Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

- Understanding the Basics: Grasp the foundational principles of investment to navigate the financial markets with confidence.

- Strategic Asset Allocation and Diversification: Learn how diversifying your portfolio across different asset classes can minimize risk and maximize returns.

- Risk vs. Reward: Explore the intrinsic link between risk and potential returns, learning to navigate this balance to meet your financial goals.

- Long-Term Strategy: Discover the importance of a long-term perspective in investment, emphasizing patience, discipline, and the critical role of regular review and adjustment.

- Starting Your Investment Journey: Equip yourself with actionable guidance to overcome hesitations, assess your financial situation, and take the first steps towards effective investing.

Why does the word 'investment' spark more anxiety than excitement in most of us?

If the thought alone plunges you into the depths of unease, you're not alone. Many believe that navigating the investment landscape requires a secret map known only to the wealthy or financial prodigies, (or those with a penchant for the illegal like that Wolf guy from that street). And they just sit on the sidelines as a result.

But what if I told you that this map is not only accessible but can be mastered by anyone willing to take the journey?

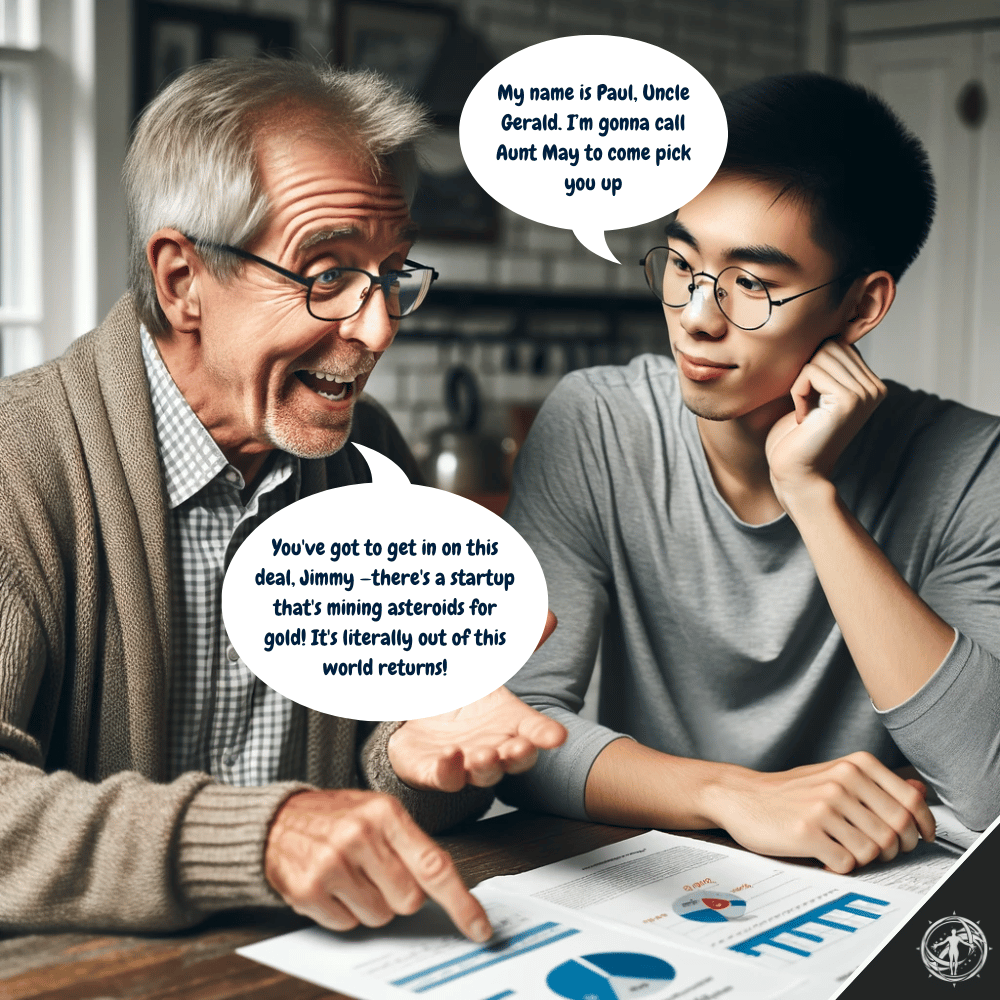

The truth is, myths and misconceptions have steered too many away from the wealth-building power of investing, leaving them adrift in a sea of 'what-ifs.' From the tall tales of market doom to the misguided financial 'wisdom' of Uncle Gerald (yes, we all have one), these narratives have locked many into a fear-driven mindset, overlooking the opportunities right in front of them.

I'm not here to spin you a fairy tale. Once upon a time, I too was a devout member of the 'Play It Safe' congregation, worshiping at the altar of the Almighty Dollar. Growing up, my financial roadmap was simple: value cash, avoid risk. It was a map drawn by those well-meaning advisors—family, friends, the media—but one that led me through a maze of missed opportunities.

The real turning point came when I dared to step off this prescribed path and challenge my preconceptions. I discovered that investing wasn't a dark art reserved for the elite but a skill, grounded in principles, that could be mastered by anyone willing to learn (of course I learned one more harsh lesson on the other extreme before reaching this point - you can read the full story in section IV).

In this final Basic Level Module (well done!), we'll demystify those core principles of investing, delve into the various asset classes at your disposal, and reveal how diversification acts as your financial safety net. More importantly, you'll learn to spot opportunities where others see barriers, enabling you to craft a personalized strategy that aligns with your risk tolerance and paves the way for sustainable wealth.

Here's a sneak peek at what you'll uncover:

- Understanding Investment Principles: Unpacking the core concepts that every investor should know.

- The Building Blocks of Investment: A closer look at different asset classes and their roles in your portfolio.

- The Safety Net of Diversification: How spreading your investments can protect and grow your wealth.

- Kickstarting Your Investment Journey: Practical steps for beginners, aimed at shifting your mindset from 'Play It Safe' to 'Play It Smart.'

Through personal anecdotes and lessons from my own experience, this article serves as the foundational primer to your investment education. It's crafted to dispel the myths that shroud investing, aiming to place the power back in your hands to confidently shape your financial future.

As we navigate through the essential principles of investing, consider this a launchpad for what's to come. Each section paves the way for deeper dives in future articles that delve further into each principle, equipping you with a comprehensive toolkit to navigate the complexities of investing with confidence. So keep an eye out for that.

Additionally, if you need immediate clarification on any new (or old) terms introduced, our jargon article is an excellent resource.

So there is still plenty to come, but for now, let’s make Uncle Gerald proud (or at least, a little less skeptical)!

I. What Are The Essential Investment Principles I Should Know?

Jumping into investing without grasping its core principles is like trying to sail a boat without a map—you might stay afloat and catch a favorable wind but you'll likely end up lost and somewhere where you don't want to be.

Understanding these investment principles is the difference between making your wallet fat and turning it into an endangered species. Each one offers invaluable insights that collectively guide your decisions, mitigate risks, and amplify potential returns, and their application is crucial to ensure your investments are working as hard as you are and to avoid the common pitfalls that ensnare many beginners.

Principle #1: Have a Clear Long-Term Strategy

Having a solid, long-term strategy isn’t just beneficial. It’s imperative!

Why, you ask?

Because a clear strategy acts as your financial compass. It’s the master plan that guides your investment decisions, and more importantly calms your mind, ensuring each move is aligned with your ultimate financial goals—be it retirement, purchasing a home, or securing your children's education.

For my readers - yes, you, the ambitious young professionals, and the forward-thinking families plotting to secure a financial fortress — this is not about throwing money at the latest hot stock because your neighbor’s cousin’s dog walker made a killing on it. It’s about crafting a master plan, based on research and understanding of risk - a financial magnum opus, if you will.

A well-defined strategy is crucial for several reasons:

- Direction: It provides a clear path to follow, helping you make investment decisions that align with your long-term goals.

- Risk Management: It enables you to balance your risk tolerance with your investment choices, avoiding unnecessary exposure to high-risk investments that don’t match your comfort level.

- Efficiency: A strategy helps in allocating your resources more effectively, ensuring your investments are working as hard as you are towards your financial objectives.

- Adaptability: The market loves a good roller coaster. Without a strategy, you’re just screaming along with everyone else, hands in the air, clueless. But with a solid strategy, you’re better equipped to adapt to market changes and economic fluctuations, making informed adjustments to your portfolio as needed and better manage your mindset when things start going against you!

And let's not forget, for those familiar with our Nexus Framework, this principle should not come as a surprise - it is one of our core pillars after all. The Framework champions strategic planning as the cornerstone of wealth accumulation, signaling that a deliberate investment strategy is not just smart, it’s non-negotiable. You can read more about it here.

Principle #2: Balance Risk and Maximize Returns Through Smart Asset Allocation and Diversification

At the heart of every investment decision is a balancing act between risk and return. It's the fundamental equation that dictates the potential success of your investment endeavors. The absence of sound risk management is a recipe for a disaster.

But why is striking this balance so crucial?

The relationship between risk and return is direct and inevitable: generally, the higher the risk, the higher the potential return. However, more risk also means a greater chance of loss.

By understanding and managing this balance, you can tailor your investment portfolio to match your risk tolerance while aiming for the desired returns. It's about finding that sweet spot where you're neither lying awake at night worrying about your investments nor are you settling for returns that won’t meet your financial goals.

Introduction to Asset Allocation

At the core of building a solid investment strategy is the concept of asset allocation. This involves spreading your investments across a variety of asset categories—stocks, bonds, real estate, and cash being the primary ones. Each of these asset classes comes with its own risk and return characteristics - more on that in Section II below.

By spreading your investments across asset classes, you can achieve a blend that reflects your risk tolerance and investment horizon. For instance, stocks are generally riskier but offer higher return potential over the long term, whereas bonds are typically less risky but provide lower returns and are generally more of a safe haven during volatile periods. Real estate can offer both a tangible asset and income through rent, with its own unique set of risks and benefits.

The Role of Diversification

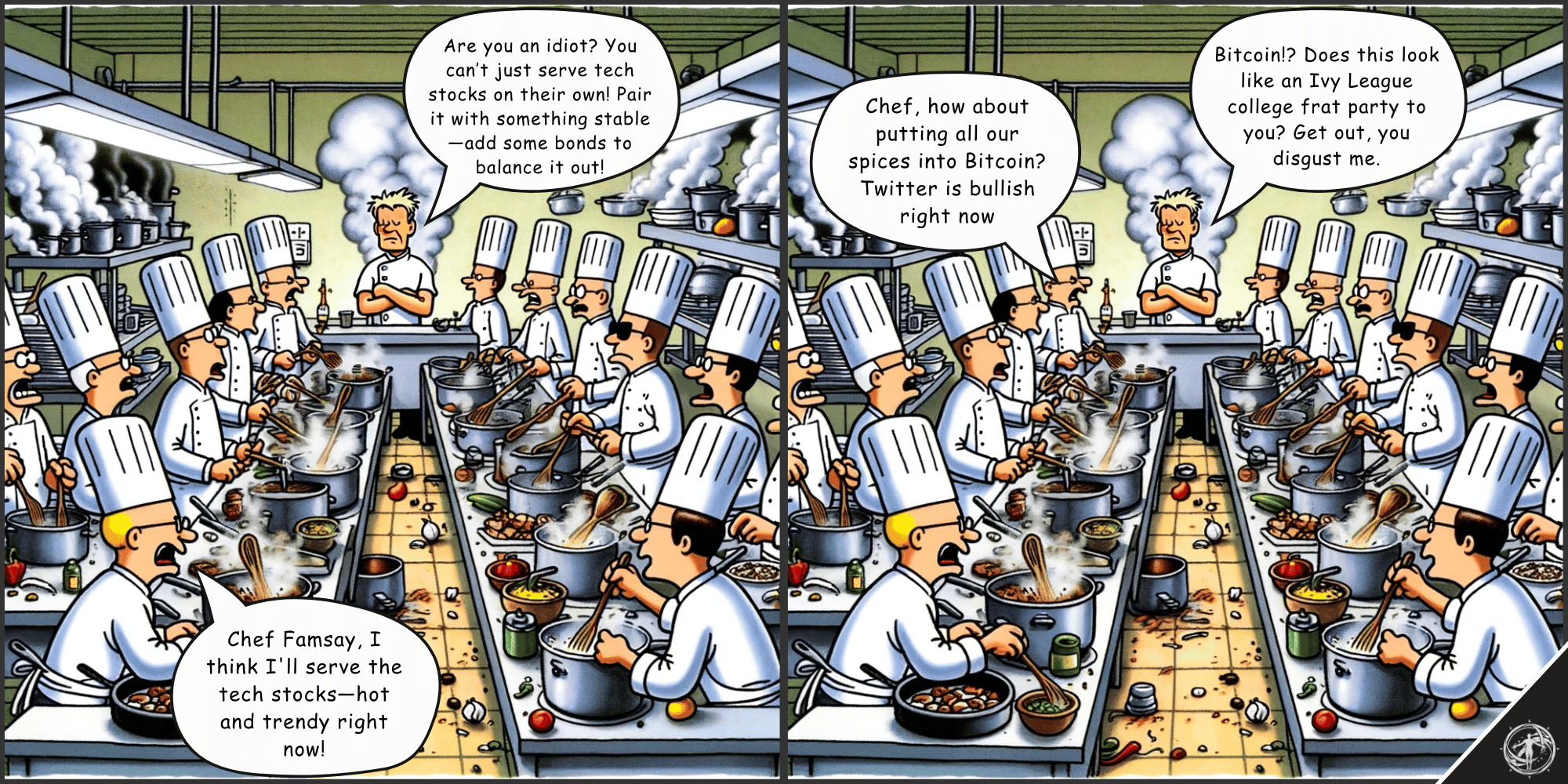

Diversification takes the concept of asset allocation a step further. It is the tactic of spreading your investments not only across different asset classes but also within those classes. So not only are you mixing up your plate, but you’re also making sure you’ve got a little bit from every chef in the kitchen (because not every cook is Gordon Ramsay).

Even within a single asset class like stocks, you can diversify across different sectors, geographical regions, and company sizes. This strategy helps mitigate the risk of a significant loss if one investment, sector, or region performs poorly, as other parts of your portfolio can help offset the loss, thus ensuring your investments don't all move in the same direction at the same time.

It’s akin to not relying on a single player to win the game but having a well-coached team ready to score from any position. We go into more detail in diversification in section III.

Before we move on from risk, I will leave you with a thought-provoking quote from Mellody Hobson. Read it carefully and ask yourself what it means to you:

The biggest risk of all is not taking one.

Principle #3: The Power of Compounding and Time

To truly harness the full potential of your investments, grasping the principles of asset allocation and diversification is just the beginning. To go further, we're going to be diving into the realm of the compounding principle, which is essentially the finance world’s version of a magic beanstalk—except this one actually exists.

As you well may be aware from earlier modules, this principle gets me more excited than finding an extra fry at the bottom of the takeout bag. This is the secret sauce, the financial wizardry that transforms your investments from modest seeds into a towering forest of wealth over time.

Why is compounding so exhilarating?

Let's revisit an example from earlier modules.

Continuing this process, the amount you earn each year grows because you're earning interest on a larger sum each time—the initial amount plus all the interest that's accumulated along the way. After 10 years, without adding any more money to your investment, it grows to about $2,594. That's more than double your initial investment, all thanks to the power of compounding.

This example underscores a pivotal insight: compounding's true potency is unleashed over time. The longer the horizon, the more dramatic its effects.

This is where Ken Fisher drops a truth bomb and delivers one of my all time favorite finance quotes:

"Time in the market beats timing the market."

It's a simple yet profound reminder that sticking with your investments often pays off more than trying to jump in and out at the "right" times.

So, what's the takeaway here? Start investing as early as you can. It’s not about making a quick buck but about letting your money grow steadily over the years. This is why I keep banging on about the importance of compounding—it's essentially the golden rule for building wealth. Stick with it, and over time, you’ll see just how powerful it really is.

Yet, the universe of compounding extends far beyond the confines of interest-earning accounts. This principle can turbocharge your wealth across various asset classes. Let's explore some further examples:

Why Understanding This Is Crucial

Recognizing how compounding works across different investment vehicles enhances your ability to make informed decisions about where to allocate your resources, and when to allocate them.

Whether it’s reinvesting dividends into more stocks (in lieu of pocketing the profits) or using the equity from a property to climb the real estate ladder, each action harnesses the power of compounding to accelerate your wealth accumulation.

Always remember, that a financial advisor and/or accountant can offer specific insights into how compounding can be optimised within your situation, especially if you're just starting out - let me illustrate why with my own bit of experience (or lack thereof).

As mentioned earlier, my initial hesitation with investments stemmed from a lack of understanding of these principles. FOMO led me to random stock purchases without a thought of implementing dividend reinvestment ("why reinvest when I can buy a new shirt?" - 20yo me)

And my first foray into real estate? Let's just say it was less about strategy and more about lifestyle (being single and apartment living was the extent of my financial strategy in my 20s). Only when I grasped how to strategically reinvest and leverage gains did I truly start to see the power of my investments multiply (thankfully, where I am now).

So, if you take one thing away from our dive into investment principles, let it be this: start early, and let compounding work its magic. Your future self will thank you, probably from a yacht or while sipping a fine beverage on a beach somewhere. Because yes, compounding is that powerful.

Principle #4: Minimise Taxes

Last time in the Wealth Intelligence Academy, we indulged in the oh-so-thrilling saga of tax strategies (give it a read here if you missed it, and let's pretend you didn’t just for my sake), and nailed down that old adage, "It's not about how much you make, but how much you keep".

Because, let's face it, while we can't avoid taxes entirely (unless you’re aiming for a featured role in a reality show set at the nearest federal penitentiary), we can certainly get savvy about minimizing their impact on our investments.

Tax efficiency is a critical component of your investment strategy because, frankly, the less you fork over to the taxman, the more stays in your investment pot, compounding and growing over time. Think of tax-minimization strategies as the legal art of keeping your money where it belongs: working for you.

Why It's Important

- Boosts Net Returns: We know from the previous module that focusing more on investment asset appreciation over a salary, you are benefiting from favorable tax treatments. This approach, coupled with smart timing of asset sales and retirement contributions (IRAs or 401(k)), can significantly reduce your tax liability, ensuring that your investment returns are optimized for both growth and tax efficiency. Over time, this can lead to a significantly larger portfolio due to the magic of compounding.

- Maintains Investment Control: Understanding the tax implications of your investment decisions means you can time your buy and sell actions more judiciously. This level of control extends to using strategic debt against appreciating assets, providing liquidity without incurring taxable events—demonstrating how the wealthy maintain and grow their assets in a tax-efficient manner.

- Aligns with Your Financial Goals: Marrying your investment plan with tax strategies is like swiping right on financial security. It’s a match made in heaven, efficiently supporting your ambitions with a focus on long-term financial security.

For a deeper understanding of how to apply these principles to your investment strategy, whether you're an individual or a business owner, remember to refer back to our comprehensive tax playbook here.

Principle #5: Understanding Market Fluctuations

If you’ve ever tuned into a soap opera, you know the drama never ends—today’s villain is tomorrow’s hero (or someone's twin brother with an eye patch), and vice versa. The investment world—stock, real estate, and especially crypto (the undisputed drama queen of volatility)—plays out in a similar vein, with its relentless mood swings swayed by everything from the economic wind to the butterfly effect of global events.

Understanding that these fluctuations are not only normal but an integral part of the investing journey is crucial.

Why is this acceptance so important?

Because it directly impacts your mindset, which is as much a tool in your investment arsenal as your financial strategy. In fact, a robust mindset is more critical than any secret investment sauce you think you've concocted. It arms you against the impulse to hit the panic button and sell at the first sign of trouble.

Really, panic selling during a downturn is about as savvy as jumping ship in a storm because you got your socks wet.

Moreover, this understanding fosters patience, resilience and perspective—key components of a successful investment mindset. Let's break this down:

- Realizing that short-term fluctuations are less important in the context of long-term growth enables you to stay the course, even when the ride gets bumpy.

- It’s not merely about clinging on for dear life but about spotting the golden opportunities hidden in the chaos. After all, many of the greatest investment gains have been realized in the wake of market downturns, by those with the foresight to see beyond the immediate chaos.

- Armed with a bulletproof strategy from the get-go (P#1), you’re better positioned to figure out if a market dip is just the market being its dramatic self or a cue to possibly rethink your game plan. This strategy keeps you from morphing into a headless investor chicken in the midst of market upheaval.

- On the flip side, a solid grasp of market fluctuations also prepares you to handle gains with equal grace. Experiencing significant gains can be exhilarating, but without the right mindset, it’s easy to become overconfident, leading to risky decisions based on emotion rather than strategy. Understanding that today’s gains are not guaranteed tomorrow encourages a balanced, strategic approach to reinvesting or adjusting your portfolio.

Let's illustrate:

In essence, understanding market fluctuations is not just recognizing the inherent volatility of the investment landscape, but also about developing a mindset that embraces this reality.

This mindset—rooted in acceptance, patience and strategic resilience—enables you to navigate both the ups and downs with a clear vision, ensuring that your investment journey is defined not by the market’s temporary movements, but by your long-term financial goals and the robust strategy you’ve employed to achieve them.

Principle #6: Regular Investment and Review

Set it and forget it?

Oh, please. If investing were that easy, my cat would be a billionaire from all the stocks he's accidentally bought walking across my keyboard.

Investing is an ongoing process that requires regular reviews and adjustments, to ensure your portfolio remains aligned with your goals.

Let's dissect this beast, shall we?

Consistency Beats Timing (at least in the beginning)

The Holy Grail of investing is buying low and selling high, but when you’re just wading into the investment kiddie pool with your arm floaties on, forget about timing the market. The priority shifts to simply gaining market exposure.

In future as you grow your wealth, fine-tune your investment strategy, and sharpen your market fluency and mindset, then you'll be better positioned to target market dips like an investment savant.

If you are just starting your investment journey, I recommend sticking to a regular investment schedule, kind of like how you pay your Netflix subscription each month without thinking about it.

This approach of regularly contributing to an investment pool employs what's known as dollar-cost averaging (DCA), a fancy term for spreading out your investment purchases over time. This method does wonders for smoothing out the average cost of your investments, making market volatility less of a wild beast to tame. There are two ways to approach DCA:

- The Beginner’s DCA: This method involves consistently investing a fixed amount of money at regular intervals, regardless of the market's condition. It has the dual advantage of mitigating the impact of market volatility and lowering the average cost per share over time. Market's up? Cool. Market's down? Still cool. The point is, that you're building the habit, not trying to predict next week's lottery numbers.

- Advanced DCA: For the more adventurous souls poised to dive deeper into the investment world, there is a more strategic approach. This method involves timing your investments to buy more as the market dips, thereby lowering your average cost even further. It's a technique that requires a keen understanding of market patterns and the flexibility to adjust your investment amounts dynamically. Dive deeper into this strategy in the WIA Advanced Modules, where I’ll teach you to juggle fire without burning your wallet.

Keeping Goals in Focus

Life changes, and so do your financial goals. What was important five years ago might not hold the same weight today. Regular reviews of your investment portfolio ensure that your investment strategy stays aligned with your current goals and life stage.

Adaptation to Market Changes

As we covered in P#5, the market is a living, breathing entity, influenced by global events, economic shifts, and countless other factors. A portfolio that was balanced last year might lean too heavily into one asset class this year due to market changes. Regular reviews allow you to rebalance your portfolio, ensuring that it maintains the desired asset allocation.

Identifying Opportunities and Red Flags

Frequent check-ins with your portfolio also give you the chance to spot both opportunities and potential issues early. Perhaps a certain sector shows promise for growth, or maybe a real estate investment hasn't performed as expected and needs reevaluation.

Regular review sessions are your chance to fine-tune your strategy, ditching what doesn't work in favor of more promising ventures. It’s a proactive approach, keeping your portfolio dynamic and responsive rather than static and susceptible.

In short, treating your investment journey like a "set it and forget it" roast is a surefire recipe for disappointment stew.

Regular investment and review are the sunshine and water your financial garden needs to blossom into a verdant vista of wealth.

Stay active, stay engaged, and, for the love of compounding interest, water your investments.

Principle "6 1/2": Ignore Your Uncle

Why is "Ignore Your Uncle" slotted as principle six and a half? Because, after years of navigating the investment seas, I've come to recognize it as the unsung hero of investment wisdom. It's a bonus principle, born from experience rather than textbooks (hence the half), and it's about filtering out the noise that can distract and mislead.

This principle is crucial because the world is full of armchair experts. Everyone has an opinion on where you should invest your money, from Uncle Gerald, who's made a hobby of giving unsolicited NASDAQ advice at family BBQs, to my lawn-mowing aficionado who's betting his retirement on these mining prospect stocks, each priced less than the gum stuck to your shoe.

Sure, he dreams of the day he'll mow lawns on a gold-plated riding mower, but given he's still keeping my grass trim, it's safe to say those dreams are a tad premature (or maybe he really loves his job!). In all seriousness, he's a top guy and I wish him well, but it is a stark reminder that investment tips often rely more on luck than on solid strategy.

Sticking to your selected research sources and consulting with trusted advisors/mentors ensures that your investment decisions are based on sound principles and verified insights and not on the latest fad or speculative gamble. Remember, just because someone offers you free advice doesn't mean it comes without cost. Misplaced trust can lead to decisions that jeopardize your financial goals.

The same goes for me and the Intelligence Compass content - at the end of the day, I'm just some guy on the internet. And while trust is one of my core values and I would never deceive people, the fact of the matter is you don't know me (unless you're one of my mentees) - so critical thinking should be your constant companion. Question everything, verify twice, and then maybe, just maybe, consider acting on it.

So, next time Uncle Gerald launches into his spiel on why you absolutely must invest in the latest crypto fad over mashed potatoes, just smile, nod, and file it under "entertainment."

For those eager to explore these principles further, we're crafting deep dives that will delve into the relevant practical applications and strategies you can use to incorporate this knowledge into your investment decisions. Stay tuned, these are coming soon.

II. What Are the Different Asset Classes, and Why Should I Care?

So, you’ve mastered the investment ABCs and now you're itching to know where to stash your loot.

Let's take a whirlwind tour through the investment supermarket, where the aisles are lined with everything from the dependable loaf of bread (cash equivalents) to the exotic spices (cryptocurrencies)., each with distinct characteristics, risks, and potential returns.

My usual pearl of wisdom here. Each asset class comes with its own set of characteristics, risks, and benefits. Considering how these asset classes fit into your investment portfolio is a nuanced process that can significantly benefit from the personalized guidance of a financial advisor, ensuring your choices reflect your personal risk tolerance and financial objectives.

Cash and Cash Equivalents

Cash and cash equivalents (e.g. treasury bills) are the simplest form of investment, including things like savings accounts, treasury bills, and money market funds. They’re low risk, meaning they offer lower returns compared to other asset classes, but they provide liquidity and safety for your money, making them ideal for short-term needs or emergency funds.

Just don’t expect these safe havens to fund your lavish retirement on the Riviera.

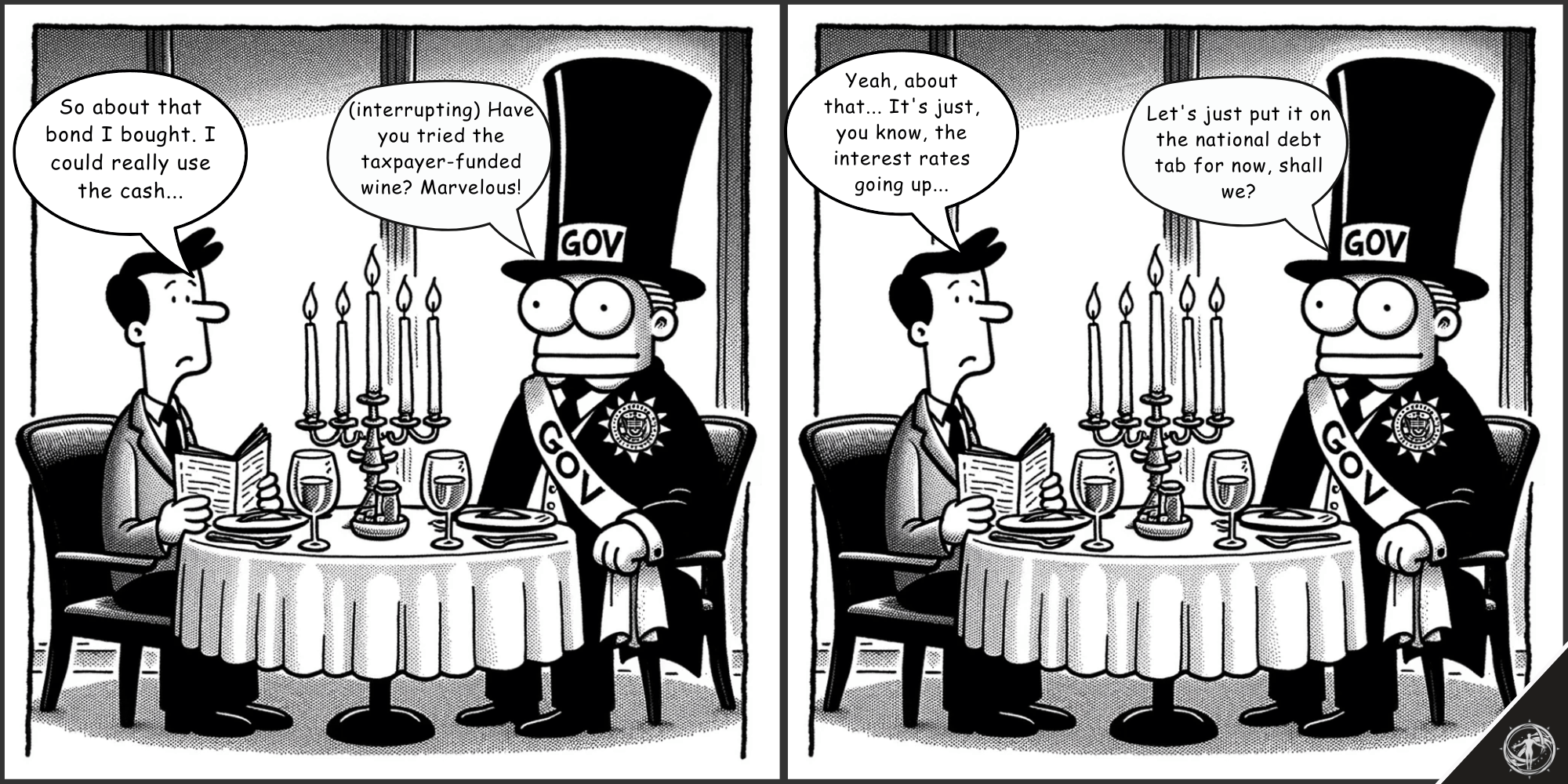

Bonds and Other Fixed-Income Securities

Bonds are essentially loans you give to governments or corporations, in exchange for regular interest payments, making them a source of fixed income. They’re generally safer than stocks, offering more stability but with varying risk levels based on the issuer's creditworthiness. It’s like lending cash to your friend, except these friends are governments and corporations, and they're less likely to forget to pay you back.

Bonds are crucial for those seeking steady income or a more conservative investment approach.

Stocks and Equities

Stocks represent ownership in a company. When you buy stocks, you're hoping the company grows so your shares increase in value. Stocks are riskier; they can offer high returns if the company does well but can also lead to losses if the company's value drops. They're suitable for investors looking for growth and willing to accept market volatility.

Real Estate

Real estate involves direct investment in properties or indirect investment through real estate investment trusts (REITs). It can provide rental income and potential for appreciation but requires significant upfront capital and is less liquid than other investments, but it is one of my favorite ways to grow tangible wealth - —just don’t underestimate the headaches of being a landlord.

Real estate can be a good option for long-term investors looking to diversify and hedge against inflation.

Commodities

This asset class includes physical goods like gold, oil, or grains. If you’ve ever wanted to speculate on the price of soybeans or hedge your bets with bullion, commodities are your playground.

Commodities can diversify your portfolio and serve as a hedge against inflation but are subject to market, geopolitical, and environmental risks. They can be unpredictable and require a good understanding of the market dynamics.

Funds (Mutual Funds, ETFs, Index Funds)

Funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. They are like those meal kits—they bundle everything you need into one convenient package.

They offer an easy way to achieve diversification with professional management. Examples include ETFs and index funds, which are popular for their low fees and flexibility, and trade like stocks on the exchange [4]. You just need to keep an eye on those management fees.

Derivatives

These are advanced financial instruments that derive their value from underlying assets, like currencies or commodities. They can be used for hedging or speculative purposes but are high-risk and best suited for experienced investors who understand their complexities [3]. Not for the faint of heart or the light of wallet.

This one may need an analogy. Imagine you're planning a big summer barbecue, but you're worried about the price of beef skyrocketing by the time your party rolls around. So you enter a deal with your local butcher to lock in today's beef prices for your summer barbecue, protecting against future price hikes. This agreement mirrors a futures contract in finance, where you agree on a future transaction at a preset price, guarding against market volatility.

Just as this strategy ensures your barbecue budget stays on track, derivatives like futures help investors manage risk or speculate for profit. However, there's risk involved—if market prices fall, you're still paying the premium price. Hence, navigating these financial instruments is for those with advanced knowledge and experience.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies developed using blockchain technology. They are high-risk and subject to minimal regulation, offering potential for high returns but also significant volatility and risk. They're recommended only for knowledgeable investors who can withstand potential losses. Popular examples are Bitcoin (which now has its own ETF), Etherum and various dogs and frog ones (don't ask!)

Understanding these asset classes helps you build a diversified investment portfolio tailored to your risk tolerance and financial goals, and lays the groundwork for savvy investment strategies—our upcoming articles will show you how to select and combine these assets for optimal growth and security.

III. The Safety Net of Diversification

Imagine you're at a buffet, loading up your plate. Would you pile it high with just spaghetti, or would you opt for a bit of everything?

Sure, you love spaghetti, but what if it's a salt mine? Suddenly, your entire culinary adventure is a bust.

That's your portfolio without diversification—vulnerable to just one "too salty" investment tanking your financial future (I don't want to hear from any of you salt addicts saying "what is wrong with that?", you're ruining my analogy).

This is the essence of diversification in investing, a principle we covered in Section I. Just as a well-balanced plate can lead to a more satisfying meal, a well-diversified portfolio can lead to a healthier financial future, safeguarding you against the "too salty" moments in the market.

But how exactly does this strategy act as a safety net for your money, and how do you go about implementing it?

Think of diversification as your portfolio's armor against the arrows of market volatility and economic downturns. By spreading your investments across various asset classes, sectors, and geographical regions, you're essentially making sure that a setback in one area won't spell disaster for your entire portfolio.

Strategies and Principles for Effective Diversification

- Balancing Act: Different assets come with different levels of risk and potential returns. While stocks might offer high growth potential, they're also more volatile. Bonds, on the other hand, provide steadier, albeit lower, returns. To put it more simply, stocks are like that friend who’s a blast at parties but unpredictable, while bonds are your dependable buddy who always brings the snacks but never starts a conga line. The trick is inviting enough party animals to keep things interesting without letting chaos reign.

- Overall Reduction of Risks: Diversification helps in minimizing both unsystematic risks (specific to a single entity or industry) and systematic risks (those impacting the entire market) [5]. For instance, while a tech stock might plummet due to a product failure, your bonds or real estate investments could remain unaffected, cushioning your portfolio against the fall. A drop in interest rates usually turns people towards risk-seeking assets, so money flows into crypto usually see an uptick during this period.

- Stability and Growth: Think of a diversified portfolio as a well-anchored ship in stormy seas. While it may not outrun the fastest speedboat in calm waters (i.e. your neighbor bragging about his Nividia stock), it's built to withstand the waves, ensuring a smoother journey toward your financial destinations.

- Comprehensive Coverage: Effective diversification covers not just a range of asset types but also sectors, geographic locations, and investment vehicles. This broad coverage ensures you're well-positioned to capture growth across the board and mitigate risks. Aim for that sweet spot where your investments complement each other (i.e. if one goes up, the other goes down) - diversification thrives when your investments don’t mimic each other. Using correlation helps gauge how different investments react in relation to one another [7].

Benefits of Diversification

The beauty of diversification lies in its dual ability to manage risk and provide exposure to a variety of growth opportunities. It's about playing the long game, aiming for consistent growth rather than chasing after the market's shooting stars, which can burn out just as quickly as they flare up.

Let's break these benefits down, shall we?

- Enhanced Protection Against Losses: it reduces the jolt to your investments caused by any single market downturn. Diversification spreads the impact, so you're standing, not staggering, when the dust settles.

- Smoother Investment Ride: your portfolio's shock absorbers, helping to smooth out the bumps of market volatility and providing a more stable growth trajectory. Sure, there will be bumps, but you won’t be spilling your investment coffee at every market pothole.

- Wider Gateway to Growth: opens doors to a broad spectrum of investment opportunities, from the familiar terrains of stocks and bonds to the potential untapped riches of real estate and commodities. From the high towers of stocks to the dungeons of commodities, you’ve got the chance to explore every nook and cranny for hidden treasure, not just the main hall.

- Flexibility in an Ever-Changing Market: equips your portfolio with the agility to navigate through diverse economic conditions, leveraging growth in booming sectors while cushioning against downturns elsewhere.

Strategy Development and Misconceptions

Crafting your diversification strategy is a personal journey. It should mirror your risk appetite, investment horizon, and financial goals. Yes, that means doing more work and thinking than just putting your entire life savings into what you heard on a finance podcast last Thursday (I'm looking at you, gambling retail investors [9])

Here are some points to keep in mind:

- Assess Your Risk Appetite: Understand your comfort level with risk versus potential returns. It's about knowing how much financial turbulence you can stomach without losing sleep. If the thought of a 2% dip sends you into a panic spiral, high-volatility stocks might not be your jam - and don't even Google crypto, let alone put money into it.

- Define Your Investment Horizon: Are you saving for a dream vacation in five years, or are you looking at retirement planning? Your timeline influences how aggressively or conservatively you should invest.

- Set Clear Financial Goals: There's that "have a strategy" tip again - having specific targets guides your diversification strategy and keeps you disciplined. Having a plan/strategy is hopefully becoming a clear theme throughout WIA for you.

Remember, though diversification is a powerful tool, it's not a magic wand. Despite its benefits, diversification is often misunderstood. It's crucial to recognize what it can and cannot do for your investment portfolio:

- Not a Guarantee Against Loss: Diversification spreads risk but doesn't eliminate it. Market downturns can still affect diversified portfolios, but at least with diversification, you won’t be barreling down a one-way street to Brokeville.

- Doesn't Promise the Highest Returns: The goal is to achieve a balanced, risk-adjusted return over time, not to outperform the market at every turn. It's about batting averages, not swinging for the fences and hoping for a miracle with every pitch.

- Requires Regular Maintenance: Like any strategy, diversification isn't set-and-forget. It needs regular review and rebalancing to stay aligned with your evolving financial goals and market conditions.

A Personal Lesson:

Let me dish out a slice of humble pie from my own "genius" investment moves. There I was, young, finance degree in hand, and absolutely enamored with the tech bubble. Look how handsome I was (disclaimer: that is not me!)

Enter "TechGiantX" (not its real name, but let's keep things spicy), the beacon of my investment dreams. Every Tom, Dick, and Reddit guru had crowned it the next big thing. I jumped on the bandwagon, visions of early retirement dancing in my head. Spoiler alert: it was a disaster waiting to happen. Thanks to some regulatory curveballs and a few spectacularly bad calls by TechGiantX's brain trust, my portfolio took a nosedive worthy of a Guinness record.

This experience reshaped my approach to investing. Now, I knew about the principle of diversifying from my university lectures in Finance, but I brushed it off as something that only the financial illiterate had to deal with. "Diversification is for the timid and not geniuses like me," I thought, armed with arrogance and a degree that suddenly seemed as useful as a chocolate teapot. Wrong - on so many fronts. And my suit got ripped in the process...

First of all, just because I had a university degree in Finance, it did not make me financially fluent. Secondly, university doesn't teach strategy and mindset - they were severely lacking in this case. Thirdly, even the rich diversify - never forget that.

From that day on, I diversified, spreading my investments across various sectors and asset classes, ensuring that the failure or success of any single investment wouldn't make or break my financial future - even if that meant potentially taking a bit longer to achieve my goals (although I am ahead of the S&P at the moment). It's a strategy that has since provided not just returns, but something equally valuable—peace of mind.

Don't get me wrong, I still favor an aggressive approach, but intelligently so, with diversification as my co-pilot, not my adversary. Don't brush it off like I did, otherwise you will learn the same lesson, perhaps more harshly.

Beyond mere tactic, diversification is the pillar of sound investing, offering a more balanced, risk-managed pathway to achieving your financial goals.

IV. How Can I Start Investing, and What Should My First Steps Be?

Alright, let's cut the fluff and get down to brass tacks. You've been bombarded with the A to Z of investing, from asset classes to why putting all your eggs in one basket is basically setting yourself up for an omelette disaster.

But I get it, you're sitting there, scrolling through this, thinking, "Cool story bro, but how do I actually start without setting my bank account on fire?"

Maybe you're thinking you've got a handle on about 80% of what's been said but still haven't made that leap into investing. Could be fear, could be uncertainty, or maybe you think this is reserved only for the wolves of wall street types.

First off, let’s address the elephant in the room: Investing isn't reserved for the elite with their vaults of gold or those Wall Street wizards with insider scoops.

Nope.

That myth got busted the moment I realized you don't need a fortune to start. Investing is for everyone—yes, including you, sitting there wondering whether you're ready to dive in.

You're more equipped than you think. With a now solid foundation in investment principles, a grasp on the different asset classes, and an understanding of how diversification works, you're practically at the starting line already.

Investing doesn't demand perfection from the get-go, it asks for a start. Somewhere. Anywhere. With whatever you have.

It's about making that first move, guided by the knowledge you've gained and the guidance we're about to cover. And remember, even small steps can lead to significant growth over time.

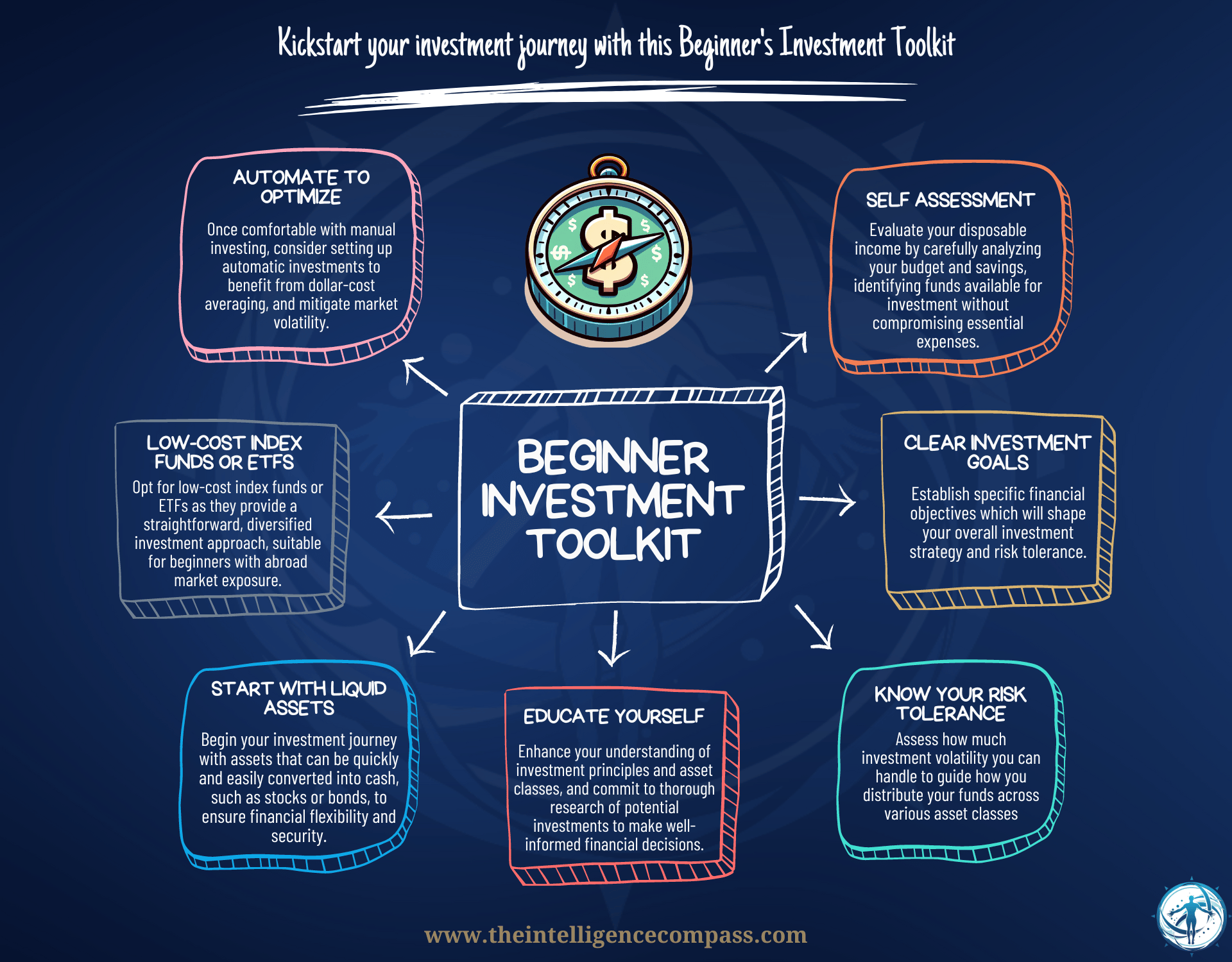

So, how do we kickstart this shindig? Well let's go through a bit of a toolkit that you can keep in your back pocket

- Start With Self-Assessment: Not just a casual glance, really dive into it. How much extra cash can you play with without living off ramen noodles? This isn't about reallocating the funds earmarked for day-to-day necessities but rather about identifying surplus cash that can work for you over time. Refer back to Modules 3 (Budgeting) and 4 (Saving) for tips and guidance on how to complete this step

- Define Your Financial Strategy and Goals: Are you saving for a down payment on a house, planning to retire before 90, or targeting a future passive income goal? Setting clear, achievable goals is critical. It shapes your investment strategy, from choosing the right asset classes to determining your risk tolerance.

- Identify Your Risk Tolerance: Crucial to your investment journey is understanding how much volatility you can stomach. Your risk tolerance will guide your asset allocation, influencing how you distribute your investments across different asset classes to balance potential returns with acceptable levels of risk. Reflecting on the principles discussed in Section I, remember that knowing your comfort level with risk is foundational to crafting a strategy that’s truly yours. Read my story below to understand how I yo-yo-ed between risk appetites.

- Educate Yourself: There are two key aspects to this. First, boost your investment knowledge. We've kick-started this process by covering investment principles, exploring asset classes, and explaining diversification. Second, rigorously research any potential investments. It’s crucial to fully understand what you’re putting your money into. Remember, knowledge is your most powerful tool in investing, and for Pete's sake, don't chase after every "hot tip" you hear from Gary at the water cooler or some random internet guru. Utilize resources like our very own Intelligence Compass to delve deeper. You don't need to become an overnight expert, but a firm grasp of the fundamentals will greatly enhance your ability to make informed choices.

- Prioritize Liquid Investments Initially: Liquidity refers to how quickly you can turn an investment into cash without losing value. It's like having a savings account versus owning a painting; you can withdraw cash easily from the savings account, but selling the painting might take time and could involve a price cut. Starting with liquid investments, like stocks or certain bonds, means you can access your money when you need it, serving as a financial cushion in emergencies. Once your funds grow, you can go after real estate to some of the other asset classes we've discussed.

- Consider Low-Cost Index Funds or ETFs (Exchange Traded Funds): For beginners, these funds offer a straightforward path to diversification without the need for extensive market knowledge. They track a specific index and offer exposure to a wide array of stocks, mitigating some of the risks associated with picking individual stocks. VanGuard is a favorite of mine and has some great "beginner" options, and generally have low fees - one for you to consider researching for your specific situation.

- Automate Your Investments: Many platforms allow for automatic investments into chosen funds or stocks - caution, only start this part once you are comfortable with the process and have done it manually for a period of time. This not only disciplines your investment habit but also leverages the power of our friend, dollar-cost averaging, reducing the impact of volatility.

When I got my first job, I just loved the look of my cash account growing each month - it made me feel rich. There was something comforting about knowing my money was there, safe and sound, not going anywhere. The idea of buying stocks felt like throwing my hard-earned cash into the ocean and hoping it would swim back to me, multiplied.

Nope, not for me. I was too scared of losing any of it. Wealth mindset? More like a 'keep everything under the mattress' mindset.

It took ages before I finally mustered the courage to buy my first stock. And when I did dive into investing, boy, did I swing from one extreme to the other. From too scared to let go of a single dollar to suddenly trying to catch up on everything I felt I'd missed out on.

Hello, FOMO.

I dove headfirst into the deep end, latching onto every "hot tip" and "next big thing" whispered in the corners of the internet or by any random Joe claiming they had the inside scoop or sucking me in with their bro marketing - yes, I fell for it as well. Enter the debacle with "TechGiantX" I covered in the previous section. The new me was having the "I told you" argument with the old me.

So, there I was, having felt the sting of keeping my money idle and then the burn of reckless investing.

The lesson from my comedy of errors?

That it's crucial to kick fear to the curb, arm yourself with a solid plan, and for the love of all that's financially holy, start somewhere—anywhere. Fear drove me at both ends of the spectrum. The fear of losing money kept me from starting, and the fear of missing out led me to make some pretty dumb choices once I did. Neither is where I want you to be.

What changed everything for me was shifting that mindset and getting strategic about my investments. It wasn't about being ultra-conservative or blindly aggressive, but first with understanding my goals and strategy, and then understanding what my risk tolerance was. And let me tell you, that risk tolerance changes once you get married and have little ones running around - and that's ok. You need to adapt your goals to your lifestyle.

Now, I invest with a clear strategy and with full understanding of those essential principles, not led by fear or FOMO, and that's something I wish I'd understood from the start.

And that in a nutshell is my mission not only by sharing my story, and this information in this article, but with this whole business I've started.

My Closing Thoughts

As we wrap up this whirlwind tour through the investment landscape, it's like we've journeyed from the Shire to Mordor and back, armed now with the One Ring of knowledge (minus the whole Sauron situation, thankfully!).

Remember how we started, contemplating why the mere mention of 'investment' could send us spiraling into dread? We've journeyed far from there, traversing through the essential principles of investment, understanding not just the mechanics but the mindset shifts required to navigate this landscape confidently.

Let's quickly recap the adventure we've been on:

- We demystified Investment Principles, making sure you know your financial ABCs before you even think about diving into the deep end.

- We explored the diverse Asset Classes, showing you that there's more to the investment world than just stocks and bonds. Yes, even crypto got a shoutout.

- We wrapped you in the Safety Net of Diversification, ensuring you understand that spreading your investments isn't just wise, but essential.

- And finally, we armed you with the knowledge on How to Start Investing, taking those first tentative steps into a future where your money works for you, not the other way around.

Through it all, I've shared bits of my own saga—to show you that the path to investment wisdom is paved with good intentions and sometimes spectacular missteps driven by fear and FOMO, but in the end, the path from fear to empowerment wasn't just about learning, but more of a metamorphosis, preparing us to make informed decisions and to see investment not as a domain for the few but a landscape of opportunity for many.

Now, as we stand on the brink of venturing into the "Intermediate" level, where The Money Mindset module awaits, remember this: The journey of a thousand miles begins with a single step... or in our case, a single investment. Don't let fear of the unknown or the dread of making a mistake paralyze you. Mistakes are just lessons in a very expensive disguise. Don't forget to follow our detailed strategies and mindset guidance when investing for an even more robust plan.

So have a think about what your first action be after reading this article? Is it to open an investment account, to schedule a meeting with a financial advisor, or to deepen your research into a specific asset class? Whatever it is, I encourage you to take that step today. Investing is a journey that begins with a single decision to start. As always, myself and the wider Intelligence Compass team is always here to guide and support you along the way.

Remember, the best time to start was yesterday, the next best time is today.

Every investor starts somewhere, and today, armed with a newfound understanding and strategy, you're already steps ahead of where you were yesterday.

References

- Fidelity. (n.d.). Does diversification still matter? Fidelity Investments. Retrieved from https://www.fidelity.com/learning-center/wealth-management-insights/does-diversification-still-matter

- Stash. (n.d.). What is compounding? Stash Learn. Retrieved from https://www.stash.com/learn/what-is-compounding/

- Corporate Finance Institute. (n.d.). Asset class. Retrieved from https://corporatefinanceinstitute.com/resources/wealth-management/asset-class/

- NerdWallet. (n.d.). Asset classes. Retrieved from https://www.nerdwallet.com/ca/investing/asset-classes

- Benzinga. (n.d.). How does diversification protect investors? Retrieved from https://www.benzinga.com/money/how-does-diversification-protect-investors

- USAA. (n.d.). Building a diverse portfolio. Retrieved from https://www.usaa.com/inet/wc/advice-finances-building-diverse-portfolio?akredirect=true

- Thrivent. (n.d.). Why is diversification of investments important? Retrieved from https://www.thrivent.com/insights/investing/why-is-diversification-of-investments-important

- The Measure of a Plan. (n.d.). Investment returns by asset class. Retrieved from https://themeasureofaplan.com/investment-returns-by-asset-class/

- Forbes Finance Council. (2022, December 20). Retail traders: It’s discipline that slays markets. Forbes. Retrieved from https://www.forbes.com/sites/forbesfinancecouncil/2022/12/20/retail-traders-its-discipline-that-slays-markets/?sh=5de52819481d

- Investopedia. (n.d.). ETF. Retrieved from https://www.investopedia.com/terms/e/etf.asp

Check out The Nexus Saga