine?

My Closing Thoughts

As we wrap up our journey through the world of saving techniques, let's take a moment to recap the golden nuggets we've unearthed together.

Encapsulating the Key Strategies

- For the young professionals, we dove into the art of balancing life's pleasures with the discipline of saving. Remember, it's not about living on breadcrumbs today for a feast tomorrow, but finding that sweet spot where your savings grow without suffocating your today.

- For families, it's about turning financial management into a team sport, where every family member plays a role - think Monopoly but with real money, and less table flipping. From smart grocery shopping to discussing big purchases, it's a collective journey towards a shared dream.

- Compound interest, the 8th wonder, is the backstage hero, silently amplifying your wealth. It's the force that turns modest savings into a financial powerhouse over time. It's the kind of magic that would give Potter a run for his money.

- The emergency fund, a crucial pillar of financial stability, acts as a buffer against life's unexpected turns. It's about being prepared, so when life throws curveballs, you're ready with your glove.

- Finally, adapting saving techniques as life evolves. It's about being as adaptable as a chameleon on a disco ball, ready to pivot and balance as your financial situation changes.

As we look ahead, I encourage you to view saving not as a mundane task but as a vital component of a fulfilling, financially secure life. Take these lessons, apply them consistently, and watch as they transform not just your bank account, but your entire approach to life and money.

And I want to hear from you, so share your thoughts, your triumphs, and even your challenges (via email at admin@theintelligencecompass.com or comment below). Let's keep this conversation going – your insights and experiences are invaluable(I'm always learning).

When you're ready, turn the page to our next chapter in the Wealth Intelligence Academy: Understanding Debt. Here, we'll dive into the captivating world of debt – dissecting the good, the bad, and the savvy ways to handle it. This knowledge, combined with your enhanced saving strategies and financial planning, will equip you to navigate the multifaceted world of personal finance with greater confidence and foresight.

In the meantime, have some fun reading through our friends' adventures at the mysterious Nexus Academy in the link below.

Here's to your success in savings, and I can't wait to continue our journey together in the next session.

Please note: The information provided in this article is intended for educational and informational purposes only. It does not constitute professional financial advice. Financial decisions should be made based on your individual circumstances and goals. We recommend consulting with a qualified financial advisor to obtain advice tailored to your specific situation

References

- Marcus. (n.d.). Savings strategies for young professionals. Retrieved from https://www.marcus.com/us/en/resources/saving/savings-strategies-for-young-professionals

- Ramsey Solutions. (n.d.). The secret to saving money. Retrieved from https://www.ramseysolutions.com/budgeting/the-secret-to-saving-money

- Money Crashers. (n.d.). Money-saving tips for families. Retrieved from https://www.moneycrashers.com/money-saving-tips-families/

- Intuit Mint. (n.d.). Money management for young adults. Retrieved from https://mint.intuit.com/blog/budgeting/money-management-for-young-adults/

- Pape, S. (2017). The Barefoot Investor. John Wiley & Sons.

- MoneyZine. (n.d.). Personal finance savings statistics. Retrieved from https://moneyzine.com/personal-finance/savings-statistics/

- The Tokenist. (n.d.). Millennial income statistics. Retrieved from https://tokenist.com/millennial-income-statistics/

- Zippia. (n.d.). American savings statistics. Retrieved from https://www.zippia.com/advice/american-savings-statistics/

the Nexus Saga