Did you know that as of September 2023, the personal saving rate in the United States was a mere 3.4 percent? [1]

Crazy, huh? If your first thought is "I wish mine was higher than that. Wish somebody would show me how", you're in the right place. If your second thought is, "What is a personal saving rate?", you're also in the right place. I'll explain why.

But before you ask Google Maps the way to Wealthville, let me introduce you to something better than a GPS. It's a framework I was forced to build from the ground up, after the education system left me well-versed in algebra and 17th-century English Literature, but little in shares, and sent me off with a, "Good luck in the world, young man!"

I call it the Nexus Framework, and it consists of three simple pillars. The basic premise is that once you understand these three concepts, you have all the skills you need for financial mastery and wealth. Let me explain...

Pillar One of the framework is Financial Fluency, the kind that turns jargon into 'aha!' moments. It's knowing your ETFs from your 401(k)s without needing a PhD.

Pillar Two? Mindset. Because diving into the market with the wrong attitude is like surfing with a door—it just doesn't work (weirdly, I've tried it). I credit this pillar with turning my financial fortunes around, and once I go into the detail of the "how", it will do the same for you.

And Pillar Three is Strategy, the game plan that's more tailored to you than a bespoke suit. Together, they're the trifecta that transformed my net worth from a street number to a seven-figure powerhouse.

Why should you care?

Great question. Because this isn't your grandma's "save every penny" lecture. This is the blueprint I wish I had when I was fumbling in the financial dark, learning the hard way that a savings account getting bigger isn't a strategy. It isn't wealth.

I've been through the trials, the errors, and the "oh no, why did I do that?" moments. I know that's a cliche, but it's true! And honestly, I don't want anyone else to go through that. I'm on the side of humanity - I truly believe we all have the ability to achieve our own version of wealth. All we lack is those three pillars.

This isn't just about building wealth. It's about wielding it with the finesse of a maestro. Because when you find the sweet spot where fluency, mindset, and strategy collide—you've found your wealth Nexus.

So, let's get down to brass tacks. I'm not just here to teach, I'm here to transform you into the financial ninja you were always meant to be. Welcome to the Intelligence Compass—where your financial journey gets real.

First, we'll start with explaining what I'm actually talking about, and validating that I'm not a robot...or crazy.

I. The Bedrock of Wealth - Financial Fluency

We're about to lay the foundation of your financial empire, and guess what? It's not made of gold bars or stashed cash under your mattress. It's something far more critical: financial literacy and, more importantly, fluency. Let's dive in!

Understanding Financial Literacy

Picture this: You've got a treasure map in your hands, but it's in ancient Greek. That's your financial landscape without literacy (ps. this analogy only works if you're not actually ancient Greek).

Financial literacy is about more than just recognizing numbers and terms, it's about understanding them well enough to make informed and effective decisions with your resources. It's the cornerstone of personal and societal economic well-being.

Why is this so crucial?

Because the stats don't lie. Individuals who are financially literate tend to stack their wealth like a pro-Jenga player, while those without it are more likely to see their financial stability topple. It's the difference between sailing through calm seas or getting caught in a maelstrom with a leaky boat.

Advancing to Financial Fluency

So you've got the basics down, and you're feeling pretty good. But it's time to level up from financial literacy to fluency. If literacy is knowing the words, fluency is crafting poetry.

Financial fluency is the art of making your money dance to your tune, understanding the nuances of financial instruments, and making decisions that align with your long-term wealth goal.

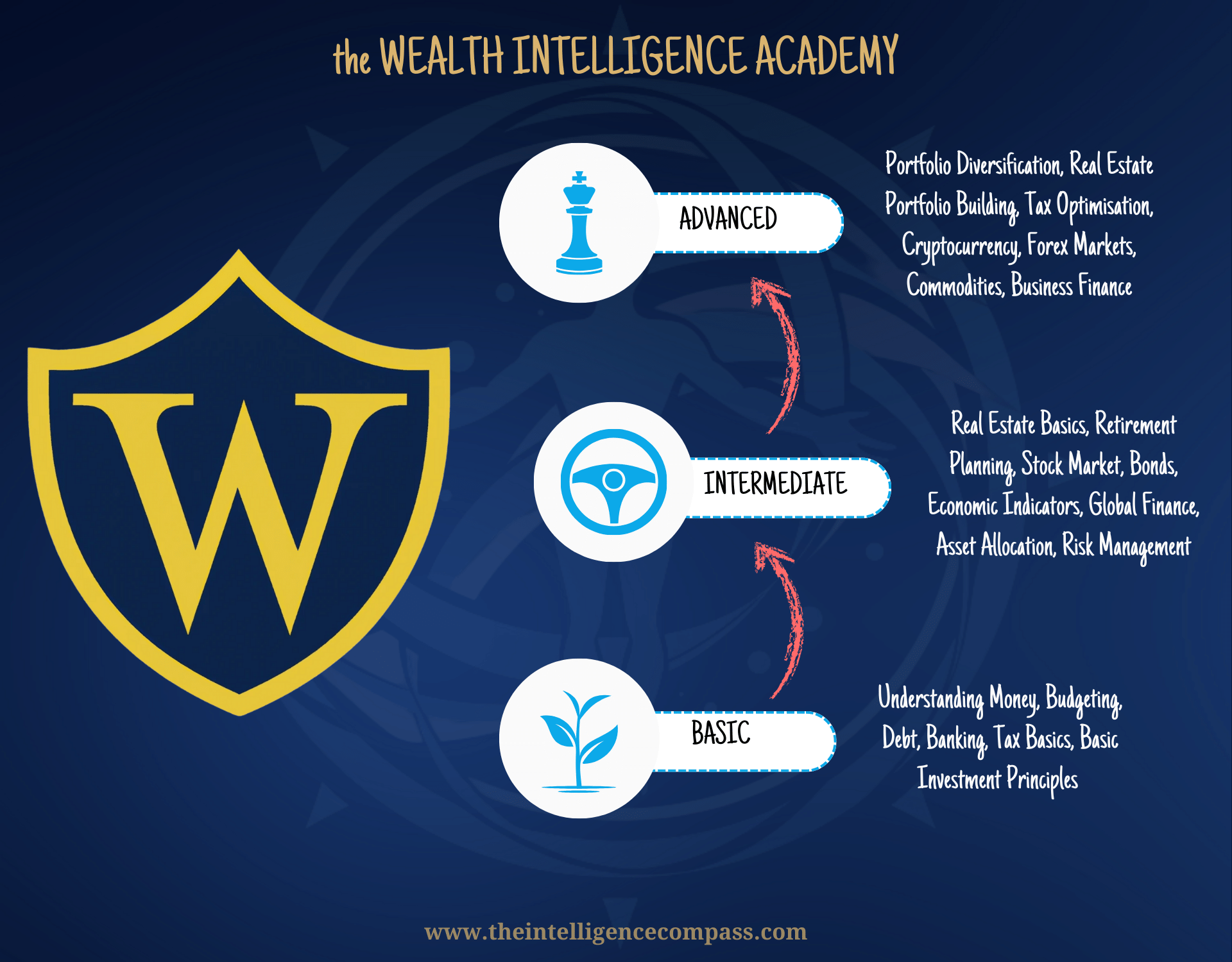

Within this pillar, you'll discover the Wealth Intelligence Academy, your personal financial Hogwarts, where you'll learn to cast spells on your bank account (metaphorically speaking, of course). You'll journey through basic, intermediate, and advanced levels, each designed to elevate your financial savvy to wizardry status (disclaimer: you'll still be a muggle, just a really wealthy one). And I refuse to charge for this - it's knowledge that belongs to everyone!

And because of the large volume of material I have consumed on financial theory over the year, with most of it being responsible for the best sleep of my life, I have taken some creative liberty with this material: a cast of characters and their lives will join you, guiding you through the journey with a twist or two!

They're the Gandalf to your Frodo in the realm of finance, helping you navigate through the misty mountains of money management, mental blocks, and investment strategies.

The Journey Ahead in Literacy and Fluency

As we gear up to transition from the 'what' to the 'how,' remember that this is just the beginning. Financial literacy and fluency are your first steps toward becoming a wealth-building maestro.

Now, I won't sugarcoat it – this journey from financial ABCs to Shakespearean sonnets of wealth isn't a walk in the park. It's more like a hike, with some breathtaking views and the occasional blister.

We'll start with the basics, like understanding the difference between a stock and a sock (hint: one's a lot less cozy).

As we progress, we'll delve into the meatier stuff – the strategies, the mindset work, the kind of insights that would make Warren Buffett raise an eyebrow (maybe not, but we'll give it a shot!). And no, we're not settling for the same old advice that's been regurgitated since the floppy disk era. We're talking fresh, deep insights that cut through the noise like a hot knife through butter.

So, are you ready to transform from a financial novice to a savvy investor? To go from nodding along to financial jargon to being the one who drops knowledge bombs at dinner parties? Excellent! Keep your eyes peeled, your mind open, and let's get that financial fluency to a level where even your wallet starts to look at you with newfound respect.

II. The Mindset for Wealth-Building

Alright, let's switch gears from the nuts and bolts of financial literacy and fluency to something that's often the invisible hero of wealth-building: mindset.

This isn't just a supplementary chapter in our journey. It's the bedrock upon which the edifice of financial mastery is built. Alongside the acumen of financial fluency, the right mindset is a force multiplier in the alchemy of wealth creation. It's the secret sauce, the wind in your sails, the je ne sais quoi, the... you get the picture. It's big.

And I credit the mindset as the single biggest influence on my financial odyssey.

The Psychological Foundation

Imagine trying to build a skyscraper on a foundation of marshmallows. Not the best idea, right?

That's what it's like to dive into wealth-building without the right mindset. Emotional intelligence and resilience are your concrete and steel. They're what keep your financial skyscraper standing when the economic earthquakes hit.

Your mindset is the lens through which you view your entire financial journey. It's the difference between seeing a market crash as a disaster or an opportunity. Without the right mindset, all the financial knowledge and strategies are like a ship without a rudder—aimless and at the mercy of the currents, and ultimately, doomed to fail.

And let's not forget about risk appetite. This is about understanding your personal risk threshold and ensuring that your financial decisions resonate with your inner compass of comfort and ambition.

Cultivating the Right Attitude

Let's do a quick brain gym. Think of a financial decision that scares you.

Got it?

Now, instead of recoiling in fear, approach it with curiosity. Ask yourself, "What can I learn from this?" This pivot from fear to curiosity is the first step toward cultivating a growth mindset.

The virtues of patience, discipline, and proactive behavior are your new BFFs in this quest. Patience grants you the foresight to recognize the fruits that only time can ripen, and when I introduce you to my BFF, compound interest, you will see why (compound interest is in my top 5 human-level concepts of all time).

Discipline is the relentless guardian of your financial plan, keeping you true to your course.

Proactivity is the skill of preemptive action, the art of preparing for opportunities and buffering against potential setbacks.

Mindset as a Continuous Journey

Crafting the perfect mindset isn't a one-and-done deal—it's more like leveling up in the world's most rewarding video game. It's continuous and ongoing. It's about constantly calibrating your mental compass to align with your evolving financial landscape.

Throughout this journey, we'll be diving deeper into the psychology of wealth-building, unlocking mental strategies and mindset principles and their specific applications and utilisations in wealth creation. If there is one thing I ask of you, do not skip this pillar and dive straight into the strategies - it's tempting, I know.

A reminder that the Mindset Pillar isn't a solo act. It's part of a power trio with financial fluency, and our next hero...strategy. They're like the Destiny's Child of wealth-building (don't ask me which one is Beyoncé)!

III. Strategy – Knowing Your Game Plan

Alright, let's huddle up and strategize. Now, for the savvy among you, strategy in wealth-building might sound like yesterday's news.

And you're right.

I'm not here to claim I've reinvented the financial wheel. But here's my point: I see too many bright sparks out there playing pin the tail on the donkey with their wealth strategies (assuming they have one at all).

They either grab a strategy off the shelf because it's trendy, or some "marketing bro" in a "first-class flight" on YouTube told them it's a slam dunk, or they lack the discipline to stick with it when the going gets tough (cue the knowing nods from those of you who've been journeying with us through this article and concepts are starting to click).

This is not about slapping together a plan with spit and hope. It's about knowing what is available out there and using that to create your own Goldilocks game plan – not too hot, not too cold, but just right for you.

It's about finding your sweet spot amongst the maze of noise, your personal Nexus, where your newfound financial savvy and that rock-solid mindset we've been talking about spark into action.

The Game Plan for Wealth Growth

If you don't have a strategy at all, I imagine you're the kind of person who likes showing up to a chess match and winging it against a grandmaster.

Spoiler alert: It won't end well (unless it's a plot twist and you're actually the grandmaster? No, stay focused!).

That's why even the brainiest can stumble on the wealth path—they're missing that game plan. If you have a lot of capital with no game plan, that just means you have more money to lose - just look at Manchester United (a sore topic!)

Your strategy is your financial fingerprint—unique to you. It's about creating a bespoke blueprint for your wealth-building journey. And trust me, when you have a strategy that's as tailored to you as a bespoke suit, that's when the magic happens.

Let's face it, the traditional move here is to dial up a financial planner or advisor to whip up a custom strategy for you. And hey, they're great at what they do, but let's talk turkey—sometimes, their price tags can make your wallet weep.

Now, don't get me wrong, I cannot take the place of a personal financial advisor/planner and anything I say cannot be seen as financial advice, but here's the scoop: my goal is to arm you with the smarts, the know-how, and a Swiss Army knife of financial tools so that you can be the master chef of your own financial kitchen.

If I can get you to a place where you're slicing and dicing through financial plans with the precision of a sushi chef, then I've hit the bullseye.

And sure, if you decide to bring in a financial sous-chef to your kitchen because you've got the dough to spare, more power to you (I still rely on experts to this day).

But you'll be in the driver's seat, steering the conversation, asking the tough questions, and making sure they don't sprinkle too much salt on your financial steak. You won't be one of those people who just blindly adopt a strategy some "expert" is selling you! And you'll feel confident doing it.

Exploring the Spectrum of Strategies

There's a whole kaleidoscope of strategies out there, and my job is to introduce you to them like we've got a financial Hogwarts letter in hand. From the basics for the budding financiers to the complex for the fiscal wizards, we'll cover the gamut.

But it's not just about laying out the strategies like a buffet. It's about empowering you to pick the right dish for your palate. With each strategy we unpack, you'll gain the savvy to choose what works for you, because informed choices are the name of the game.

And who knows? You might just find that the 'strategy smorgasbord' is more appetizing than you thought.

Adaptability and Strategic Pivoting

If there's one thing that's constant in life, it's change. And the financial world? It's like a dance floor with a mind of its own. The music changes beat when you least expect it. That's where adaptability comes in. It's your ability to pivot like a pro basketball player when the game takes an unexpected turn.

We're not just talking about having a plan B. We're talking about having a whole alphabet of plans. Because when life throws you lemons, you want to be ready to make lemonade, lemon tart, and maybe even a zesty lemon risotto. There's a strategy for every season of life, and we'll help you know them with the grace of a financial ballerina.

As we close this section, remember: strategy is the bridge between your financial dreams and reality. It's the path that connects your fluency and mindset to your Nexus.

What Does It All Mean, Basil?

And there we have it, folks—the grand tapestry of wealth-building, woven together with threads of fluency, mindset, and strategy.

But let's rewind the tape a bit.

My odyssey into the financial wilderness started just over a decade ago, armed with nothing but shiny engineering and finance degrees and a burning curiosity to experience the excitement the world has to offer (lots of disappointment on that last point, but that's a story for another day). Little did I know, I was about to embark on a journey of epic proportions.

The road was paved with books—a library's worth, to be exact. I devoured them with the gusto of a kid in a candy store. There were triumphs and face-palms, lessons learned in the trenches of my corporate gig, and then came along my secret weapon, my unofficial mentor—my wife.

She's the Yoda to my Luke, only with less swamp living, heaps better looking, and more savvy financial advice with correct sentence structure (sorry, Yodes). She alone helped me realize the power of the mindset - it's no coincidence our wealth status exploded exponentially since that faithful point in 2015.

Now, I'll let you in on a little secret: it took me until my early 30s to have that lightbulb moment. But for you, my intrepid reader, I'm hoping to flip that same switch much sooner. I've distilled a decade's worth of wisdom, wins, and whoopsies into this blueprint. And I'm laying it out with the confidence of a cat who knows exactly where the warmest spot on the bed is.

The Nexus isn't just a fancy term I cooked up to sound cool (although, admit it, it does have a nice ring to it, and it took me a disproportionate amount of time to come up with it). It's the culmination of a journey that began with a young graduate's dream and a pile of books taller than a hobbit.

The Nexus framework is the heart of the matter, the core of the quest and your financial True North!

Now because I consider Mindset and Fluency an absolute foundation bedrock, the initial content will focus solely on building mastery in these pillars. I would be a terrible mentor if we made the leap to strategies and secret tricks before I've even covered the basics. I promise you, you will thank me for this approach down the track, so I will ask you to trust me (yes, a complete stranger on the Internet, I know how that sounds).

So, are you ready to take the leap?

Because I'm here to give you a boost, a nudge, or even a gentle shove in the right direction. Let's make your 20s or 30s (or whatever glorious decade you're rocking) the time when it all clicks for you. Hit that subscribe button, come back to join in the journey and let's turn that Nexus from a 'what if' into a 'heck yes.'

References: