Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

- Mindset Shift Is Essential: Embrace taxes as a pivotal part of your financial planning, rather than a begrudged obligation. This shift from a passive to an active mindset allows you to see taxes as a lever for wealth building rather than a mere expense.

- Tax Essentials - Why Do We Pay Them: Taxes fund crucial public services and infrastructure, playing a vital role in societal wellbeing and economic policies. Understanding the purpose behind taxes can help contextualize their importance in financial planning and societal contribution.

- The Tax Playbook - Key Strategies:

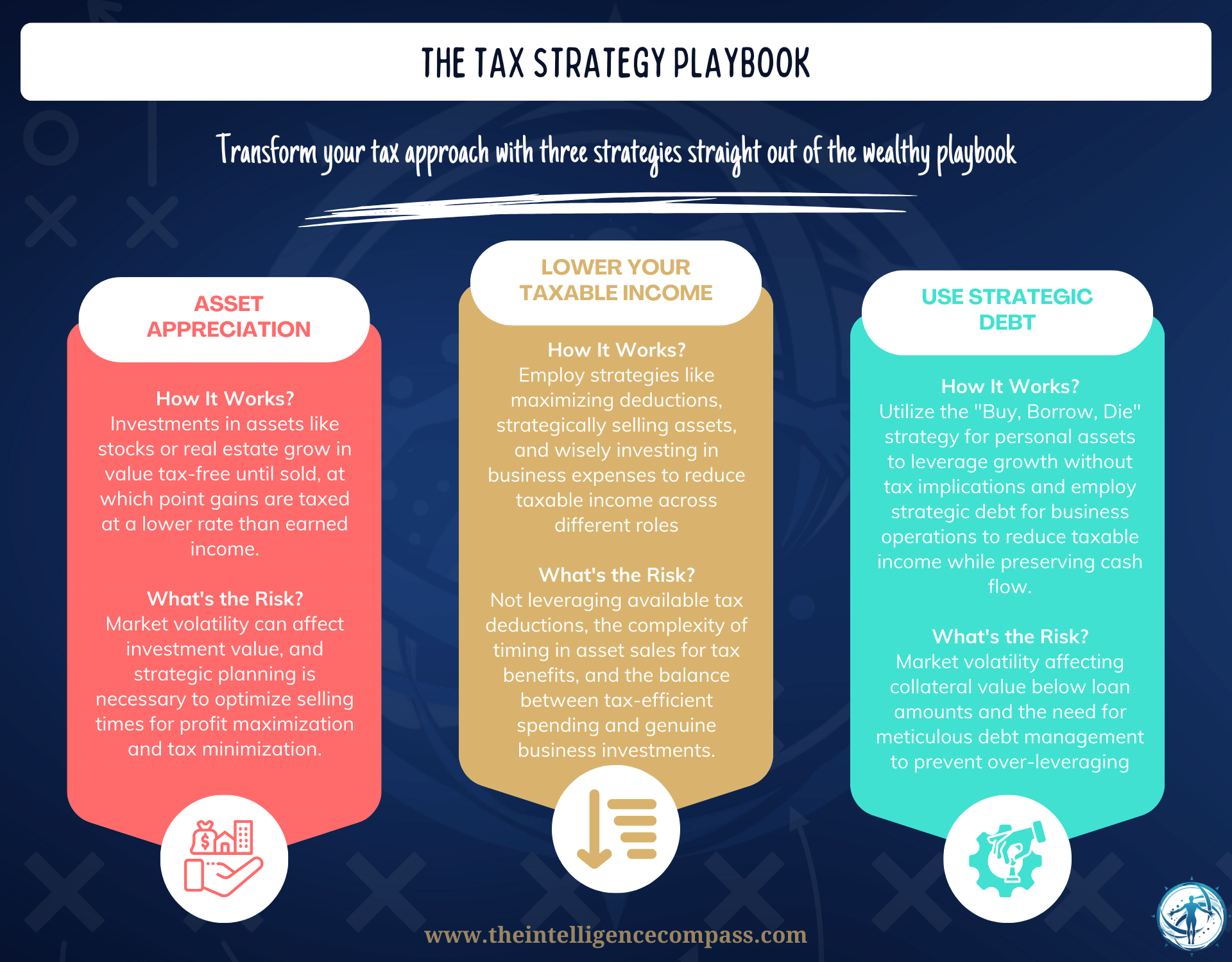

- Asset Appreciation: Investing in assets likely to increase in value over time can lead to wealth growth with favorable tax treatment compared to earned income.

- Managing Your Taxable Income: Utilizing deductions, credits, and retirement contributions effectively can lower your taxable income, reducing your overall tax liability.

- Use of Strategic Debt: Leveraging debt against appreciating assets provides liquidity without triggering taxable events, a common strategy among the wealthy for maintaining and growing their assets.

- Individual Versus Business Thinking: The tax strategies differ significantly between individuals and businesses. Individuals focus on deductions and investment income, while businesses can deduct expenses before income is taxed, showcasing the importance of strategic financial planning respective to each entity's characteristics.

- Practical Tips:

- Work on Your Mindset: Adopt a strategic approach to taxes, viewing them as a tool for wealth management rather than a burden.

- Develop Strategy: Regularly assess your financial situation, set goals that align with your financial vision, and adjust your tax strategy accordingly.

- Engage Experts: Collaborate with financial advisors and tax professionals who can offer personalized advice and strategies to navigate the complex tax landscape, ensuring you make informed decisions tailored to your situation.

What is your first thought when you see the headline below?

Is it rage?

Thinking it's downright unfair?

Like, here's Jeff Bezos, Michael Bloomberg, Warren Buffett, and Elon Musk, apparently giving the IRS the proverbial finger from their yachts, while you're hunting for discounted bread and still pay tax than they do!

It's easy to get riled up seeing billionaires seemingly outsmarting taxes, but calling them out as criminals and tax cheats would be missing the point. That's not the mindset I want for you.

Here's what I do want for you: Shift your mindset. Don't get mad, get curious. Think like a strategist, not just a critic. And instead, ask this question instead...

Once you channel your inner Anakin, then you are ready to read on.

Welcome back to the Wealth Intelligence Academy series, where our latest instalment delves into the intricate maze of taxes—a subject as inescapable as it is perplexing for many.

So, why should you care about this one? Well, taxes touch every aspect of our lives, from the paycheck we eagerly await to the receipt from our morning coffee run. They fund roads we drive on, schools we learn from, and parks we escape to, yet the thought of navigating the tax system can induce a level of dread that rivals stepping on a Lego barefoot.

Most importantly, mastering taxes stands as a critical financial lever—if not the most critical—for wealth accumulation. The rich folk and their savvy accountants can attest to that as per the article above. And the moment I truly learnt about the power of taxes (for me), was my first real moment of financial awakening.

A few years back, I stumbled upon a transformative book titled "Tax-Free Wealth" by the insightful Tom Wheelwright. This was the read that fundamentally shifted my outlook on taxation. Wheelwright introduces a compelling perspective, suggesting we see ourselves as partners with the government in the realm of taxes. He presents a choice in his teachings that turned out to be my financial awakening

Do we remain passive partners (dutifully paying our taxes without question) or do we step up as active partners (strategically navigating the system to maximize our benefits)?

My goal is to guide you through the tax maze with this article, simplifying complexities and introducing practical tax strategies so that you can become an active partner. While I can't cover everything in one article, consider this a starting point to shift your mindset and strategize effectively.

I do apologise as the article is LOOONG because there's much to cover, but it's crucial for everyone, regardless of your financial stage. Here's some tips on navigating it more efficiently:

- New to Taxes? Read everything. Understanding taxes is crucial so the concepts should make sense.

- Know the Basics? Jump to Sections III and IV for strategies on minimizing taxes. If anything confuses you, revisit the earlier sections.

- Confident but Seeking Mindset Tips? Head to Section IV, but glance over Section III to ensure you've caught all strategies.

- Also at the start of every section, I have provided a quick insight summary to help you digest the information easier. Hope this helps.

By the end, you'll see taxes not as a burden but as something you can master. And when I tell you one of the best ways to minimise taxes is to not earn any money (that is not a joke), you will not recoil in shock and disgust, but instead nod slowly in acknowledgement of understanding.

Before we begin, I need to stress that the below information on rates and strategies is primarily focused on my US-based readers - this is really important as tax laws and codes differ across the world, even if some of the principles remain the same. I promise to write future article focused on education on international regions, but for now, and as always, consult your local tax codes for the right information.

I. Understanding the Essentials of Taxes

Understanding why we pay taxes and grasping the basics of the tax system are crucial first steps in transforming you from tax novices to tax masters.

Why We Pay Taxes

- Public Services: Taxes fund crucial services like education, infrastructure, and healthcare, ensuring societal well-being.

- Economic Policies: They help shape economic balance, redistributing wealth to reduce inequalities.

- Civil Investment: Paying taxes is investing in a functioning, equitable society for all.

Envision a society stripped of public parks, crumbling roads, and shuttered schools. This isn't a scene from a dystopian novel, but a glimpse into a world devoid of taxes. Without our collective contributions, the societal framework supporting public safety, education, and healthcare crumbles, leaving a landscape where only the rich can navigate basic services.

Put simply...at its core, taxation is the lifeblood of civilization.

But there's more to taxes than just funding public goods. They're a tool for shaping economic policies, redistributing wealth to reduce inequalities, and fostering a stable, inclusive economy. In essence, paying taxes is our investment in a functioning, equitable society.

But let's not don rose-colored glasses just yet. The efficiency of governmental spending is a debate packed with enough material to fill libraries—let's shelf that discussion for another day, shall we?

For now, we'll tread on the optimistic side of the street, and assume those in power wield our tax dollars with wisdom and foresight (I had acid reflux writing that last sentence, but let's keep moving)

So where did this idea to tax cirtizens originate?

Let's take a walk down (the long) the annals of history, as the saga of taxation unfolds, revealing how this foundational concept has sculpted civilizations from the dawn of society to our bustling modern world (I can feel the collective squeals of excitement from you all):

- Ancient Egypt: Over 5,000 years ago, Egyptians paid taxes in grain — a currency of life itself. This wasn't merely about filling the pharaoh's coffers but ensuring the kingdom could sustain its people and grow. Ancient Egyptians also levied taxes on cooking oil. Imagine Pharaoh's tax collector knocking, not for gold, but for your cooking supplies [1].

- Ancient Rome: Then came the Romans, with Julius Caesar casually implementing a sales tax, initially 1%. Then came Caesar Augustus, who thought 4% more appropriate (sound familiar with our world leaders). These taxes funded the infrastructure and military might that built an empire.

- Middle Ages: Leap into the Middle Ages, and the narrative of taxation gets a bit more... dramatic. Enter Lady Godiva, galloping through Coventry in her birthday suit, protesting not just her husband's tax policies but symbolizing the heavy burden taxes could impose [3]. Yet, these very taxes were what kept the kingdoms afloat, from majestic castles to muddy battlefields

Fast forward to today, and while the specifics have evolved, the essence remains. Taxes support public goods, drive economic policies, and aim for a fair distribution of wealth. It's a delicate balance, aiming to reflect society's priorities and values in every tax dollar spent.

Basics of the Tax System

- Income Taxes: Progressive taxes on your earnings, meaning higher income leads to higher tax rates.

- Sales Taxes: A percentage added to goods and services, affecting every purchase.

- Property Taxes: Annual taxes based on property value, funding local services.

The tax system, in essence, is the structured way governments collect revenue to fund public services and infrastructure. And its complexity is unmatched.

Navigating this system is akin to playing a game of chess with a pigeon: no matter how strategically you plan your moves, the pigeon is just going to knock over the pieces, leave a mess on the board, and strut around like it's victorious. We are now entering a realm where logic and strategy often seem overshadowed by confusion and ever-changing rules.

Let's start with the basics before the pigeon gets too excited. At its heart, the tax system is how governments fund their operations. It's built on three main pillars: income tax, sales tax and property tax.

The system operates on a few seemingly straightforward principles. Income taxes (e.g. your federal income tax, payroll taxes, capital gains etc) are progressive, meaning the more you earn, the higher the percentage of your income you're expected to contribute to the communal pot.

Think of it as being penalized for winning too many coins in a video game (i.e. working hard, being successful); the better you do, the more the game (government) takes away, supposedly to keep things "fair" for all players.

Sales taxes are the government's way of taking a slice of every transaction, like a persistent younger sibling demanding a cut of your allowance for the sheer joy of existing in your presence.

And property taxes? They're the annual membership fees for the exclusive club of property owners, calculated on a mysterious formula that seems to involve dartboards and magic 8-balls.

Now, if like me, you have found yourself confused many times trying to understand your tax bill - you're not alone. The tax system is a complex beast, constantly evolving with new laws, deductions, and credits. The categories just discussed are merely the tip of the iceberg.

A Brief Overview of Tax Planning and Its Benefits

Now that we've meandered through the "why" and untangled the basics of the tax system, let's get straight to the point on why you're really here: understanding and leveraging the tax system to your advantage.

Tax planning, while perhaps as enticing as watching paint dry on a Sunday afternoon, is in fact a golden key to unlocking financial efficiencies.

Understanding taxes is the ultimate life hack.

You want to make the tax system work for you, not against you - aka the "active partner" concept we introduced at the start. By navigating through exemptions, deductions, and credits with the precision of a cat burglar, you minimize what you owe, and maximise what you keep.

I'm sure you're across the benefits, but here's a list anyway for completeness sake:

- More Money in Your Pocket: Understanding and applying tax laws can seriously reduce what you owe.

- Boost Your Net Worth: I've personally seen my net worth jump by ~20% just by being tax-savvy. Specifically, by fully understanding and then employing the strategies listed in Section III. Once you understand the basics, you realise it's not rocket science, it's just about playing the game with intelligence and surrounding yourself with the right resources (i.e. me, my team and a really good accountant/advisor)

- Make Informed Decisions: Knowing the tax implications of your financial moves means you can choose the path that keeps more cash with you, rather than handing it over to the government.

- Peace of Mind: There's a certain calm that comes with knowing you're not leaving money on the table at tax time. Sleep better knowing you’ve maximized your returns legally and intelligently.

I'm not talking about finding extra change in the couch cushions, but about making sustainable gains that can transform your financial landscape. And while a 20% increase might not sound like striking gold at first glance, over the years, this can compound into a mountain of wealth that far exceeds initial expectations.

Section II: Types of Taxes and Their Impact

Building on the foundation from Section I, let's delve deeper into the basic tax categories that that nibble away at your finances like a hungry caterpillar on a leaf: taxes on what you earn, taxes on what you buy, and, just for the thrill of it, what you own.

Understanding these tax systems is crucial, as they not only affect our day-to-day finances but also shape our long-term financial planning.

Taxes on What You Earn: The Uninvited Dinner Guest

First up, we have the category that hits closest to home for most of us. These are the taxes that directly take a slice of your hard-earned pay-check. It's the government's way of reminding you that sharing is caring, especially when it's mandatory and results in a major source of revenue for the said federal government.

The amount of tax you are ultimately required to pay will depend on the source of your income.

This is crucial to understand before we get to the potential strategies in Section III.

Let's take a look at some well known examples [5]:

- Individual income taxes (also known as federal income taxes) we've already discussed and they are a familiar part of every paycheck, structured progressively to tax higher earners at higher rates.

- Corporate income taxes affect the businesses you might own or invest in, influencing their bottom lines and, ultimately, their contributions to the economy. If you run the business yourself, you will be required to pay taxes on your profits, but at a different rate to what you would pay if earn your income via a salary

- Payroll tax, a dual contribution system funding social insurance programs like Social Security and Medicare, split between employers and employees.

- Capital gains taxes come into play when you sell assets for a profit, from stocks to real estate, highlighting the tax implications of you making intelligent moves resulting in investing success. Because heaven forbid you make a profit without a hand dipping into the pie. Important to note that you only pay tax if you sell the asset at a gain from its basis or initial cost. You do not pay taxes on unrealized gains (that is, if you hold the asset and don't sell it) - I will expand on this in Section III, but this is one of the key methods the rich use to get wealthy, and stay wealthy.

Taxes on What You Buy: The Stealthy Wallet Snatcher

Not satisfied with only hitting your savings, the tax man goes after the spendings as well.

Every purchase you make, from daily essentials to luxury items, is subject to sales taxes, a percentage added to the sale price of goods and services. This is the tax on everything from your morning coffee to that impulse buy online (because retail therapy is taxed too). For instance, buying a $1,000 laptop for your freelance gigs suddenly becomes a $1,080 decision, thanks to an 8% sales tax.

But why does this tax exist?

In short, it's the government's way of ensuring that everyone, regardless of income, contributes to the fiscal pool. Whether you're splurging on luxury items or stocking up on essentials, a piece of that spending goes towards public services. Think of it as a universal membership fee for the benefits of living in a well-maintained society.

For the entrepreneurs among us, there are additional considerations in the form of gross receipts taxes on your total sales and excise taxes on specific goods that a business sells like gasoline, alcohol, and tobacco [5].

These are products that the government feels is worthy of additional taxation, so next time you're visiting your local craft brewery, spare a thought for them and have an extra drink, as each batch of beer for them is a lesson in balancing passion with pragmatism.

Though the US has largely sidestepped the value-added tax (VAT) system that's popular internationally, businesses operating beyond American borders aren't so lucky. VAT, or GST in places like Australia, adds layers of tax at each stage of production, making it a global relay race of tax handoffs.

I was in Australia when the GST was introduced at the turn of the century, and I can tell you there was much rejoicing amongst the citizens at that announcement (in the same way that you would rejoice at a root canal).

Taxes on What You Own: The Annual Tribute

Finally, owning property or valuable assets introduces you to the joys of property taxes, an annual homage to the gods of local infrastructure and services. Whether it’s the family home or the car you drive, the taxman cometh.

Property taxes, based on the value of land and buildings, fund local services but vary significantly by location, affecting homeownership costs.

Tangible personal property taxes apply to movable assets, like vehicles and business equipment, while estate or inheritance taxes come into play when transferring wealth upon death, because obviously that needs to be taxed as well [5].

For some of you who are homeowners and asset owners, understanding these taxes is key to long-term financial planning. Owning a home is the American dream, but with property taxes, it's also a recurring reality check.

Let's look at our fake friends, the Joneses, with a lovely suburban home valued at $300,000 (let's pretend it's still the early 2000s), the local property tax rate could mean an annual bill of $6,000, earmarked for schools and roads but also a significant line item in the family budget.

Each type of tax has its direct and indirect effects on individuals and families, influencing decisions from daily purchases to long-term investment strategies.

Now, let's explore practical tips and strategies to leverage this knowledge (and what not to do), ensuring you're equipped to optimize your financial health within the tax system's framework.

Section III: The Wealthy's Tax Playbook

We kicked off this journey with a clear goal: to stop just watching the tax game and complaining and start playing it like pros. You know, doing what the rich have been doing all along without breaking a sweat.

This section is where we shift gears from "what the heck are taxes?" to "here’s how you ace them."

I promise you that none of the strategies involve you disappearing to some country that nobody can point to on a map and dodging your obligations. This is about being strategic and intelligent, and employing legal ways to make sure you’re keeping more. These are legit tactics that anyone with a bit of know-how (that’s you, after reading this) can apply.

Because let’s face it, paying more taxes than you need to is like tipping the government for service you never received and giving them an interest-free loan.

The tactics we will cover below aren't locked in a vault accessible only to the elite. They're available to you, too (and you don't need a yacht or a Swiss bank account). All it takes is a bit of financial fluency, a sprinkle of intelligence, a willingness to learn and someone to point your compass in the right direction (that's my job!)

Then you too can brag like Warren Buffet about paying less tax than your secretary!

Now, I should point out that not every strategy laid out in the pages that follow will fit your current financial narrative. If your income primarily flows from a traditional 9-to-5, the advice on leveraging asset wealth and navigating business expenses might seem like reading a map to a foreign land. And that's okay—because today's job income is merely your starting line, not your finish. What's not relevant now, might be relevant in the future.

But understanding these principles is crucial as they lay the foundation for future wealth-building through asset acquisition and entrepreneurial ventures. The heart of my wealth-building journey has been a relentless focus on acquiring assets and kick-starting side ventures - learning this was a big turning point for me. And as you dive deeper into my journey, absorbing the tales of triumphs and setbacks, a vision for your financial future will start to crystallize as you yourself start contemplating doing the same.

And when you do, the relevance of these strategies will become apparent. For now, see them as a blueprint for what's to come. They're here for you to revisit and apply when you're ready to expand beyond the paycheck and step into the realm of wealth accumulation and business ownership.

1) Asset Appreciation over Income

The Short Version

Why Consider It?

- Earned income vs. capital gains: Earned income (like your salary) is taxed much higher than money made from selling investments (capital gains).

- Tax efficiency: By focusing on assets that grow in value (like stocks or real estate), you can increase your wealth with less tax compared to just earning more salary.

- Wealth growth: Investing in assets allows your wealth to grow without immediate heavy taxes, making it a smarter way to build wealth over time.

How It Works

- Investing in assets: Putting money into things like stocks or real estate.

- Unrealized gains: The value of your investments can grow, and you won't pay taxes on this increase until you sell the asset.

- Selling for profit: When you decide to sell your investments after they've increased in value, you pay taxes at a lower rate than your regular income tax.

Risks

- Market risks: The value of your investments can go up and down, which can affect how much money you make when you sell.

- Timing: Knowing when to sell your investments to maximize profits and minimize taxes requires planning.

The Long Version

The cornerstone of building wealth like the affluent lies in understanding the golden rule: not all income is taxed equally. Here's the deal with the U.S. tax code – it's like it has a favorite child. Earned income (the money from your 9-to-5) and capital gains (the bucks your assets make just by sitting pretty) are treated differently.

Guess who gets the tax break? Spoiler: it's not your paycheck.

When you toil away at your job, Uncle Sam eagerly awaits with open hands, ready to take a percentage your income as a token of his "appreciation" for your efforts. Earned income is taxed at progressive rates, which can climb up to 37% as of the latest tax brackets. In contrast, long-term capital gains—the profits from selling assets you've held for more than a year—are taxed at significantly lower rates, ranging from 0% to 20%, depending on your overall taxable income [8].

The beauty of building wealth through assets lies in the concept of unrealized gains. Let's break it down: if you own stocks or real estate that appreciates in value, you don't pay taxes on the increase until you sell the asset in accordance with current tax laws. You're essentially building a mountain of wealth that the IRS can't touch.

This means you can accumulate wealth on paper, seeing your net worth grow, without owing a dime in taxes on those gains as they happen. It's only when you decide to cash out and realize those gains that taxes come into play.

Bezos knows this. Buffet knows this. Trump knows this. Elon knows this. And now YOU know this!

Let's illustrate with a simple example:

Scenario 2: Now, let's say Jane also invests in the stock market or real estate. This year, her investments appreciate by $100,000 in value. Despite this increase, Jane pays no taxes on these unrealized gains. If she decides to sell after holding the investments for over a year, her tax on these gains could be as low as $15,000 (assuming a 15% long-term capital gains tax), significantly less than what she pays on her job's income. In this scenario, Jane keeps $85,000 in her bank account, which is more than from her job, despite starting with the same "earned value" of $100,000

Now this example is very basic to illustrate a point, but the stark difference in tax treatment between earned income and investment income it showcases is why the wealthy focus on growing their asset portfolios. They use the tax code not as a hurdle but as a hurdle they can pole-vault over, with a bit of strategic planning and a dash of patience.

2) Lower your taxable Income

The Short Version

Why Consider It?

- Tax efficiency: Lowering your taxable income means you pay less tax while still making smart financial moves.

- Legal strategies: There are legitimate ways to reduce the portion of your income that's subject to tax, without needing to reduce your actual earnings.

How It Works

- For the Job Holder: Maximize deductions like contributing to retirement accounts (401(k), IRA) to reduce taxable income. For example, contributing to these accounts can lower your taxable income and possibly drop you into a lower tax bracket, saving you money on taxes.

- For the Asset Owner: Capital gains from investments are taxed differently than regular income as we've seen. If you sell investments in a year when your income is lower, you might pay less in taxes. Planning when to sell assets can take advantage of lower tax rates.

- For the Business Owner: Business expenses are deductible. Spending on things that genuinely benefit your business (like training or technology upgrades) can lower your taxable income. This strategic spending not only reduces taxes but also invests in the growth and efficiency of your business.

Risks

- Job Holder Risks: Overlooking potential deductions or not optimizing retirement contributions can result in paying more tax than necessary. Ensure you're fully utilizing available deductions.

- Asset Owner Risks: Market volatility and timing sales for tax benefits can be complex. Selling assets to align with lower-income years requires planning and might not always coincide with optimal market conditions.

- Business Owner Risks: There's a balance between investing in business growth and overspending. Ensuring expenses are genuinely beneficial rather than just tax deductions is key to sustainable business growth.

The Long Version

To lower your tax, you need to earn less - wait, let me explain before you start rolling your eyes and sarcastically calling me Sherlock.

Now, I'm not saying you should start dodging pay raises. It's all about playing it smart with your taxable income – that's the slice of your pie the government gets to nibble on. With a few clever moves, you can make that slice thinner, legally.

Let's explore how this idea varies for individuals with salaries, assets, or businesses. We'll provide a high-level overview now and delve into more detailed strategies in future advanced modules. For now, our focus is on grasping the basic concepts.

For the Job Holder

If your primary income source is your job, focusing on maximizing deductions is key. The standard deduction (check out the IRS site for the latest figures) simplifies the process, but don't overlook itemized deductions if they exceed these amounts. Consider contributions to retirement accounts like a 401(k) or IRA (have a read of this article to understand the difference), which can reduce your taxable income while building your future nest egg.

For the Asset Owner

When you invest in assets like stocks, real estate, you open up strategic avenues to manage your taxable income more effectively. As we have already discovered, the key principle here is that capital gains—profit from selling your investments—are not taxed until they're realized (i.e., until you sell the asset).

Furthermore, assets held for more than a year qualify for lower long-term capital gains tax rates, which are more favorable than short-term rates (where tax brackets for ordinary income applies) [10].

Now, onto this idea of waiting for a "lower income year" to sell. I sound like a nut-job, right? Like who plans to earn less. But life isn't a straight line. Maybe you decide to hit pause on the rat race, go back to college, take a part time job, take a sabbatical to discover yourself amongst the monks, or even (gasp) retire. Each of these situations can result in a year where your overall income dips.

These lower-income periods can be opportune times to sell your appreciated assets. Selling during these times can mean benefiting from lower tax rates on your capital gains, as your reduced income could place you in a lower tax bracket.

While Jordan's living out his 'Eat, Pray, Love' moment, his regular paycheck's on pause, but his financial game plan is still scoring points. He decides to sell off some of those high-flying stocks. But with his income taking a sabbatical along with him, he's suddenly playing in a tax bracket that's more 'broke college kid' than 'flush day trader.' And just like that, Jordan's potentially looking at a 0% long-term capital gains tax. Yes, you read that right. Zero. Zilch. Nada.

Choosing to sell his stocks during this period means his overall income for the year is lower. He managed to turn what many would see as a financial gap year into a tax-saving masterstroke.

But here’s the real question: If Jordan can do it, why can't you? Think about it. Maybe it's time to map out not just your next vacation but also how you can make your financial portfolio work smarter, not harder, while you're out there living your best life.

By planning the sale of assets around these lower-income periods, asset owners can significantly reduce the taxes owed on capital gains, making it a smart strategy for those looking to maximize their investment returns in alignment with their broader financial planning and life goals.

For the Business Owner

Business owners possess a unique advantage in the realm of tax planning, an advantage that starkly contrasts with the tax treatment of traditional employment income (which is why I promote starting your own business as a key strategy). In a conventional job, your taxes are calculated on your gross income, with deductions taken out before your pay check even reaches your hand.

Conversely, in a business setting, your taxable income is determined after deducting legitimate business expenses, offering a significant opportunity for strategic financial planning.

Cutting down your business's taxable income doesn't mean you start splashing cash on fancy office chairs or ping-pong tables just because (unless you're Google or Meta). It's about investing smartly in things that genuinely boost your business and, as a sweet bonus, trim down your tax bill.

Every dollar spent on legitimate business expenses—from supplies and marketing to professional development and technology upgrades—reduces your taxable income, effectively lowering your tax liability while contributing to the business's potential for increased revenue in the future.

These strategic investments lay the groundwork for higher future earnings, improved service offerings, and potentially, a larger client base.

This approach underlines a crucial strategy for business owners: the power to direct pre-tax income towards fostering business growth and efficiency, not merely to throw money out the window to spite the taxman, but to build a stronger, more competitive business. While reducing taxable income, you're concurrently investing in your business's longevity and success.

But how should you finance these expenses, you might ask?

3) Use of Strategic Debt

The Short Version

Why Consider It?

- Tax Efficiency: Strategic debt allows wealthy individuals to maintain their lifestyle and minimize tax liabilities by borrowing against their assets rather than selling them.

- Lifestyle Maintenance: Borrowing against assets gives you cash for personal use without incurring taxes, allowing your assets to continue growing.

- Business Growth and Tax Savings: For businesses, strategic debt can finance expansion or operational needs, effectively lowering taxable income and leveraging debt for growth without depleting cash reserves.

How It Works

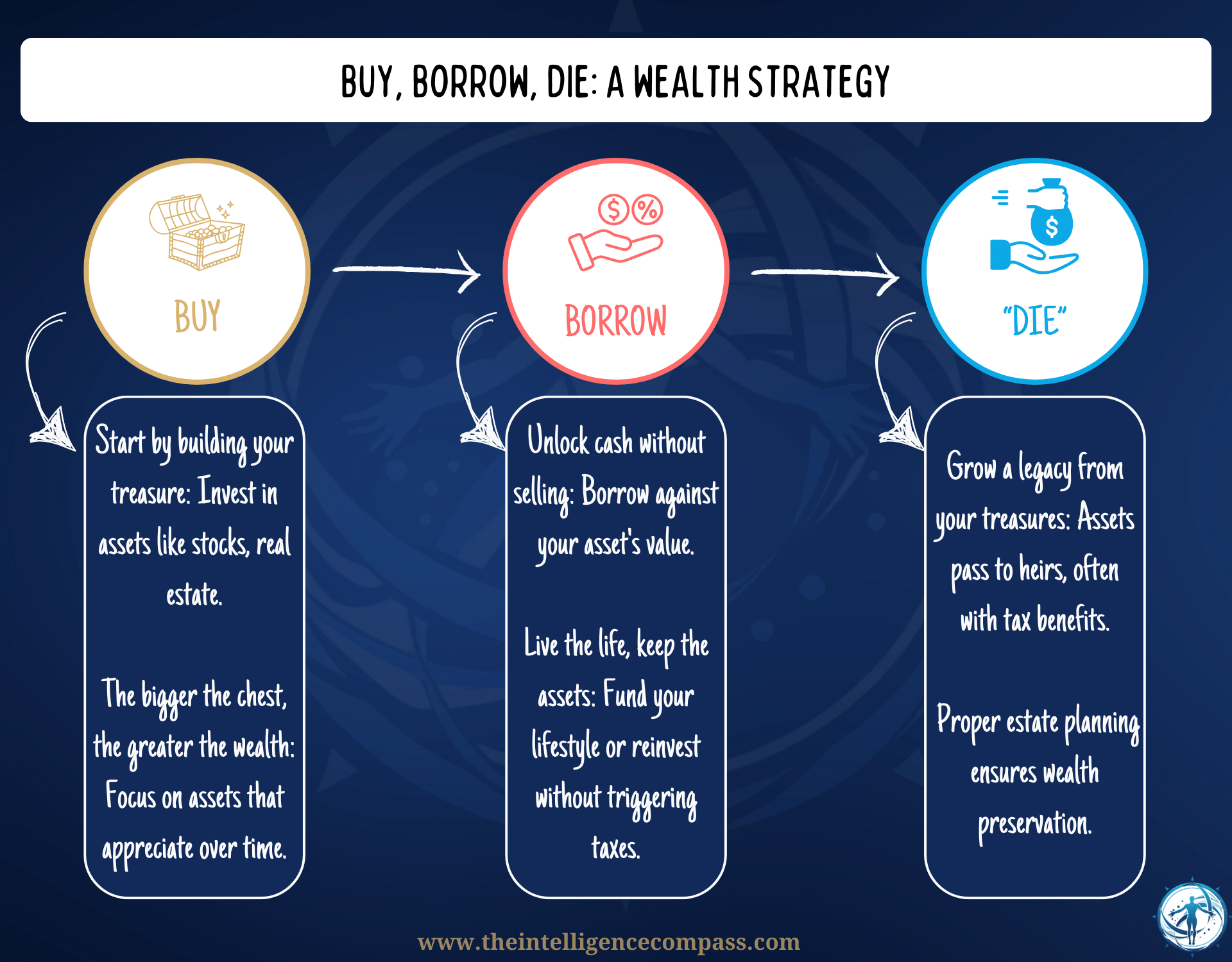

- Personal Use ("Buy, Borrow, Die" Strategy):

- Buy: Invest in appreciating assets like stocks or real estate.

- Borrow: Instead of selling assets and paying taxes, borrow against their value. This provides cash for expenses without losing asset growth or incurring taxes.

- Die: Upon the asset holder's death, heirs inherit the wealth and can use estate planning strategies to settle any debts, often benefiting from tax provisions that minimize tax impact (i.e. step up cost basis).

- Business Use:

- Use debt to finance business operations or expansion, which can lower taxable income since the cost of these expenses is deducted before profits are calculated. This approach preserves cash flow while potentially reducing taxable profit.

Risks

- Market Volatility: The value of collateral assets can fluctuate, posing risks if the value drops below the loan amount, leading to potential financial strain.

- Debt Management: Requires careful management and strategic planning to avoid over-leveraging and ensure that borrowing aligns with long-term financial goals.

The Long Version

Let's picture our wealthy neighbour, Chesterfield Johnson, who, unlike mere mortals drawing salaries, sits atop a dragon's hoard of stocks - how does he buy groceries or a Louis Vuitton outfit for his pet Chihuahua? He can't exactly rock up at his local fruit and vegetable shop and buy a banana with his Tesla options.

Well, remember our article on debt? More specifically, using it strategically as good debt with sound risk management?

Strategic debt is a tool the wealthy employ not only to sustain their lifestyles but also to minimize their tax liabilities cleverly. This can be employed by you for personal needs, or by the any business you own to find your expenses as per guidance in the previous section.

Personal Use of Strategic Debt

Enter the strategy known simply as "buy, borrow, die". This concept, developed by Professor Ed McCaffery in the 1990s, cleverly outlines how the wealthy manage to both grow and preserve their wealth across generations with minimal tax impact [13].

We've already explored the "buy" part—investing in appreciating assets like stocks, real estate, or even fine wine. Now, let's unpack the "borrow" segment, which plays a pivotal role in this wealth retention strategy.

Okay, so you've got these assets growing in value – kind of like magic beans, but better because they're real. What's next?

Well, instead of selling them (and letting the taxman take his cut), you borrow against them. It's like telling your investments, 'Stay put, keep growing – I'm just gonna take a tiny loan against your value.' You get the cash you need without selling a single asset. Intelligent, right?

Essentially, by borrowing against the increased value of their assets, wealthy individuals can enjoy liquidity for their lifestyles without triggering taxable events like capital gains.

It's a balancing act where the interest paid on such loans often pales in comparison to the potential tax on asset liquidation, ensuring that the asset continues to appreciate tax-free.

Elon Musk provides a textbook example of this strategy in action. Rather than drawing a traditional salary—which would be subject to higher income tax rates—Musk and others in similar financial positions choose to borrow against their stock holdings or other appreciating assets [14].

This method supplies them with the necessary funds for living expenses, investments, or further asset acquisitions without selling off their holdings, thus avoiding capital gains taxes.

The genius of this approach lies in its simplicity and efficiency. Loans taken against assets are not considered taxable income. This means that while individuals can maintain or even enhance their lifestyle, the IRS (internal revenue service) does not tax these borrowed funds.

It's a win-win: the underlying assets are expected to continue to appreciate in value, potentially tax-deferred, and the individual enjoys the benefits of liquidity without the immediate tax bite.

The "borrow" component underscores a crucial aspect of sophisticated wealth management—maintaining and using wealth without succumbing to the taxman's grasp more than necessary. But it does not come without risk.

Just as the value of assets like stocks, real estate, or other investments can rise, they can also fall. If the value of your collateral drops below the loan amount, you could find yourself in a precarious financial situation.

This risk underscores the importance of caution and strategic planning. The allure of tax efficiency and preserved asset growth must be balanced with a realistic assessment of how market volatility and asset devaluation can impact your financial standing.

One way to navigate these waters more safely is through conservative borrowing practices—never borrowing against the full value of your assets and maintaining a diversified portfolio to cushion against market fluctuations. Additionally, always have a plan in place for dealing with market downturns without being forced into disadvantageous positions.

Wise investors will consult with financial advisors to tailor this approach to their personal financial situation, ensuring that they can sustain their wealth-building efforts even when the market ebbs. By doing so, you ensure that the "borrow" phase of your wealth management strategy remains a powerful tool rather than a potential trap, allowing you to enjoy the fruits of your assets while wisely managing the associated risks.

Now, you might wonder, "If we're borrowing against our assets to fund our lifestyles without selling and incurring taxes, how do we eventually settle this debt?" This brings us to the intriguing finale of the "buy, borrow, die" strategy - the "die" component. (Note, please don't take the name of that component as an instruction.)

At face value, accumulating debt to avoid taxes might seem like merely postponing the inevitable. However, the strategy's culmination in the "die" component unveils the ultimate tax efficiency manoeuvre.

Upon the asset holder's passing, the heirs inherit not just the wealth but also the opportunity to resolve the outstanding loans against it. Here's where estate planning, a topic we'll delve into more deeply in future modules of the Wealth Intelligence Academy, plays a critical role.

Through carefully structured estate planning, heirs can utilize the assets passed down to them to settle any debts left behind. Moreover, thanks to the step-up in basis tax provision, heirs might find that the assets' increased value upon inheritance significantly mitigates the tax implications of selling those assets to clear the debt.

The "die" part of the strategy might seem morbid, but in financial terms, it's a powerful tool for wealth preservation across generations. It ensures that wealth can be transferred with minimal tax impact, allowing for strategic estate planning to seamlessly integrate into the wealth management process.

Using Debt in Business

On the business front, strategic debt takes on a different guise. Here, debt is used to finance operational expenses, from equipment purchases to expansion efforts. This method effectively lowers taxable income since the cost of these expenses is deducted before profits are calculated.

For instance, acquiring a business vehicle through financing not only serves operational needs but also reduces taxable profit, potentially even pushing the business into a paper loss. Yet, crucially, it doesn't deplete the business's cash reserves.

This strategy underlines a fundamental principle: debt itself isn't taxable. By borrowing, you maintain or even enhance your cash flow without increasing your tax burden.

As on the personal front, while leveraging debt can lead to significant tax savings, it's not without its risks. Strategic debt must be managed with care, understanding that it's a tool, not a free pass.

Know your value, know your risks and understand your strategy.

The Role of Experts

Each of these strategies comes with its considerations and risks. They're not universally applicable but tailored to individual circumstances, especially for professionals and business owners. Decision-making here should align with your risk profile and long-term goals.

Navigating the fine line between strategic investment and unnecessary expenditure requires insight and experience, and that's why engaging with financial wizards (also known as advisors and accountants) who can tailor these strategies to your epic saga of wealth accumulation is crucial.

A skilled accountant or financial advisor can be invaluable, ensuring your decisions are both legally compliant and aligned with your business goals. They help identify opportunities for beneficial investments that qualify as deductible expenses, ensuring you reap the dual benefits of tax efficiency and business growth.

This point cannot be overstated. Yes, I predominantly taught myself and my knowledge and mindset are powerful tools, but I couldn't have made leaps in my journey without engaging various experts: financial advisors, lawyers, accountants, mentors. These resources aren't just costs, but an investment in your financial health and a crucial player in your tax strategy team. Their expertise is invaluable.

Section IV: Implementing Tax Planning Strategies: A Practical Guide

After exploring complex tax planning strategies, let's move from theory to practical action, with some guidance on how to implement this in practice.

As you may be accustomed already with the Nexus Framework, putting the theory into practice is not just about understanding the strategy, but about embracing a mindset shift. We're moving from being that passive taxpayer, to becoming the active strategic planner.

1. Mindset Shift for Strategic Tax Planning

Let's talk about transforming how you think about taxes. It's a non-negotiable pre-requisite for you to experience a fundamental shift from seeing taxes as an annual chore to recognizing them as a crucial part of your financial strategy throughout the year.

Proactivity Over Reactivity

How often do you think about taxes outside of the tax season rush?

If you're like most, probably not much. The revelation for me came when I started integrating tax planning into my financial routine, just like budgeting or saving for retirement. It wasn't about more work, but about smarter, more efficient work.

For you, it might mean setting a quarterly reminder to review your tax situation:

- Could you be adjusting your withholdings or contributing more to a retirement account to lower your taxable income?

- Do you have capital that might be better invested in assets rather than contributing to the government's tax revenue, or Netflix?

Regarding the last point, it's not the cost of Netflix that matters, but rather the amount of time it consumes that could be better dedicated elsewhere (learning, tax planning, your partner and kids just to name a few).

The Power of Financial Literacy

Throughout this article, we've started laying down the groundwork to further build your financial fluency, covering foundational concepts such as asset appreciation to strategic debt. This understanding is your first crucial step, the tip of the iceberg on our journey together with the Intelligence Compass.

As we've discussed, grasping these basics enables you to start applying them effectively. However, comprehension is merely the starting point. The next essential step is continuous learning. Tax laws and regulations are constantly evolving, making it vital to stay informed about the latest changes to maximize your financial strategies.

Now, my journey to becoming financially literate was less 'enlightened monk on a mountain' and more 'dog chasing its tail'. I absorbed every scrap of financial advice I could until reality hit – there are only 24 hours in a day, and apparently, you're supposed to sleep for some of them, and care for your cute offspring.

Realizing the challenge of staying current with tax updates while managing personal and family life, I turned to a skilled accountant. This partnership not only saved me time but also propelled my financial strategies forward, uncovering new opportunities for savings and investments that I had never considered before, like having my business buy my car. Yep, that's a story for another day, but trust me, it's a good one.

The transformation I experienced wasn't just about saving money or reducing my tax bill. It was about gaining the confidence to make informed decisions, to strategize rather than react. And this transformation is what I want for you.

So, take a moment and ponder – what financial breakthroughs are just around the corner for you if continue learning?

Embracing Strategic Patience

Patience is the cornerstone of successful financial planning, especially when it comes to leveraging asset appreciation as part of your tax strategy. Yes, we're talking about the kind of restraint that keeps you from hitting the sell button every time the market sneezes. It's about playing the long game, understanding that true wealth isn't built overnight.

Imagine this: you've invested in an asset, maybe stocks or real estate, and you're finally seeing some capital gains and you're feeling like the Wolf of Wall Street. The excitement is palpable, and the temptation to sell and sail off into the sunset can be overwhelming. This impulse is especially strong if you're constantly wary of market downturns or if this is your first time witnessing substantial gains.

Here's where patience truly becomes a skill.

The decision to invest in a particular asset was, hopefully, based on thorough analysis—weighing its potential against the risks. Trusting in this process is crucial. It's easy to react to market fluctuations with a knee-jerk sell, but true financial growth often requires you to hold steady, even when the market seems to urge otherwise.

Remember, selling assets at the first sign of gain not only potentially misses out on further appreciation but also triggers tax implications. Each sale realized is a taxable event, and acting impulsively can lead to a higher tax bill and diminished long-term wealth.

In the hallowed halls of the Intelligence Compass, we talk about patience not as if it’s some lofty virtue but as a genuine, learnable skill. It's understanding that strategic patience can lead to significant tax advantages, like those offered by long-term capital gains rates, which are considerably lower than short-term rates. This approach requires a disciplined mindset, recognizing that the fruits of your investment decisions may take time to fully materialize.

So, as you sit there, pondering your next move, ask yourself: Can I give my investments the same time and space to grow as I would a meticulously planted avocado tree (I have a couple myself)? Do I have the grit to weather the storms, trusting in the plan I laid out on those long, spreadsheet-filled nights?

This is where strategic patience intersects with financial literacy, allowing you to navigate the complexities of investing and tax planning with confidence.

2. Developing Your Tax Strategy Plan

Now that we've honed your mindset to rival that of a Tibetan monk, calm and unshakable in the face of financial tempests, it's time to channel that inner peace into action. Think of this next step as charting your course to the treasure chest of tax efficiency and wealth accumulation, as it's clear that a good game plan doesn’t just fall from the sky. It requires a bit of elbow grease and some serious brainpower.

Here’s some guidance for you to consider when planning your own journey:

- Assessment of Current Financial Situation

- Take a bird's-eye view of your money matters. What's coming in, what's going out, and what's sitting pretty growing in value?

- Key areas to eyeball include your income sources, investment potential, and those sweet spots for reducing your taxable income.

- Goal Setting:

- With your financial landscape laid bare, it's time to set some goals that actually excite you.

- Think: reducing your tax bill, increasing your investments, or finally understanding what your accountant is talking about.

- My goals have shifted over the years, from "Let's not owe the IRS a small fortune" to "How can I make my money work harder?" Your goals will evolve, too.

- Talk the Talk with Your Accountants and Advisors:

- A solid relationship with your financial advisor is worth its weight in gold (or Dogecoin, if that's your thing). At the very least, to seek personal financial advice that I am unable to offer

- Come prepared with questions and talking points. Not just any questions, but the kind that show you're in the driver's seat of your financial journey.

- Wondering what to ask? Here's some examples

- What's the deal with tax-advantaged accounts, and am I using them right?

- How can we outsmart the capital gains tax without ending up in a tax evasion seminar hosted by the IRS?

- Could you explain the difference between tax deductions and tax credits and how we can maximize both for my situation?

- Are there any new tax laws this year that could benefit or affect my financial strategy?

- How can we make my investment portfolio more tax-efficient?

Navigating the creation of your tax strategy plan is like piecing together a puzzle. Each piece is crucial, from understanding your financial standing to setting goals that get your heart racing (in a good way) and mastering the art of effective communication with your advisors and accountants.

3. Overcoming Common Challenges

Now, even the best laid plans and people with super powerful mindset will encounter inevitable hurdles along the way. And you need to be able to deal with them. Because let’s be honest, if managing taxes was as straightforward as following a recipe, we’d all be tax Michelin chefs by now.

Let's look at some common challenges and potential strategies to overcome them:

Recognizing the Obstacles:

- Market Volatility & Tax Law Complexity: Understand that market swings and ever-evolving tax laws are par for the course - you cannot avoid them. But you need to prepare for this and start seeing them as opportunities to refine and adapt your strategy for greater efficiency and potential savings.

- Strategic Guidance: Regularly check your investments and taxes, and be ready with a backup plan. Staying aware and managing actively can help you use challenges to your benefit. Take advantage of market lows to adjust your investments or save on taxes. And if problems arise, make sure you have an emergency fund set aside.

Embracing Flexibility:

- Strategic Adaptability: This has been a common theme for those that have played along in the academy so far, but being able to swiftly adjust your strategies in response to market trends and tax law updates is crucial. It's about foreseeing changes and having a plan that's versatile enough to adjust. This foresight allows you to capitalize on opportunities and mitigate risks as they arise.

- Strategic Guidance: Diversify your investment portfolio to spread risk across different asset classes. Additionally, keep abreast of tax law changes to swiftly adjust your tax-saving strategies, ensuring they remain effective and aligned with current legislation.

Leveraging Professional Insight:

- Continuous Dialogue with Advisors: Building on the theme on the need for expert consultation we covered earlier, it's crucial to maintain an ongoing dialogue with your financial advisors. This dialogue should evolve as your financial landscape changes. Ensuring your strategy remains cohesive and responsive to new information is key. If you can't afford advisors and don't know where to start, please reach out to me and I can provide the mentoring support to bridget the gap (admin@theintelligencecompass.com)!

- Strategic Guidance: Reference the insightful questions and topics discussed previously to keep these conversations focused and fruitful. Review your financial plan together regularly, ensuring it adapts to new financial conditions and opportunities.

My Closing Thoughts

If you've stuck with me this far, congratulations—you've just navigated through more twists and turns than a season of "Game of Thrones," but with the added thrill of potentially saving some cash (and a better ending than that awful climax we were served up with on GoT).

We've traversed the historical landscape of taxation, untangled the complexities of the current tax system, and, most importantly, armed ourselves with strategies that can transform the way we interact with taxes—from passive observers to active, strategic planners.

Key Takeaways:

- Understanding the Essence of Taxes: We embarked on this journey by establishing a foundational understanding of why taxes exist and how they function in our society—a crucial step for anyone looking to navigate the tax landscape effectively.

- Strategic Planning and Asset Appreciation: We delved into the wealth-building strategies employed by the rich folk, highlighting the power of asset appreciation and the importance of strategic tax planning.

- Practical Implementation: Transitioning from armchair theorizing to actual doing, we laid out guidance that even those allergic to spreadsheets could follow.. Emphasizing the importance of a proactive mindset, financial literacy, and strategic patience (aka the pillars of the Nexus Framework), we laid out a blueprint for effective tax planning. Remember, patience here is like fine wine—it gets better with time, and too much, too soon, can give you a headache.

- Navigating Challenges with Agility: Lastly, we accepted that the tax journey is peppered with obstacles. But with flexibility, a good team of advisors (or at least a decent internet connection for access to Google and the Intelligence Compass wisdom), and the right mindset, you can surf these waves like a pro.

As we wrap this up, let's not part with a sigh of relief but with anticipation for what's ahead. This isn't the end of your tax journey.

I urge you to keep exploring, keep questioning, and most importantly, keep reading our offerings. The strategies we've discussed are but a fraction of what's possible when you approach your finances with curiosity, knowledge, and a strategic mindset.

And remember: the only thing more inevitable than taxes is the opportunity to outsmart them.

Catch you in the final Basic Module of WIA - you don't want to miss it, it's all about investments!

References

- Mark, J. J. (n.d.). Ancient Egyptian Taxes & the Cattle Count. World History Encyclopedia. Retrieved from https://www.worldhistory.org/article/1012/ancient-egyptian-taxes--the-cattle-count/

- Reed, L. (n.d.). The Rosetta Stone Shows the Power Taxes Had in the Ancient World, Too. Foundation for Economic Education. Retrieved from https://fee.org/articles/the-rosetta-stone-shows-the-powerful-leveraged-tax-codes-in-the-ancient-world-too/

- The Herbert Museum and Art Gallery. (n.d.). Discover the History of Lady Godiva. Google Arts & Culture. Retrieved from https://artsandculture.google.com/story/discover-the-history-of-lady-godiva-the-herbert-museum-and-art-gallery/3gXBlvngzYXbLg?hl=en

- Editors of Encyclopaedia Britannica. (n.d.). History of Taxation. Britannica. Retrieved from https://www.britannica.com/money/taxation/History-of-taxation

- Tax Foundation. (n.d.). Tax Types. Retrieved from https://taxfoundation.org/taxedu/videos/tax-types/

- Lallanilla, M. (2017, September 15). Why Tsar Peter the Great Established a Beard Tax. Smithsonian Magazine. Retrieved from https://www.smithsonianmag.com/smart-news/why-tsar-peter-great-established-beard-tax-180964693/

- TV Licensing. (n.d.). Check if You Need One. Retrieved from https://www.tvlicensing.co.uk/check-if-you-need-one

- Chen, J. (2021, April 20). Tax Bracket. Investopedia. Retrieved from https://www.investopedia.com/terms/t/taxbracket.asp

- Wikipedia contributors. (n.d.). Standard deduction. In Wikipedia, The Free Encyclopedia. Retrieved from https://en.wikipedia.org/wiki/Standard_deduction

- Bankrate. (n.d.). Long-Term Capital Gains Tax Rates in 2021. Retrieved from https://www.bankrate.com/investing/long-term-capital-gains-tax/#rates

- Luhby, T. (2021, June 8). What Matters: Income Taxes. CNN. Retrieved from https://edition.cnn.com/2021/06/08/politics/what-matters-income-taxes/index.html

- American Progress. (n.d.). Addressing Tax System Failings That Favor Billionaires and Corporations. Retrieved from https://www.americanprogress.org/article/addressing-tax-system-failings-favor-billionaires-corporations/

- Yahoo Finance. (n.d.). Buy, Borrow, Die: How Rich Americans Live Off Their Paper Wealth. Retrieved from https://finance.yahoo.com/news/buy-borrow-die-rich-avoid-140004536.html

- Isidore, C. (2021, November 9). Elon Musk's Wealth Hits $300 Billion. CNN. Retrieved from https://edition.cnn.com/2021/11/09/business/elon-musk-wealth-tesla-stock/index.html

- U.S. Department of the Treasury. (n.d.). America's Finance Guide. Retrieved from https://fiscaldata.treasury.gov/americas-finance-guide/

- Cheapism Blog. (n.d.). Fun Tax Facts. Retrieved from https://blog.cheapism.com/fun-tax-facts/

Nexus Saga