Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

- Money's Evolution: Trace money's journey from barter to digital currencies, including the emergence of fiat money.

- Key Properties of Money: Understand the essential qualities of money: fungibility, durability, portability, recognizability, and stability.

- Economic Role of Money: Discover how money supply, inflation, and monetary policy are managed by central banks to stabilize economies.

- Digital and Crypto Money: Learn about the rise of digital and cryptocurrencies, blockchain technology, and significant altcoins.

- Future Money Trends: Explore future possibilities in finance, including Central Bank Digital Currencies and the changing role of cryptocurrencies

Hey there!

Ever looked at a dollar bill and thought, "This little green paper has more stories than my grandma"? Well, you're not alone.

Welcome to the quirky world of money, where every coin and bill is like a mini-celebrity with its own fan base and drama.

This is the first article of our Wealth Intelligence Academy series, and trust me, it's like the pilot episode of your favorite show – but much better, and guaranteed to succeed. Think of me as your financial Gandalf, minus the beard (and the magic staff, and the old age, and the robe, and the horse) leading you through the mystical lands of finance.

My mission in this module is simple and clear: to make sense of those cryptic things often referred to as cents and dollars/any other current you're familiar with, and the system that drives it and answer that simple question of how money works.

I'm talking about understanding its soul. Yes, money has a soul, and no, it's not always as green as you think, or the spawn of Satan himself.

In this article, we'll dive into details about the evolution of money, its various roles, how it works in the economy and what the future holds for this all-powerful concept that has some people putting it above their own mother in terms of life's priorities.

But wait, there's more!

You'll also get a first time peek into the minds of our Academy characters, each showcasing their thoughts and perspectives on each module that drops in the academy - scroll to the bottom for the links. this content is purely optional reading, but it's like adding spice to your financial soup.

These tales offer a unique and engaging perspective on each module, so dive into their world if you prefer your material a bit more creative. Who knew learning about money could have more twists than a daytime soap opera? (please lower your hopes, I'm no Agatha Christie).

I. The Evolution of Money

Let's take a whirlwind tour through the evolution of money, where we'll see it morph from primitive bartering to the digital wizardry of cryptocurrencies. It's like binge-watching a financial history documentary, but way more fun.

The Barter System and its Limitations

Let's hop into our financial time machine and zoom back to the days when money was, well, not exactly money. We're talking about the barter system, where a chicken could get you a sack of potatoes, and a nice fur mammoth coat might land you a shiny new spear.

Picture this...

You're a caveman with a bunch of extra mammoth meat but what you really need is a new club. You find another caveman who has a club but, plot twist, he wants berries, not meat. That's the barter system for you – the original "you scratch my back, I'll scratch yours," but way more complicated. It was like playing a never-ending game of matchmaker with goods and services.

Inefficient? Absolutely.

But this raises another question, one of the value dilemma: maybe that was actually your pet mammoth that passed away, and you really value its meat and think you should get two clubs for it. Who decides what's worth what? This is the concept of the coincidence of wants.

The Birth of Currency

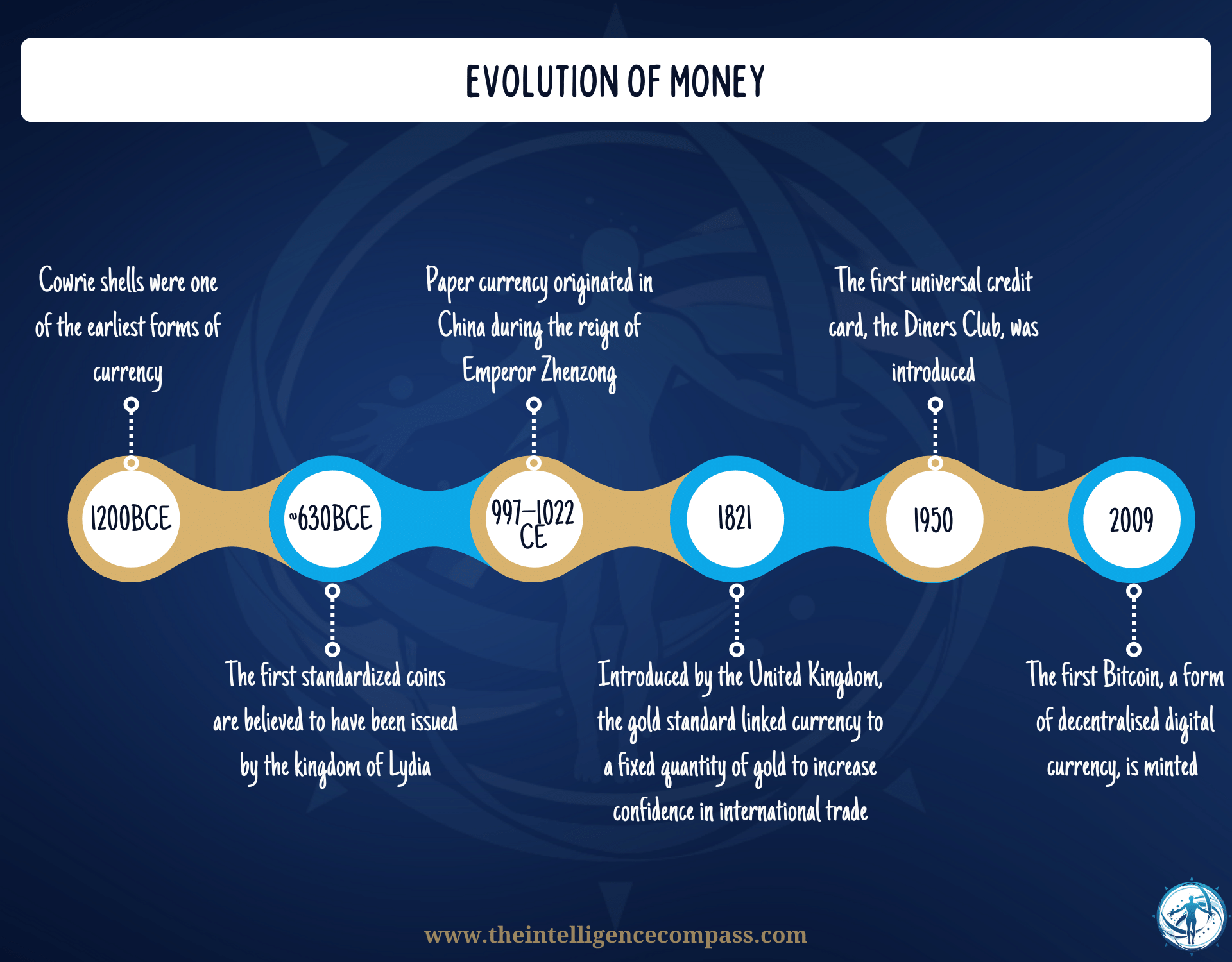

Naturally, our ancestors got sick of lugging around their goats just to source some bread, so then came the big leap – currency! Whilst the advent of currency certainly improved the practicality of getting what you wanted, the early versions were as diverse as a United Nations meeting – cowrie shells, whale teeth, and even large limestone disks in Yap Island. Talk about heavy wallets!

Coins were the next big hit. The kingdom of Lydia, around the 7th century BCE, started minting these shiny tokens of electrum, a gold and silver mix that probably had people in ancient times feeling like they'd hit the jackpot [1].

But with great currency came great counterfeiting. The penalties for faking it were straight out of a horror movie – think decapitation in 14th-century China and being burned at the stake in England. Makes getting a parking ticket seem like a walk in the park, doesn't it?

The Paper Trail and the Golden Handcuffs

Of course, then humans had enough of lugging around shells and coins, and coincidentally found trees existing pretty annoying so they killed two birds with one stone and created paper money - the stuff dreams (and shopping sprees) are made of. It all started in China under Emperor Zhenzong around the 10th century, when they used mulberry tree bark to make money.

Then there was the gold standard, a real 'golden age' for money. Introduced by the UK in 1821, it was like promising, "Every pound we print is worth a chunk of gold, trust us." Pretty logical to have something physical of value backing meaningless paper with numbers on it, right?

But, like all good things, it came to an end in the 1970s. Why? Well, countries realized tying money to gold was like financial dieting - it limited how much money they could print. And who doesn't want to print money on a whim, right?

The Digital Revolution

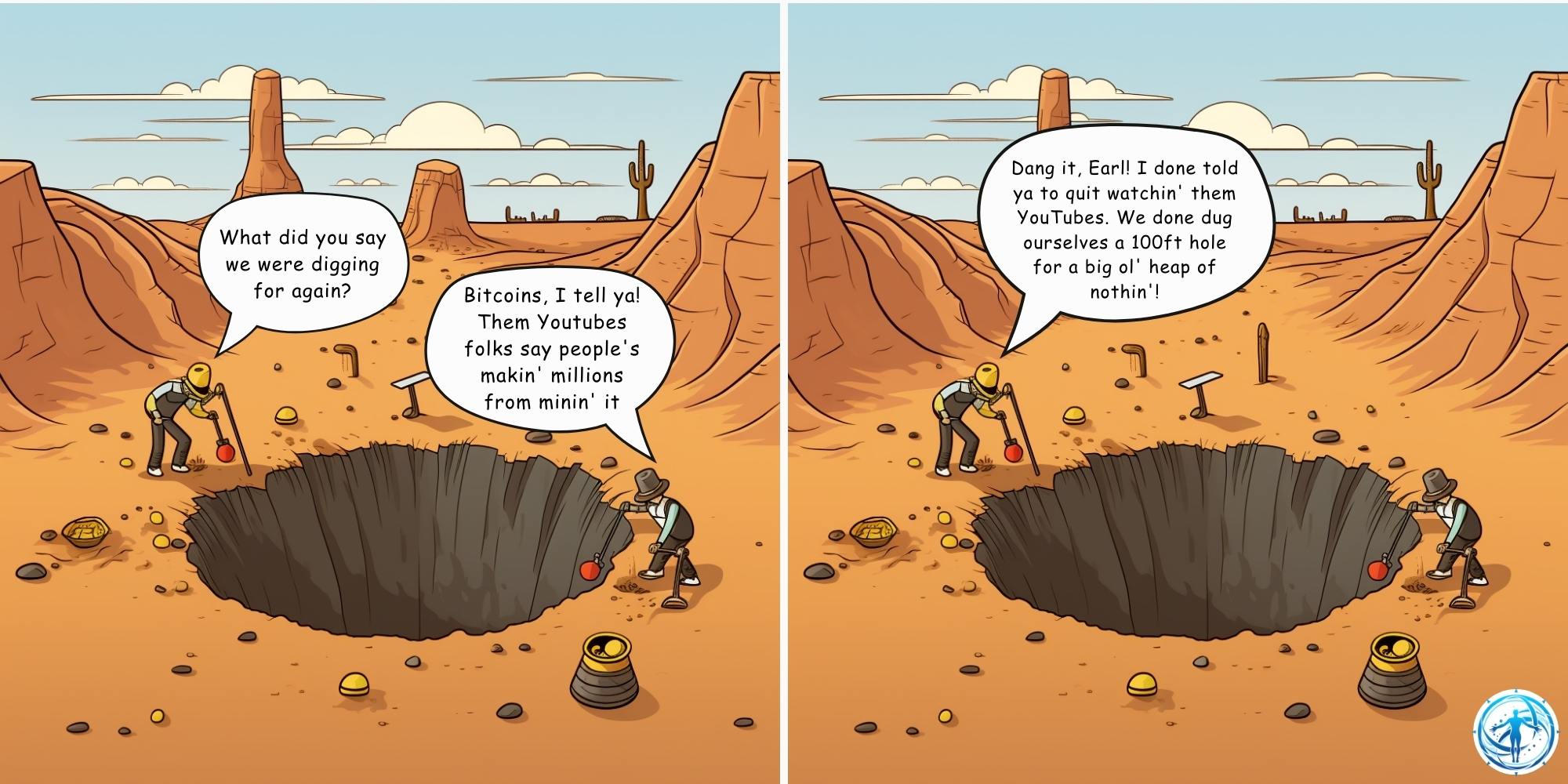

Fast forward to the digital age, and money has gone virtual. Enter Bitcoin in 2009, created by the mysterious Satoshi Nakamoto in response to the global financial crisis [2]. It's like the Banksy of the financial world – elusive, decentralized, and a bit of a rebel, showcasing humanity's rebellious streak against traditional financial systems.

But wait, there's more! We're not just talking about cryptocurrencies like Bitcoin. There's a global trend moving toward digital currencies – think of these as the more buttoned-up cousins of crypto, centralized and a bit more... establishment. It's like comparing a wild mustang to a well-trained racehorse. And don't worry, we'll dive deeper into this digital currency rodeo in Section 6 when we explore the future of money

So, we've journeyed from cowrie shells to cryptocurrencies, but what is it about money that gives it its power?

II. What Makes Money, Money?

The Essential Characteristics

Let's dive into the nitty-gritty of what makes money actually money. It's not just about being shiny or fancy, or being a co-star in the next hip-hop video clip. Money has some key characteristics that make it work in our daily lives.

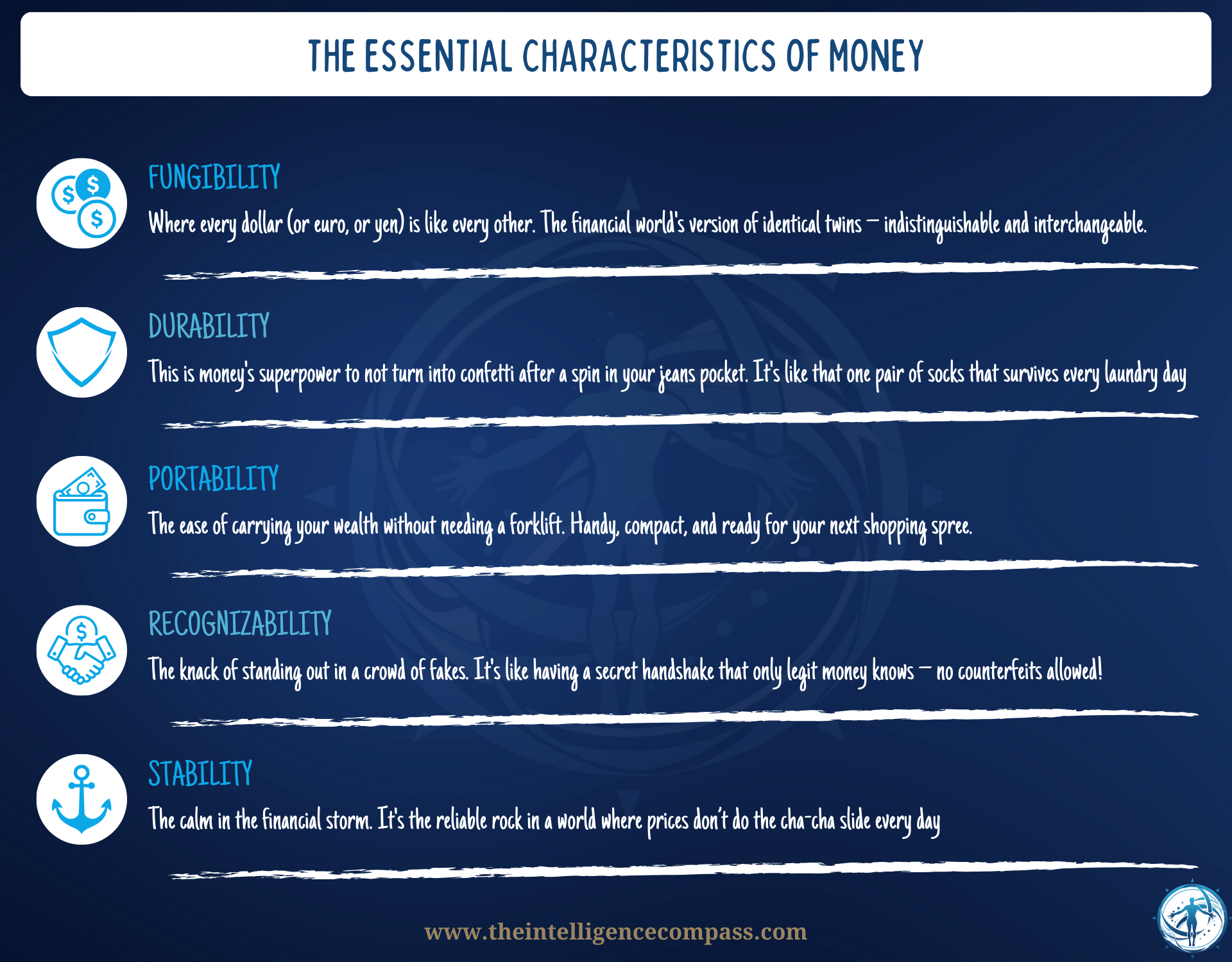

We're talking about fungibility, durability, portability, recognizability, and stability [3].

- Fungibility: This is a fancy word for saying one unit of money is as good as another. Imagine if every $10 bill was unique – buying a coffee would turn into an episode of "Antiques Roadshow."

- Durability: Money needs to last. Unlike that avocado you bought last week, you don't want your cash turning brown and mushy overnight.

- Portability: It's gotta be easy to carry. No one wants to lug around a wheelbarrow of coins just to buy a sandwich.

- Recognizability: You need to know it's money at a glance. If it looks like Monopoly money, you might have a problem.

- Stability: The value shouldn't be more volatile than your aunt's mood at Thanksgiving. Stability is key for planning and saving.

Why These Properties Matter

In the grand tapestry of our financial world, the properties of money weave together to create a fabric that's both resilient and versatile.

Think of it as a finely-tuned engine. Each property is a critical component, working in harmony to power our daily transactions and long-term financial stability, forming the backbone of our economic life.

Imagine a world where money lacked these combined properties. We'd be back in the dark ages, lugging our livestock or pet chihuahas around, bartering in a chaotic marketplace, where the value of goods is as fluctuating as the weather, and the certainty of trade as elusive as a mirage. The seamless transactions we take for granted today would be replaced by a cumbersome and unreliable system, more akin to a guessing game than a structured economy.

These properties collectively ensure that money is more than just a medium of exchange; it's a catalyst for economic stability and growth. They provide a foundation upon which we build not just wealth, but trust in the very system that governs our financial interactions.

The Role of Trust in Money

Trust in the monetary system, especially in the context of fiat currencies, is a delicate dance. Governments have been known to print money, sometimes with reckless abandon. It's a bit like a chef who keeps adding salt to a dish – a little bit can enhance the flavor, but too much, and you've got a culinary disaster.

The risk here is inflation (very topical here in late 2023 for those historians reading this), where the value of money drops faster than a bad singer on a talent show. This can lead to a loss of purchasing power, where today's dollar buys less than yesterday's and really expensive potatoes. But hey, how else do we pay off this trillions of dollars in debt?

Central banks are the conductors of this financial orchestra, ensuring that the money supply harmonizes with economic growth. But it's a tightrope walk. Stray too far, and you risk either runaway inflation or stifling deflation.

The abandonment of the gold standard that we touched on in the previous section was a bold move, akin to switching from acoustic to electric guitar. It offered more flexibility but required a whole new level of trust in the system. Essentially, the value of that cash in your hand is heavily reliant on your trust in your government to maintain that value - nothing more.

As we segue into the next section, let's keep in mind that money isn't just about what it is, but what it does. It's the oil in the engine of our economy, keeping everything running smoothly – as long as we all agree on its value and function.

III. The Functions of Money

Money, that magical paper (or digital figure) we all chase, isn't just a one-trick pony.

Remember our jaunt through history, where we touched on Lydia's groundbreaking coinage? Let's dive deeper into why that was such a game-changer, illustrating the core functions of money in a way that even a Lydian trader would appreciate.

Medium of Exchange

Ancient Lydia.

Bustling markets, goods aplenty but a headache to trade, as you recall from the limitations we covered in the earlier section.

Then comes the coin – sleek, shiny, and a trader's new best friend. These coins revolutionized trade by eliminating the cumbersome barter system. Suddenly, buying a loaf of bread didn't involve negotiating with chickens (using chickens as tokens of value, rather than negotiating with chickens themselves). This is money's role as a medium of exchange in its earliest, shiniest form.

Unit of Account

Now, let's talk about money as the ultimate referee in the game of value. Imagine trying to figure out if a cow is worth three bags of wheat or maybe four chickens. Sounds like a math problem you never want to solve, right?

Money gives us a common measure, turning the abstract concept of value into a number we can all agree on. Lydian coins introduced a standard unit of account. Today, when you check price tags, you're witnessing the modern legacy of this ancient innovation.

Store of Value

Here's where money shows its time-traveling prowess. You work hard today, earn money, and voilà – you can store this effort and use it in the future. Those Lydian coins weren't just trade facilitators, they were tiny vaults of value. Unlike perishable goods or even less durable forms of money, these coins held their worth over time.

Fast forward to today, and this concept is why you can stash money in a savings account for a rainy day, confident that it won't turn into financial compost.

Standard of Deferred Payment

Last but not least, money as the cornerstone of credit and future payments. It's the glue that holds together deals and promises in the business world.

The Lydian coins laid the groundwork for deferred payments. It's a concept that has evolved from simple IOUs in ancient markets to complex financial instruments in today's economy.

So there you have it – from the ancient Lydian coins to the digital dollars of today, the functions of money have not just shaped economies.

But as we stand on this historical bridge, looking back at where we've come from and peering into the future, a crucial question emerges: What exactly constitutes 'money' in our rapidly changing world? And how has our perception of money evolved, and what new forms are emerging on the horizon?

IV. The Many Faces of Money

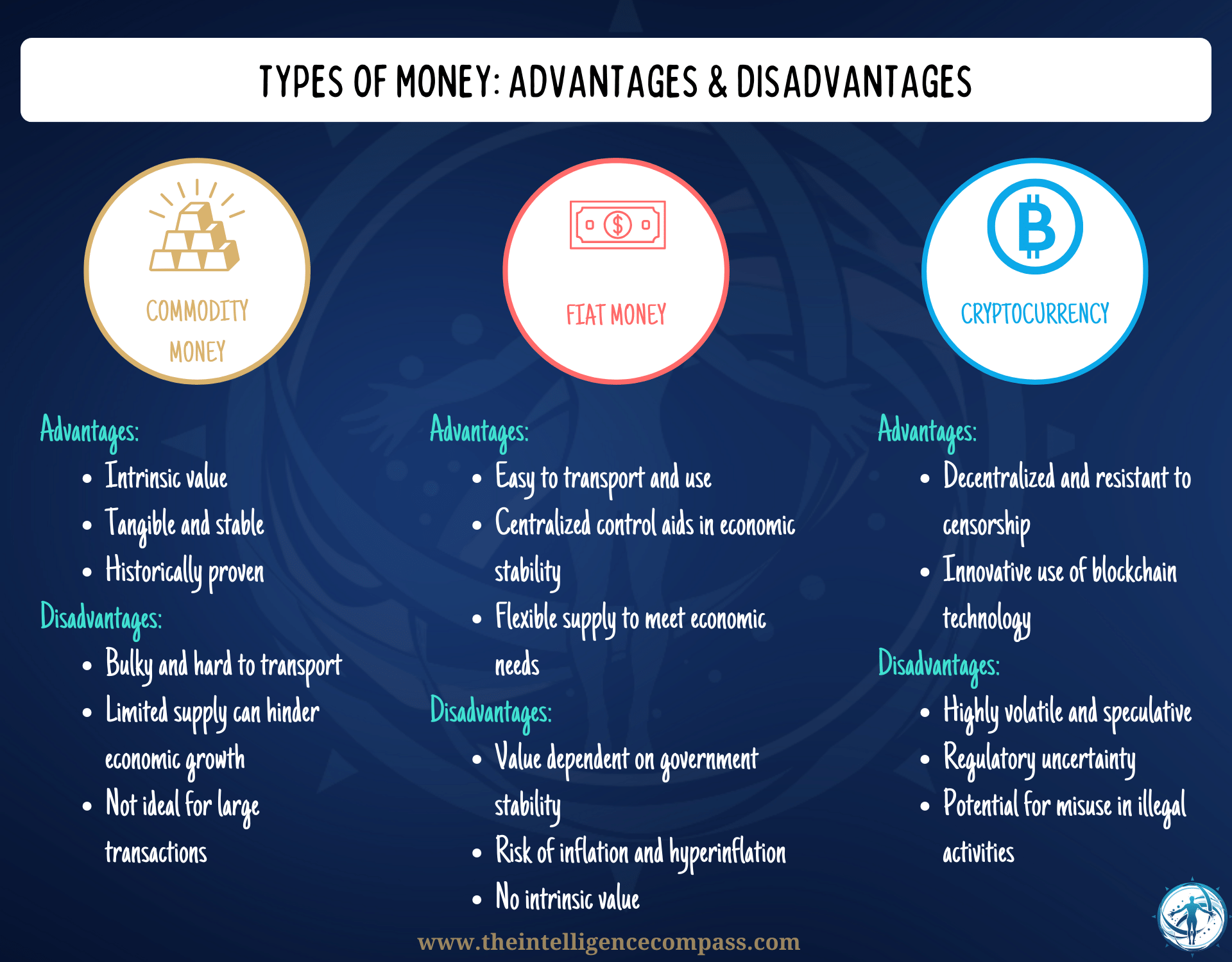

Commodity Money vs. Fiat Money

Alright, financial explorers, let’s dive into the kaleidoscope world of money types. You've probably heard of "commodity money" and "fiat money." Sounds like fancy financial jargon, but it's simpler than assembling IKEA furniture, I promise.

First up, commodity money. Think of it as the old-school, OG money. This is money that’s worth something all on its own. Classic example? Gold.

It's not just shiny and pretty, it has intrinsic value. You could be stranded on a desert island, and your gold coins would still hold value – though finding a shop to spend them might be a challenge.

Now, let's talk fiat money. This is the modern moolah – the dollars, euros, and yens of the world. But the catch is that fiat money isn’t backed by physical commodities. No gold, no silver, just good old faith.

Its value comes from the trust and confidence we place in the government that issues it. That's right, the same folks who can't decide what color to paint the new bridge are the bedrock of your currency's worth. It's like making Peter Pan the CEO of a Fortune 500 company – it only flies if we all clap hard enough.

That last point is probably a shock to most of you, but we all believe in it because, well, the alternative is a bit too grim. Who wants to wake up to a world where your dollar bill is just a fancy piece of paper good for origami but not much else? So, we all nod, agree that it's valuable, and just like that, your latte costs $5 instead of a bartered chicken (or two with inflation!)

The "beauty" of fiat money is that it gives central banks more control over the economy (some might say that's a bad thing, but you lot just need to stop thinking for yourselves). They can print more or less to manage inflation, stimulate spending, or save us from a recession (or at least try to). Of course, this power comes with risks – like hyperinflation, where money’s value plummets faster than a lead balloon (4).

Digital Currencies and Cryptocurrencies

Enter the digital era, and money goes virtual. Say hello to digital currencies and cryptocurrencies. These are the cool kids on the block, shaking up the traditional financial world.

Digital currencies are like the responsible cousins of cryptocurrencies. They’re digital, yes, but they're still tied to a central authority, like a bank or government. They represent the digitization of our everyday money – think of the digits that magically appear in your bank account on payday.

Let's revisit our friends, the cryptocurrencies. Remember, these are the mavericks that entered the financial stage with a bang. Building on what we touched upon earlier, cryptocurrencies like Bitcoin and Ethereum are emblematic of a financial paradigm shift.

Their decentralized nature challenges the conventional monetary system controlled by central authorities. The blockchain technology underpinning them isn't just nifty for security, but a whole new way of thinking about transparency and transaction integrity.

Their value? Well, that’s a rollercoaster ride based on supply, demand, and investor sentiment

Cryptocurrencies have been a hot topic not just for investors looking for the next big thing but also for regulators grappling with how to fit this square peg into the round hole of traditional financial systems. They embody the spirit of financial innovation, simultaneously exciting and unsettling the established order.

Their impact on the financial landscape has been huge. They're challenging the way we think about money – who controls it, how we use it, and what it’s backed by. In the digital age, money is no longer just paper and coins; it's lines of code and digital trust.

In a nutshell, from gold coins to digital bits, money has evolved in fascinating ways. Each type of money – commodity, fiat, digital, and crypto – has its unique flavor, advantages, and challenges.

You: "Yes, that's great Compass guy, but I still don't understand how money makes the world go around?"

Me: Hold your horses, we're getting to that...

V: Money in Motion: Its Role in the Economy

Let's dive into the economy's deep end where money isn't just the lifeguard but also the water, the waves, and sometimes, the riptide. In this section, we're unraveling the mysteries of money's role in the grand economic ocean

The Money Supply and Inflation

Picture the economy as a giant bathtub (bear with me here). The water in the tub? That's your money supply.

Now, if the tub is overflowing (too much money), you get inflation. Prices rise, and suddenly, your hard-earned cash buys you less than before. It's like going on a shopping spree only to realize everything's priced for millionaires.

Conversely, if there's not enough water (money), the economy gets thirsty, stalling growth. This is where central banks come in, playing the role of the world's most powerful plumbers. They adjust the taps, trying to get just the right flow – not too much to flood the bathroom (hyperinflation), and not enough to turn it into a desert (deflation).

Remember, inflation is about your purchasing power. More money chasing the same amount of goods?Prices go up, and your dollar starts feeling a bit lightweight, like it’s been hitting the gym too hard and lost some muscle.

Central Banks and Monetary Policy

Central banks are like the DJs of the economic party, and monetary policy is their playlist. They can turn up the volume (print more money) or bring the mood down (reduce money supply), all in the name of economic stability.

They're the puppeteers pulling the strings of interest rates, influencing everything from your mortgage payments to the health of national economies.

The IMF stresses the importance of macroprudential policies (fancy term, I know) to avoid financial crises. It's like having a chaperone at the economic prom to make sure things don't get too out of hand [5].

Central banks use these tools to build buffers against financial shocks. Think of it as economic shock absorbers, keeping the ride smooth even when the road gets bumpy.

They’re constantly juggling – trying to keep inflation in check, ensure enough money is flowing through the economy, and, oh, prevent it from crashing into a recession.

No pressure, right? I would feel bad for them, but my mortgage payments just went up again, so...

Global Perspective

Let’s zoom out for a global selfie. Money on the global stage is a whole different ball game.

Here we enter the world of foreign exchange and international trade. Currencies flirting with each other, exchange rates doing the tango – it's a financial fiesta.

In this global marketplace, money works as the universal language. It's like the Esperanto of economics. Countries trade, currencies exchange hands, and the balance of payments keeps score. One country's surplus is another's deficit, and the exchange rates are the scorekeepers.

This global dance of money affects everything from the price of your imported coffee to the stability of entire nations.

It's a delicate balance, where a hiccup in one part of the world can send ripples across the globe – like a financial butterfly effect.

As we navigate the currents of money's role in the economy, one can't help but ponder: What does the future hold for this ever-evolving entity called money? Is it destined to transform beyond our wildest imaginations or will it retain its age-old essence?

VI: The Future of Money

As we stand on the precipice of the future, peering into the vast unknown of the financial universe, let's speculate a bit, shall we?

The future of money, much like the finale of a long-running TV show, is shrouded in both excitement and uncertainty. So, what could be in store for our wallets and bank accounts?

Central Bank Digital Currencies (CBDCs)

First off, let's talk about Central Bank Digital Currencies (CBDCs). Remember those digital currencies we chatted about earlier?

Well, CBDCs are their more official siblings. Around 100 countries are exploring these digital darlings, including the Bahamas with its Sand Dollar and China’s e-CNY, already a hit with millions of users [5]. CBDCs are like the hybrid cars of the currency world – they bring together the efficiency of digital with the trustworthiness of government backing.

Now, don't get me wrong, CBDCs aren't just about putting old wine in a new bottle. They have the potential to revolutionize financial inclusion.

Think about it – digital money that's as legitimate as the paper stuff in your wallet but more accessible to those in remote or underserved areas. CBDCs could be the bridge over the digital divide, bringing banking to every nook and cranny of the globe.

There are concerns from certain corners that converting cash to digital will lessen a person's control over their own money, so it will be interesting to see how the governments and central banks alleviate people's concerns in this space.

Cryptocurrencies and Utilities

Taking the stage again are cryptocurrencies. With cryptocurrencies, we're seeing the democratization of money – where control shifts from the hands of the few to the network of the many, powered by the blockchain solution.

We've already chatted about "king crypto", Bitcoin, and its blockchain entourage, but what about the other players?

Enter altcoins (coins alternative to Bitcoin - very creative, aren't they) like Ripple, Ethereum, and their digi-coin friends. The companies and individuals behind these coins are trying to carve out a niche with real utility beyond just existing as coins:

- Ripple (XRP): Aiming to revolutionize international transactions, making them as easy as sending an email. Who needs slow bank transfers when Ripple's around?

- Ethereum: Numero 2 behind the king in terms of market cap, this is a platform for decentralized apps. It's like the Swiss Army knife of the crypto world.

- Beyond Transactions: Many altcoins are exploring uses from smart contracts to decentralized finance (DeFi), pushing the boundaries of what 'currency' can mean.

Speaking of gold, let's not forget the role of digital gold. Cryptocurrencies like Bitcoin are already seen by many as a modern version of gold – a store of value in times of economic uncertainty.

I've observed on more than one occasion when the banking world hits turbulence, people have sprinted towards Bitcoin like it's a Black Friday sale. It's mirroring gold's role as a financial safe haven, offering an escape hatch during banking crises and economic meltdowns.

Bitcoin's price action sometimes waltzes in step with gold, showcasing its emerging status as digital gold in a world where traditional finance dances to a sometimes unsettling tune

And let's not ignore the elephant in the room – the environmental impact of digital money, especially cryptocurrencies. The energy consumption of Bitcoin mining has raised eyebrows and concerns. The future of money will need to balance innovation with sustainability.

So, as we peek into the crystal ball of financial futurism, we see a landscape where altcoins strive to be more than just digital trinkets, Bitcoin flirts with being the new-age bullion, and CBDCs promise a streamlined monetary future (with a side of surveillance concerns).

Will your digital wallet be the new Fort Knox, or will it be as volatile as a reality show romance?

Closing Thoughts

As we draw the curtains on this financial literacy odyssey through "How Money Works," let's anchor at the shore with three key takeaways:

1. The Evolution and Diversity of Money: From bartering to Bitcoin, money has transformed dramatically. Understanding its history and the various forms it takes – commodity, fiat, digital – is crucial in navigating the modern financial landscape.

2. Money's Role in the Economy: The intricate dance between money supply, inflation, and monetary policy underscores the delicate balance central banks maintain to keep economies afloat.

3. The Future of Money: The evolving landscape, from the advent of CBDCs to the rise of cryptocurrencies and digital gold, paints a picture of a future where money is not just a medium of exchange but a dynamic tool for innovation and change.

As you reflect on these insights, ponder these questions: How does your understanding of money's evolution impact your financial decisions? In what ways can you prepare for the shifting landscape of digital currencies and their role in your financial future?

Got thoughts or lightbulb moments from our money talk? Don't just ponder in silence - your thoughts, questions, and insights are invaluable. Feel free to share them in the comments, or better yet, sign up for our newsletter to continue this enlightening journey. Every step you take on this path empowers you, not just with knowledge, but with confidence in your financial decisions.

And don't forget to check out the financial mystery of the century with our tragic Academy participants in the Nexus Saga series below.

If understandably you want to bypass the financial soap opera, skip right ahead to the next installment in the Wealth Intelligence Academy: "Demystifying Financial Jargon" where I look to bring out the financial thesaurus and dictionary and really beef up your financial vocabulary so you can blow everyone's minds with your newfound genius at your next BBQ gathering, using "quantitative easing" in a sentence and explaining to your neighbor Bob why 'hedge funds' aren't about gardening.

I want to remind you that here at the Intelligence Compass, you're the hero in your own financial epic. I'm just here to hand you the compass and the map and occasionally remind you not to sail off the edge. Chart your course to success – because let's face it, drifting aimlessly is so last season.

Until Next Time, Keep Your Compass True and Your Financial Wisdom Sharp!

Please note: The information provided in this article is intended for educational and informational purposes only. It does not constitute professional financial advice. Financial decisions should be made based on your individual circumstances and goals. We recommend consulting with a qualified financial advisor to obtain advice tailored to your specific situation

References

- Tikkanen, Amy. “A Brief (and Fascinating) History of Money.” Encyclopedia Britannica, Encyclopedia Britannica, Inc., www.britannica.com/story/a-brief-and-fascinating-history-of-money.

- Mezrich, B. (2019). Bitcoin Billionaires: A True Story of Genius, Betrayal, and Redemption. Flatiron Books.

- Investopedia. (n.d.). Understanding Money: Its Properties, Types, and Uses. Investopedia. Retrieved from https://www.investopedia.com/terms/m/money.asp

- Investopedia. “Fiat Money: What It Is, How It Works, Example, Pros & Cons.” Investopedia, Investopedia, www.investopedia.com/terms/f/fiatmoney.asp. Accessed [Date of Access].

- International Monetary Fund. (2023). Monetary Policy and Central Banking. Retrieved from https://www.imf.org/en/About/Factsheets/Sheets/2023/monetary-policy-and-central-banking

- Federal Reserve History. (2021). Federal Reserve History. Retrieved from https://www.federalreservehistory.org/essays/federal-reserve-history

the Nexus Saga