Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings:

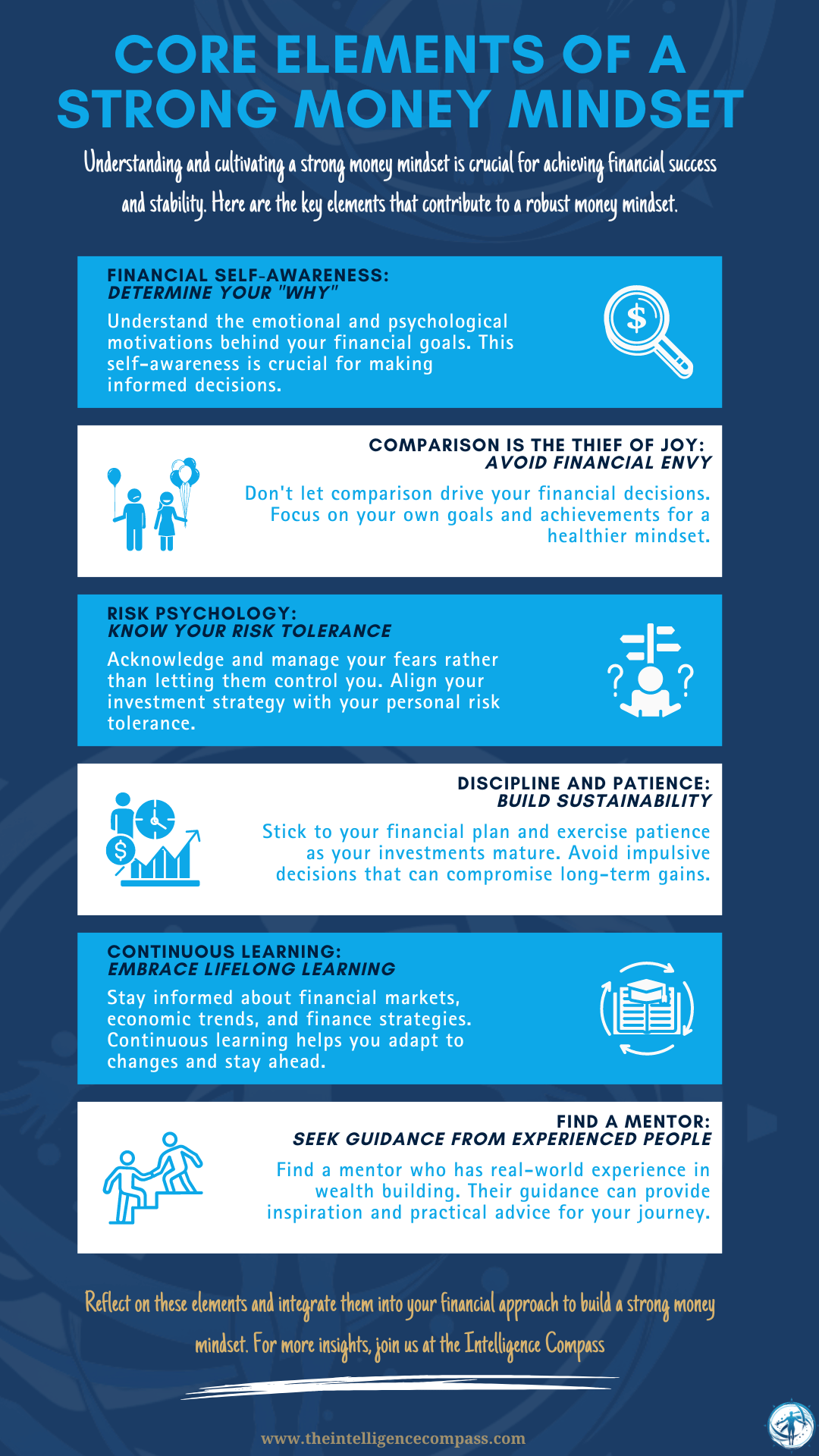

- The Power of a Money Mindset: Discover why a strong money mindset is just as crucial as financial knowledge and strategies in achieving long-term wealth.

- The Core Elements of a Money Mindset: Discover the fundamental principles, including self-awareness and emotional intelligence, that are crucial for making informed and effective financial decisions.

- Common Barriers to Financial Success: Learn about the typical obstacles that can derail your financial journey, such as cognitive biases, emotional pitfalls, and societal pressures, and understand their origins.

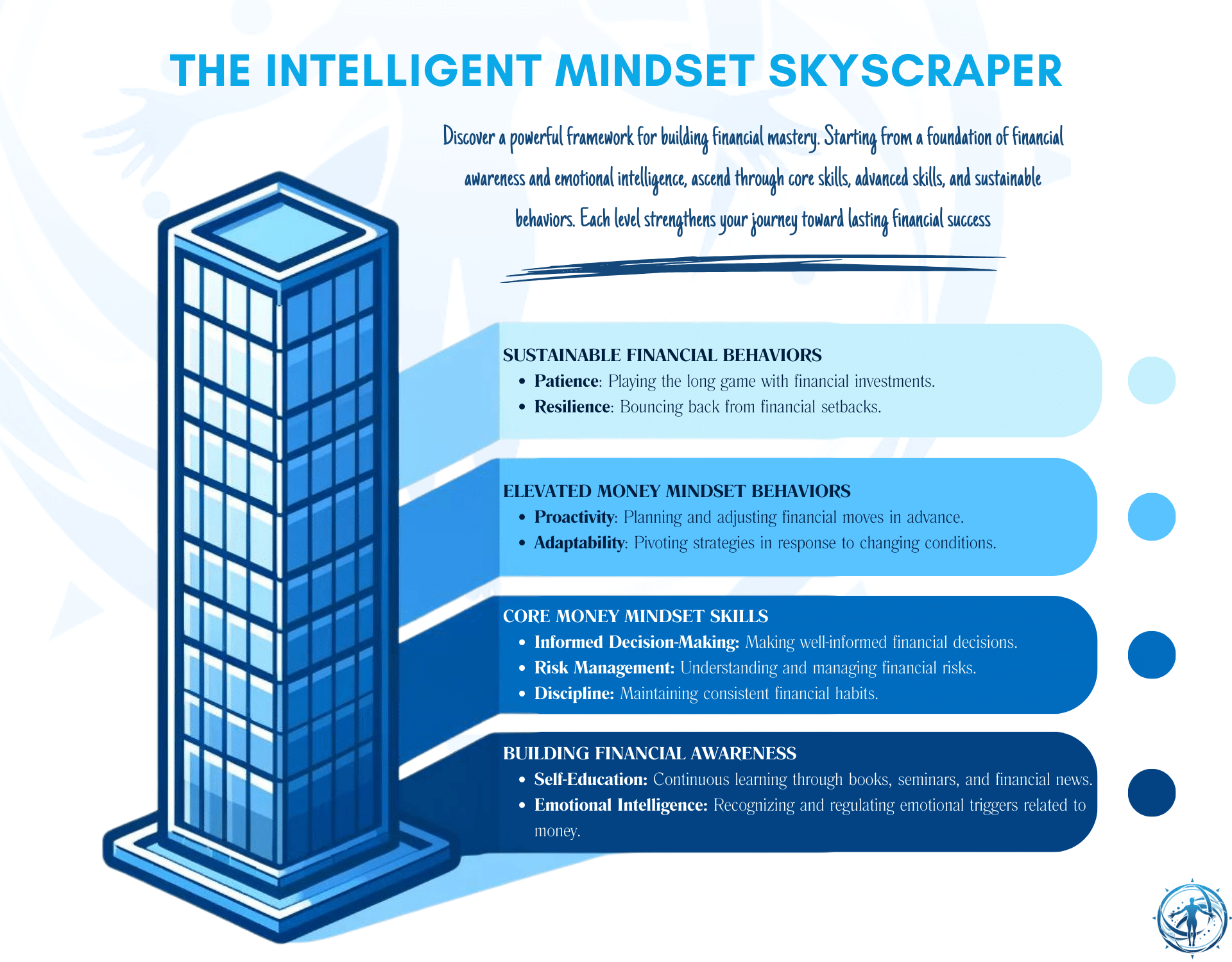

- Effective Strategies for Overcoming Financial Barriers: Explore practical strategies to dismantle these barriers, featuring the Intelligent Mindset Skyscraper, which provides a structured approach to building financial habits and mindset skills from the ground up.

- Adapting to Financial Challenges: Gain insights on how to adapt your financial mindset and strategies in response to personal and market changes, ensuring your financial plan remains robust and effective.

Have you ever wondered why some people seem to effortlessly ascend the financial ladder, while others, perhaps even more knowledgeable or skilled, falter at the first rung?

It's easy to find advice on financial strategies and investment tips by drowning yourself in an ocean of Google or YouTube searches or listening to the endless drone of financial gurus on social media, but here’s a little secret they often skip over—the mighty role of your mindset in achieving and sustaining wealth.

In a world drowning with financial advice, the focus often leans heavily on tactical know-how and less on the psychological warfare that plays out silently behind each decision we make.

What happens when the best-laid plans fall apart?

How do you manage risk without succumbing to overwhelming fear?

And how do you stop a minor hiccup from turning into a full-blown financial meltdown?

Take, for instance, the Elliott Wave Theory, a method some traders use to predict market movements. This theory hinges entirely on the psychology of investors to predict future market movements based on past behaviors. It's a prime example of how understanding psychological patterns can give you an edge sharper than a Wall Street suit.

In the first module of the Intermediary level in the Wealth Intelligence Academy (WIA), I will introduce you to one of the three core pillars of our Nexus Framework ((for those not familiar, ). For my regular readers, you are no doubt aware of this map that I have developed to guide you to your True North in your wealth journey. If you're new, I highly recommend you get acquainted with the trifecta of wealth success here.

It's my firm belief, born from both professional experience and personal journey, that failures in wealth accumulation are more often a result of an inadequate mindset rather than a deficiency in financial knowledge or a sound strategy. You need to be proficient in all three, but you will not achieve your goals with just the other two (unless you have the luck of the Irish with you, but sadly that is not a pillar).

In this introduction to our series on the Psychology of the Money Mindset, I will introduce you to the core principles of a strong money mindset, identify common barriers that prevent people from fostering this mindset, and offer strategic insights into overcoming these challenges. By the end of this series, you'll understand that controlling your financial destiny involves much more than just understanding the numbers; it's about mastering the mind that manages the money.

Strap in as we explore the wild, underappreciated world of financial psychology, where you’ll learn not just to survive but thrive through the ups and downs of your financial journey. This is where your path to true financial empowerment truly begins to unlock.

I. What is a Money Mindset?

The money mindset is the prevailing attitude and comprehensive approach an individual adopts towards managing money and building wealth.

Now, I know some of you will read this article and think this sounds less like a 10x financial strategy that you so sorely seek, and more like something a guru would preach about. But trust me, you don't want to skip this one.

You will see with time that your mindset will become the bedrock of every financial decision you make, impacting everything from the small choices at the grocery store to the big decisions like buying a house or investing for retirement. It's really about embracing a way of life that puts financial growth and stability front and center.

But what really constitutes a strong money mindset?

Is it about being so tight that you squeak when you walk, or so loose that your wallet is basically an open charity?

During my escapades through the thrilling world of personal finance—backed by a treasure trove of books and some sage advice from folks who’ve been in the trenches - I’ve identified several core money mindset elements that have consistently emerged as crucial for my financial success stories.

Each plays a role, sure, but some are definitely the VIPs in turning your financial journey and your life from meh to marvelous and you will be relying on those more frequently than the others. The VIPs will differ for each person.

I want to emphasise that my goal with this project is not just to guide you in increasing your net worth, but also to do it in a way that is stress-free and allows you to love and enjoy life.

Let's break them down to understand how each can contribute to your financial success and stability.

Financial Self-Awareness: Determine Your "Why"

So, what's the real driver behind your mad dash for financial success?

It might seem like a straightforward question, but the answer often dives deep into the emotional and psychological motivations that shape your relationship with money. This isn’t just about how expertly or disastrously you manage your finances, but more importantly, why you're driven to achieve financial success.

Whenever I bring up this topic with my clients or family members, it brings to the forefront one of my favorite Stoic philosophical quotes from Epictetus, one of the ancient gurus of keeping it cool:

This perspective challenges us to examine our desires closely. Are your financial goals rooted in genuine needs, or are they driven by fleeting wants that don't stick? (i.e. do you really need that pink Posh Becks-endorsed Range Rover??)

Financial freedom isn't about amassing a vast wealth of assets - your first reaction might be to think me a crazy fool, but hear me out. To me, it's about intelligently managing your money so you’re the puppet master pulling the strings, not the marionette flopping around with a sense of direction of a headless chicken.

Society often equates more money with success, but let's be real - true freedom and power comes from calling your own shots and knowing what you actually need to be happy.

Know and understand your goal!

If you don’t need a lot of money to enjoy life, than you don’t need to stress about building a huge wealth empire.

Having said that, if your ultimate goal is to just amass a huge array of wealth assets, then knock yourself out. All I'm saying is you need to be honest with yourself on the "why".

One of my favorite books on this topic, "The Psychology of Wealth" by Morgan Housel, emphasizes that our past experiences influence our financial choices much more than technical economic theories or market data [1].

Ever wondered why you’re a penny-pincher or a splurge?

Blame your past experiences—they dictate your risk tolerance and influence every financial decision, from stocks to socks. Understanding this can help you figure out your relationship with money and further inform your "why" on this journey. It's another piece to the puzzle, so go sit somewhere quite and analyse your history (note, this introspective may take a while).

For example, a wealthy individual who grew up during periods of high inflation will have a different financial worldview than a similarly wealthy person who’s only ever experienced stable prices. Below is a great example from Housel's book:

So, ask yourself: What is your fundamental reason for seeking financial success? Is it for security, freedom, or maybe to prove something?

Your answer—your 'why'—should be the compass that guides your financial strategies and decisions. It’s what keeps you steady when the financial seas get rough and makes sure your wealth chase doesn’t end up being just a wild goose chase.

Comparison is the Thief of Joy

Ah, the digital age, where everyone's life is just a swipe away and looks shinier than yours. Scrolling through your feed might make your own financial wins feel like participation trophies, especially when pitted against someone else’s Greek-island vacation snaps or their latest monster-sized home upgrade.

Every peek into someone else’s life can make your own victories seem smaller, not because they are, but because you’re measuring them against someone else’s curated exhibit.

But financial envy is not just unpleasant—it can be a fast track to making monumentally dumb financial moves.

- Envy as a Destructive Force: When envy grabs the steering wheel, common sense is the first thing tossed out of the speeding car. Suddenly, you’re not making financial decisions based on what’s sensible for you, but instead trying to one-up the Joneses, who, by the way, are probably in debt up to their designer sunglasses. These decisions often involve risks that don’t match your financial strategy, and the stakes can be your financial stability. Recognizing when you have enough and sticking to that understanding is crucial.

- Shift in Mindset: Here’s a novel idea—what if you celebrated others' successes instead of using them as a yardstick for your own life? Unlink your self-worth from your net worth, and watch your financial (and mental) health transform. Plus, cheering for others can actually feel good, unlike that nagging envy.

- Cultivating Contentment: Embrace gratitude, not as some new-age fad, but as a genuine shield against the barrage of "look-at-me" social media culture. Real contentment means knowing what you have is good enough, which, in today’s world, is about as radical as wearing socks with sandals. Remember, that envy you feel? It might just be a two-way street. Maybe someone out there is looking at your life with the same green-tinted glasses. This shift in perspective can dampen the impulse to engage in financial one-upmanship and making you less likely to spend money you don't need to spend [3].

- Dangers of Social Comparison: Constantly measuring your backstage against everyone else’s highlight reel is a recipe for serious financial and emotional strain. It’s vital to remember that what you see online is often a polished version of reality, showcasing peaks without the valleys. Acknowledging this can help you feel more secure in your own financial path and more resilient against the pressures of apparent social norms.

So, next time you catch yourself eyeing someone else's financial grass, which might not be as green as it appears, pivot to appreciating your own lawn. It’s probably greener than you think, and hey, it’s paid for.

Risk Psychology: Get Comfortable with Fear, Anxiety, and Discomfort

Navigating the financial landscape is not for the faint-hearted. It's tough.

It's like trying to walk a tightrope in a hurricane. One minute you're up, the next you're wondering how much a cardboard box goes for these days. Dealing with the "what-ifs" of volatile investments or sudden market crashes—and the accompanying cocktail of fear and anxiety—is par for the course.

To keep from being blown off your financial path, you need to bulk up your resilience and truly understand just how much risk you can stomach. There is no need to banish your fears, but you want to acknowledge them, give them a nod, and not let them make your decisions for you.

You'll want to find a pace and path where you can handle the ups and downs without feeling the need to hyperventilate into a paper bag, and not recklessly charging forward like some kind of Wall Street bull in a china shop. I should warn you - this will take some time, and you may need to experience some pain first before you get to a comfortable state.

Realizing this, Kevo and I sat down to reassess not his investment strategy, but his relationship with risk and anxiety. Through our discussions, it turned out his fear was flashing in neon lights that there was a serious misalignment between his aggressive investment strategy and his actual nerve for it. He needed a game plan that let him sleep at night, not one that turned every market twitch into a horror movie marathon. He might be ready for that one day, but he wasn't now!

Kevo decided to shift to more conservative investments (after confirming with his accountant and advisors, of course), aligning more closely with his new-found risk tolerance and personal values. This shift wasn't about giving up on growth, but about fostering growth at a pace that didn't send his pulse racing every time the market twitched. By becoming comfortable with his level of fear and anxiety—acknowledging it but not letting it rule his decisions—Kevo found financial peace. His investments grew, sure, but more importantly, he took back the reins of his financial decisions. Could he have experienced a higher return with the previous option? Maybe. But at what cost?

This transformation in my mate Kevo is something many can learn from. It's crucial not only to be aware of the psychological aspects of investing but also to ensure that your investment strategy resonates with your personal risk tolerance and life goals.

It's not just about how well your investments perform, but also about how well you sleep at night knowing you're on the right track. Remember, always consider speaking with a financial advisor to help assess your comfort with various investment risks and specifics.

Maintain Discipline and Patience

Wealth accumulation is a marathon, not a sprint. Maintaining discipline in sticking to your financial plans and exercising patience as your investments mature are pivotal habits.

Maintain discipline in your decision-making. Impulsive reactions to market fluctuations or new investment fads can severely compromise your long-term gains. They are like junk food—thrilling at the moment but regrettable soon after. And just like that, your long-term gains can get crunched harder than a potato chip under a boot.

Stick to your strategy. Patience is your best ally in the finance game. Remember, the most rewarding financial gains aren’t the ones that sprint to the finish line, but the ones that take their sweet time, and are based on informed decision-making, aging to perfection like a fine wine or your favorite cheese. So next time you feel the itch to jump on a hot new investment trend, take a breath and ask yourself...why. Slow and steady wins the race, and often, the stock (and definitely crypto) market too.

Continuous Learning and Adaptability

The financial world is ever-evolving, and staying informed is non-negotiable. Embrace a mindset of lifelong learning—keep up with financial markets, economic trends, and personal finance strategies.

If you're not learning, you're probably losing—money, opportunities, your mind, you name it. Here at the Intelligence Compass, and the reason for the WIA existence, we preach the gospel of lifelong learning not because we love the sound of our own voices, but because staying clued up on financial markets, economic trends, and the latest in personal finance strategies is absolutely crucial. And there is no shortage of resources on that.

This mantra of perpetual education has been a recurring theme in our guidance within the WIA modules - basically, the reason we exist. Being informed isn't just a fancy trait to flaunt at dinner parties. It's what allows you to flex and pivot your financial plans when the world decides to throw yet another curveball your way. And this will happen, as sure as taxes.

Keeping your strategy relevant and robust in the face of global financial tantrums means you need to be on your toes, a textbook (or phone for you young ones) in one hand and the latest financial news in the other. I don't care where you get your news from, but make sure it is reputable.

So, if you find yourself scoffing at the idea of spending your evenings diving into the latest market analyses or wrapping your head around economic theories, remember this: the market doesn’t care. It’s relentless, it’s ruthless, and it rewards those who stay informed and punishes the ignorant. Don’t just aim to keep up—strive to stay ahead. Your wallet will thank you, and frankly, it’ll make our job here at the WIA a heck of a lot more fulfilling.

Find a Mentor

Navigating the financial world can be daunting and isolating and is about as fun as a root canal. Finding a mentor who has tangible, real-world experience in wealth building can provide not only guidance but also inspiration.

Look for the everyday financial heroes, the ones who’ve built their wealth from the ground up. These aren't the folks making headlines because they’ve just bought their third yacht, or are constantly letting you know they're flying first class to Europe (I really do not like those "bro marketers").

No, I’m talking about the ones who know the value of a dollar because they’ve had to work hard for every single one. These are the mentors who can provide not just guidance, but real, tangible inspiration and real experience because they’ve actually lived through the ups and the downs. Trust me, you learn more from the painful episodes.

And hey, since I've brought it up, I do genuinely fit all of the above myself. When I decided to surround myself with mentors, my whole approach to wealth changed. It became more holistic and clear. Now, I want to pass on that golden baton of knowledge. A good mentor will take you beyond the usual yammering about investments and tax strategies, and will instead cover all three pillars of the wealth journey—fluency, strategy, and yes, the all-important mindset. Or they'll just listen. In other words, I am available if you want to reach out.

This section sets the foundation for understanding the critical elements that constitute a robust money mindset, guiding you through not just the "how" but the "why" behind each element. As we proceed, you will notice these same themes recurring, helping you build on the understanding that managing money is as much about managing oneself.

II. Why is Developing a Strong Money Mindset Essential for Wealth Building?

Got your head around those core elements?

Good.

Let’s dig deeper into why nurturing a strong money mindset isn't just a nice-to-have, but an all too critical pillar for piling up that wealth and keeping it.

Impact on Financial Decisions

Want to know why some folks are debt magnets or why they blow fortunes faster than a rigged slot machine?

You don’t need to study interest rates or their investment strategies to get the answer – you just need to dig into the all-too-human history of envy, greed, and optimism (aka that spirit that convinces even the best of us that "this time it's different"). These three are the real-world forces that play a significant role in driving financial decisions every day.

Most of us have experienced one of these at least once. You hear from a friend that a new tech stock is "guaranteed" to skyrocket (if someone had said Nividia in 2023/24, turns out they were right, but let's ignore that one). Everyone's talking about it, and you don't want to miss out. Do you:

A) Dive in headfirst, investing a huge chunk of your savings because you can't bear the thought of everyone else getting rich without you?

B) Take a step back, do your research, and consider how this fits into your overall investment strategy focused on ETF accumulation and conservative risk tolerance before making a move?

If you chose A, congratulations, you’re letting envy and greed drive your decisions. But if you chose B, you're on the right track to developing a healthier money mindset - not because it is conservative, but because it is aligned with your "why".

A healthy money mindset is about consistently making decisions that will compound positively over time. Those sporting a robust financial psyche see setbacks like a bad day at the casino—temporary and instructional, not apocalyptic. They manage risks wisely, invest thoughtfully, and spend deliberately—always aligned with their long-term goals. <— You want this!

On the flip side, a poor money mindset is about as useful as a screen door on a submarine, often leading to impulsive decisions, mismanagement of funds, and a reactive approach to finance.

This often results in accumulating bad debt, missing out on investment opportunities, and enduring a roller coaster ride through fiscal hell often driven by one, or a combination of all three forces mentioned above. It's the kind of mindset that has you chasing get-rich-quick schemes (hello once again to the bro marketers on YouTube) or making fear-based decisions that could scare even Stephen King. <— You DON'T want this (and neither does Mr King)!

In the same city lived another merchant, Giorgio, who in contrast, was the impulsive gambler, seduced by the siren call of immediate gains. His strategy? What's that? His ships were hastily assembled, his crews unvetted, and his routes planned under the intoxicating influence of greed and envy. Each venture was a roll of the dice in a high-stakes game, driven by a desire to outshine his contemporaries. When the rare opportunity to trade with the Far East arose, promising untold riches, Giorgio leaped without looking, investing heavily without regard for the brewing storm season. His mindset was blinded by the glitter of gold, for he saw only the destination and ignored the journey.

As the fleets set sail, a fearsome storm descended, as unpredictable yet inevitable as a market crash. Giorgio’s ships, poorly prepared and overladen, foundered in the tempest. They sank under the weight of their ambitions, taking down fortunes and futures as they plunged. Marco’s ships, however, navigated through the storm with resilience born of careful preparation. His diversified investments and robust planning meant that even those ships that struggled were supported by the rest of his fleet, ensuring not all was lost.

Moral of the story?

The tale of Marco and Giorgio serves as a poignant metaphor for the financial decisions many undertake. Marco’s approach—grounded, diversified, and patient—highlights the merits of a sound money mindset. It’s about playing defense as well as offense and knowing that sometimes, the best move is to hold steady and wait out the storm.

Giorgio’s tragic misadventure? A stark reminder that a poor money mindset, fueled by envy and impatience for wealth, is often a one-way ticket to disaster. We sincerely hope he learned his lesson.

As you reflect on your own financial strategies, ask yourself: Are you a Marco or a Giorgio? Are you making decision to build your financial empire for the long haul, or are you chasing the horizon without a compass?

Long-term Benefits

The story of Marco and Giorgio vividly illustrates how a robust money mindset impacts not just immediate outcomes but sets the stage for long-term wealth accumulation and financial stability.

Marco's strategic, measured approach to investment and risk management didn’t just help him survive the storm, but ensured his financial growth continued steadily into the long term horizon, even in the face of adversity. Think of his strategy like planting an oak tree. You don’t just chuck an acorn in the ground and yell, “Grow!” You nurture it, protect it, and maybe chat with it a bit.

The care and foresight you invest in your mindset in the early days determine the strength and shade it will provide for years to come. Marco’s prudent planning and disciplined investment strategy functioned like strong foundations that supported his growth through volatile conditions.

By diversifying your investments and preparing for potential downturns, you can build a financial fortress that has the best chance of withstanding economic fluctuations and continue to prosper.

In contrast, Giorgio’s approach, driven by short-term gains and a lack of a strategic foundation, highlights the risks of a weak financial mindset. His failure to plan for the long term and his reactive decision-making led to a collapse under pressure and a financial empire that lasted less than the "career" of your average reality TV "star".

To avoid morphing into a Giorgio-clone, you need to develop a mindset that embraces:

- Strategic Diversification: Just as a well-planted garden isn’t reliant on a single source of sustenance, a well-planned portfolio spreads risk and opportunity across a variety of investments. You can read more about the benefits of diversification in Basic Module 8 of WIA.

- Preparedness for Volatility: Think of the financial markets as seasons—they change, they surprise, and they definitely test your wardrobe. Suit up for all weathers by expecting unpredictability and planning for this volatility, ensuring that you are better equipped to handle sudden downturns without panic.

- Consistency and Patience: Rome wasn’t built in a day, and neither is a robust portfolio. Your success will not be the result of a few swift moves but of ongoing, consistent actions aligned with his long-term vision.

Remember, if you want to build wealth that lasts longer than a meme on the internet, take a leaf out of Marco’s book, not Giorgio’s. Long-term thinking, strategic planning, and a cool head will make sure your financial story is one for the history books, not just a cautionary tale.

Evolution of Money Mindset

Establishing the right mindset is a great first step, but it is not the only step. There is a broader truth to learn here: our financial strategies and mindsets must evolve. Sticking to the same old financial strategies is like trying to sail the Atlantic with a map of the Mississippi.

Your relationship with money is crucial to this journey of evolution. Much like any personal relationship, it is dynamic and influenced by several factors from our upbringing to our personal experiences. Early in life, you might find your financial decisions are heavily influenced by your broke college days surviving on ramen (gourmet, obviously).

Or going back even further, it may be deeply influenced by family history and childhood experiences related to money - perhaps you were lucky enough to be exposed to deep-seated money habits passed down from your Great Aunt Mildred who bought stock in typewriters. These influences can shape attitudes toward money, spending habits, and financial responsibility [4].

As you grow up and gain more (sigh) responsibilities and grow richer (hopefully), your financial game plan has to mature too. What worked when you were living paycheck to paycheck isn't going to fly when you're juggling a mortgage, a college fund, your kids' stomachs, and maybe even some retirement fantasies that don’t involve ramen. Applying your old mindset to new, evolved needs is a recipe for disaster.

This progression is essential. Embrace this evolution of your financial mindset like you might embrace a long-lost friend who shows up with a winning lottery ticket. It reflects a deeper understanding and a more sophisticated approach to managing your finances. Early mistakes or successes are part of the learning curve—they shape your risk tolerance, inform your strategies, and refine your goals. Use them to your advantage.

As Morgan Housel points out in his book, you're not going to eliminate the need for money, unless you’re planning to become a hermit (no judgment if you are). So you must master its role in your life, controlling it so that it serves you rather than controls you [1].

- What lessons have you learned?

- What mistakes have you made and what successes have you celebrated?

- How have these experiences shaped your current financial strategies?

Keeping these questions in mind will help you navigate your financial future with greater wisdom and confidence

My Money Mindset Anecdote

You, the readers: "Oh yeah, I bet your mindset "evolved" right from your daddy's trust fund!"

Me:

Pfft, I wish. Let me take you on a stroll down memory lane to my university days. Picture this: a younger me, content with a cheap kebab on a park bench, virtually penniless yet as serene as a retiree on a tropical beach. Back then, my financial strategy was laughably simple: get through the week without tipping my bank account into the red. Life was simple, because, let’s face it, you can’t stress over money you don’t have or need.

Fast forward through a montage of graduation caps and entry-level job hustles to when the real fun begins. I landed a "dream" grown-up job, and with it came grown-up money and grown-up stress. Suddenly, I'm not just eating kebabs, I'm investing in the joint that makes them (not really, but you get my point). But with an increasing bank account came greater stress.

Suddenly, I found myself lying awake at night, agonizing over investments and market fluctuations. The laid-back, carefree mindset that served me well during my ramen-noodle days was suddenly a massive liability. It just didn't fit.

You see, the problem wasn't that my university mindset was wrong. It was perfectly suited for a simpler phase of life. It just didn’t graduate with me. It was perfect for a life of minimal responsibility, but utterly inadequate for the wealth level I wanted and needed. As my goals, ambitions, and responsibilities expanded, my old ways of thinking about and handling money lingered, costing me not just peace of mind but also real financial growth.

Because of my overly cautious nature, a remnant of my university days, my money sat in the bank, gathering dust instead of interest. When I finally clued in that money could actually grow (mind-blowing, right?), I swung from financial sloth to investment cheetah—too fast, too furious, and yup, it ended in a crash (read more about that here).

Here’s the cold, hard cash truth: Your financial mindset needs to evolve with your pay grade. Sticking to your college budgeting tactics when you’re playing in the big leagues is like bringing a knife to a gunfight—adorable, but you’re going to get obliterated.

So, here’s a piece of advice:

Adapt early, and keep refining your approach. A strong money mindset isn't static, but dynamic, evolving with your life’s chapters.

III. What Common Barriers Prevent People from Establishing a Good Money Mindset?

As we explore the transformative power of a positive money mindset, it’s crucial not just to dream about swimming in pools of cash but to face the ugly trolls under the financial bridge that might trip you up. I've experienced and seen firsthand in my mentees how seemingly small mindset obstacles can accumulate and wreak havoc, creating a formidable barrier to financial success.

Recognizing these barriers is a fundamental strategy for anyone serious about building lasting wealth. Understanding who these troublemakers are, where they come from, and how they operate allows us to develop targeted strategies to overcome them effectively.

Identifying Barriers

Several common hurdles can hinder the development of a healthy financial mindset. Let's have a look at what typically stands in the way:

- Cognitive Biases: These are mental shortcuts that can mislead us, causing us to focus only on information that supports our existing beliefs. For example, the anchoring bias might lead an investor to rely too heavily on the first piece of information received (such as the initial stock price) when making decisions, ignoring subsequent information that should influence the choice.

- Lack of Financial Education: A foundational knowledge of financial principles is essential (which is why you're here!). Without it, people can make uninformed decisions, like misunderstanding the power of compound interest on savings or debt. Ignorance might be bliss, but in finance, it's like paying for a premium subscription you don’t need.

- Emotional Intelligence Deficits: Being unaware of or unable to manage your emotions can lead to poor financial decisions, such as panic selling stocks or your favorite dog crypto coin during a market downturn or buying a sports car to soothe a mid-life crisis. Another great example is not managing your anxiety (we ALL experience it). Anxiety about financial matters leads to avoidance behaviors, which can perpetuate a cycle of further avoidance. This cycle often prevents people from addressing their financial issues, which can exacerbate the problems [4].

- Overconfidence and Ego: This dynamic duo can blind you to reality, making you think you’re the financial Midas, and subsequently lead to overly aggressive financial behaviors. For instance, someone might throw all their money into a risky venture believing they're invincible or skip diversification, thinking they’re the next Warren Buffett in the making.

- Limiting Beliefs: These nasty beliefs are the chains you don’t see. They are the deeply held convictions that constrain our behavior. Beliefs such as "I'll never be wealthy" or "Investing is only for the rich" can prevent individuals from taking steps to improve their financial situation. My wife would constantly point out my limiting beliefs, and for a long time I didn't truly understand its power (I owe her a lot, actually!) - until I was forced to face the truth!

- Societal Pressures: Trying to keep up with the Joneses? Spoiler alert: the Joneses are in debt. The pressure to conform to social standards or maintain a certain lifestyle can lead to unsustainable financial habits, like excessive spending on luxury items to project an image of wealth. It's gotten worse since the advent of social media, making you believe that everyone is on vacation in a French Chateau except you. Rachel Cruze nails this argument in her book, "Love Your Life, Not Theirs" – worth a read if you ever feel like smashing your piggy bank while scrolling through Instagram [3]

Understanding Formation

So, how do these barriers form?

In reality, they don't just spring out of nowhere. These obstacles have deep roots, twisted around a mix of psychological messiness and social shenanigans that have been marinating since you were in diapers, shaping how we think about and manage our money.

Let's dive deeper into the origins of these barriers to understand why they emerge and how they influence our financial behaviors:

- Impact of Family and Personal History: Money attitudes are like family recipes—passed down whether you like them or not. If you grew up in a household where money was a constant source of anxiety, you might find that you either shy away from financial risk or perhaps swing to the opposite extreme, throwing caution (and cash) to the wind like a financial rebel without a clue [1].

- Emotional Influence on Financial Decisions: Emotions like fear, guilt, shame, and envy can significantly skew our financial decision-making processes. For instance, Feeling envious? You might splurge on that fancy car everyone’s been Instagramming just to feel like you’re keeping up. Scared? You might sell off stocks at the first hint of a dip, missing out on potential gains because you got cold feet.

- Cultural Influence on Financial Behavior: Cultural narratives around money can deeply influence our financial behaviors. In some cultures, there is a stigma associated with wealth or talking about money, which can deter people from seeking financial success. Conversely, flaunting wealth might be as common as flaunting abs at the beach, prompting poor financial decisions. Chris Hogan’s Everyday Millionaires digs into how these cultural scripts can lead you to make some pretty lousy financial choices [5].

- Impact of Generational Timing: Economic conditions during one's youth can significantly shape their financial attitudes. Come of age during a recession? You might clutch your wallet a bit tighter than someone who grew up during a boom, potentially missing out on beneficial financial opportunities [1].

Recognizing these barriers is the first step, but actively overcoming them demands strategic action and continuous self-awareness.

- How can you reshape your financial strategies to navigate around these common pitfalls?

- What steps will you take to transform your financial thinking into a powerful tool for wealth creation?

Don't worry—I’ve got a plan for tackling each one. The next section dives deeper into practical strategies for breaking down these barriers and helping you reshape your financial destiny.

IV. What Strategies and Skills Can Help Develop a Sustainable Money Mindset?

Let’s revisit a not-so-golden moment in my life—a financial horror story. After a relationship implosion, not only was my heart shattered, but so were my finances. We had optimistically bought a property together, which became a financial burden when I was left to cover the mortgage solo. Overnight, my paycheck vanished into the mortgage, leaving my bank account empty.

Desperate for relief, I took a higher-paying job in a remote location. This move tested my resilience—it kept me afloat but barely. Adjusting to my new financial reality, I became overly conservative, clinging to cash and avoiding any risky investments. Fear dominated my mindset. To add to the chaos, I developed a chronic autoimmune illness. Because why not add a little physical turmoil to financial chaos?

Eventually, I decided to sell the property and buy an apartment, driven more by spite than financial wisdom. I spent half a million on a swanky pad as a show of 'success,' but poor research and market timing left me in debt. This was a harsh lesson in financial education and market awareness.

Salvation came through my now-wife, an entrepreneurial guru with a black belt in mindset management. She revealed a painful truth: my biggest financial drag was not bad luck but my dodgy mindset. Despite a good career and income, my conservative approach had me playing not to lose, rather than to win.

Her insights revolutionized my approach to money. Initially after our chat, I thought I understood the money mindset, but as usual I was wrong. I was juggling financial mindset skills without a solid foundation. An episode of "Engineering Disasters" gave me an epiphany: I needed a financial mindset rebuild, layer by layer - like a skyscraper. As an engineer (and thanks to this wonderful show), I knew the importance of a strong foundation and how each layer relies upon the one below it.

I shifted gears, focusing on building my financial mindset 'skyscraper' from the ground up. I started with the basics, educating myself in financial fundamentals and working on my emotional intelligence.

Once I felt secure in these, I added layers of more complex skills: disciplined decision-making, risk management, and later, some old fashioned discipline (my father would've been proud). Each new level of knowledge was applied only when the foundation was solid enough to support it. And thus, the Intelligent Mindset Skyscraper concept was born (the fancy name came much later).

Within five years, I had transitioned from debt and net losses to owning a seven-figure asset portfolio. Whilst each pillar of the Nexus Wealth Framework played its part in that success, I am in no doubt that the addition of a robust mindset was what truly elevated my wealth gains. This experience was a harsh lesson in managing your emotions in making informed and intelligent decisions, but also being ready for any outcome with resilience and adaptability in your toolbox.

Enough of my rambling. Let’s delve into this skyscraper strategy and see how each layer can contribute to one's financial success.

Base/Foundation: Building Financial Awareness

At the foundation of our Mindset Skyscraper lies the bedrock of financial awareness, crucial for anyone serious about mastering their monetary destiny.

- Self-education: Knowledge is power, especially when it comes to finance and your mindset journey. This is the concrete mix of our foundation. Continuous self-education helps you keep pace with the evolving economic landscape, sharpening your ability to make informed decisions and giving you confidence. It’s about turning every financial news piece, every book, and each seminar into a stepping stone towards greater financial literacy, and doing it on a continuous basis.

- Emotional Intelligence: Positioned at the base because it's fundamental to handling all that money throws at you. Managing your emotions is crucial - I cannot stress that enough (pardon the pun). It helps you recognize and regulate those wild emotional triggers related to money that can sabotage good financial decisions —like that knee-jerk fear when the stock market dips or the irrational exuberance when Bitcoin hits a new high. Master this, and you’re less likely to be swayed by those emotional whims that we described in the previous section and more likely to base decisions on cold, hard facts. Trust me, I’ve ridden the emotional financial rollercoaster more times than I’d care to admit—it’s a wild ride that you can and should avoid if you like your sanity intact.

Lower Floors: Core Money Mindset Skills

Building upon a strong foundation, the lower floors of our skyscraper focus on essential financial skills that every investor should wield like a financial samurai.

- Informed and Deliberate Decision-Making: Let's be clear, investing isn't like betting on horses. Every smart investment or financial plan starts with making well-informed decisions. You should not be chasing every potential gain like a kid after an ice cream truck, but rather waiting until you understand all the risks involved. Whether it’s buying stocks, real estate, or planning for retirement, every decision needs to be steeped in a potent brew of clear understanding of the broader economic implications and personal financial goals. Self-made millionaires, as described in most books, don’t just roll the dice on their fortunes—they strategize like generals in a war room. Every decision, from investments to the latte budget, is calculated with the precision of a Swiss watch. This strategic approach extends to their investments, spending, and saving habits [5].

- Risk Management: Here's where you learn to gauge your financial appetite—and trust me, choking on too-greedy investments is about as graceful as a giraffe on roller skates. Figuring out your risk tolerance is like knowing how much hot sauce you can handle before you start crying and reaching for the milk. It’s essential for tailoring investment strategies that fit what you can stomach, financially and emotionally, rather than those that turn your nights into wide-eyed insomnia fests. When you truly understand (and accept) the risks you can handle, you will experience and love the level of peace you feel with your decisions.

- Discipline: If financial success had a backbone, discipline would be it. This isn't about occasional, half-hearted attempts to stick to a budget, but the iron will to stay your course even when flashy temptations beckon (and no I don't mean ice cream!). Think of it as the financial equivalent of eating your vegetables. It's not exactly a party, but it keeps your wallet from needing a crash diet. The amount times I have come across clients who have developed an iron-clad strategy only to get distracted by the latest shiny object and ask me if they should "invest" in the latest dog coin that Elon Musk is tweeting (X-ing?) about! (No you should not is the answer.) Also, discipline is about being comfortable with your goal! If you don’t need a lot of money to achieve your goal, then you don’t need to stress about building a huge wealth empire.

Mid Floors: Elevated Money Mindset Behaviors

As we ascend to the mid floors, we focus on more sophisticated strategies that cater to individuals who have mastered the basics of the foundation and lower floors and are ready to take their money mindset to the next level. These require a good grasp of the foundational knowledge and core skills on the floors below but add a layer of forward-thinking and strategic adjustment.

- Proactivity: This skill is all about keeping a regular check on your strategy, and not treating it like a forgotten back-of-the-fridge science experiment. Being proactive means you're actually planning your financial moves in advance, adjusting to the economic climate with the precision of a weatherman forecasting rain in London—it's going to happen, so why not be ready for it? If you've never played chess, give it a try and start applying the same strategic moves to your wealth (hint: you have to stay two moves ahead to win)

- Adaptability: The ability to adapt is critical in today’s fast-changing world, where economic climates change faster than celebrity fashion trends (I don't think what they wear constitutes clothes anymore, but let's ignore that for now). Whether it’s shifting market trends or personal life changes, being flexible allows you to pivot your financial strategies faster and more effectively than a politician on debate night.

Upper Floors: Sustainable Financial Behaviors

At the top of our skyscraper, we focus on behaviors that sustain your financial health over the long term. These are your sustainability skills and are really the culmination of all the skills below.

- Patience: In a world that can’t wait two minutes for a microwave meal, patience is about as common as a unicorn in the stock market. But it is an essential tool in your mindset strategy. Wealth building isn’t a sprint, it’s a marathon. It's about playing the long game, not treating your finances like a fast-food order expecting instant gratification. I do not teach get-rich-quick schemes, nor do I believe in them. To succeed in your journey (not just wealth, but life), you need to learn to be patient. The caveat is that you still review your strategy regularly and adjust and adapt, but if there are no clear indicators to pivot, you need to trust in your strategy.

- Resilience: Financial journeys are not without their setbacks - you will suffer a loss at some point, and you need to be able to deal with it. Resilience is what helps you recover from financial missteps or market downturns without losing sight of your overall goals. It's not just about bouncing back, but about bouncing back with a plan and keeping your eye on the prize even when your stocks are doing their best rollercoaster impression. I warn you though, this is not something that can be taught overnight - it will take dedication, experience and mental training. You have to believe it, and you have to want it.

The process of developing a sustainable money mindset truly mirrors the intricate construction of a skyscraper - if that skyscraper had to deal with the occasional economic hurricane. Just as a skyscraper stands firm against the elements with a solid foundation, strong core, and carefully designed upper levels, so too does a well-constructed financial mindset withstand economic fluctuations and personal trials.

Each level depends utterly on the integrity of the one below it, so unless you fancy your financial plans collapsing like a house of cards, you'd better build and maintain each layer as if your net worth depended on it—because, well, it does.

Closing Thoughts

Throughout this exploration of the money mindset, we've tackled key principles and practical strategies that underpin successful wealth accumulation.

- We started by unpacking what a money mindset really involves—its core elements like self-awareness and emotional intelligence, which are essential for making informed financial decisions.

- We then navigated through the typical barriers to a healthy financial psyche, such as cognitive biases, emotional pitfalls, and the often-overlooked impact of cultural and your Uncle Bob's financial horror stories. Recognizing these obstacles is critical, but understanding their origins and learning to overcome them is where real progress begins.

- From there, we moved into practical strategies that help break down these barriers. The Intelligent Mindset Skyscraper concept was introduced, emphasizing the importance of building financial knowledge and skills in a structured, layered approach—starting with the basics and advancing to more complex financial strategies. Because trying to wing it in finance is about as effective as a chocolate teapot.

Reflecting on my personal journey and the lessons learned from countless others, I can affirm that building a sustainable money mindset is not a luxury but a necessity. It’s about constructing a life where financial decisions support personal aspirations without succumbing to fleeting whims or societal dictates.

As we conclude, remember: the strength of your financial skyscraper hinges not just on knowing these principles but on applying them. Take some time out and scrutinize your current financial mindset with brutal honesty.

Are you building a structure that will stand the test of time, or are there cracks in your foundation that need urgent repair?

That's all from this edition of our financial deep-dive. Stick around for the WIA Intermediate Module 2, where we’ll slice and dice stock analysis techniques like a ninja in a cucumber field. Keep your ledgers close and your calculator closer—until next time!

FAQs

1. You mentioned "cognitive biases" as a barrier. Can you explain more about what these biases are and how to identify them in my financial decisions?

Answer: Absolutely! Cognitive biases are those sneaky little mental shortcuts our brains take that can mess with rational decision-making. Think of them as the "auto-pilot" mode of your brain. For example, the "anchoring bias" makes you rely too heavily on the first piece of information you receive. So, if you hear that a stock is a hot buy at $50, you might ignore later info that suggests it’s a dud. To identify them, start paying attention to your decision-making patterns. Are you overly influenced by initial impressions? Do you stick with familiar choices even when better options are available? Awareness is your first defense.

2. I’ve heard about the "Nexus Framework" you developed. Can you give a bit more detail on what that involves?

Answer: Ah, the Nexus Framework—a personal favorite! It’s my roadmap for guiding you to your financial True North. It’s built on three pillars: strategy, fluency, and mindset. Strategy is about having a clear plan for your finances, fluency is being well-versed in financial concepts (knowing your APRs from your ETFs), and mindset is the psychological strength to stick to your plan and adapt as needed. Think of it as the trifecta of financial success: without one, the others just don’t work as well.

3. You talked about financial self-awareness and determining your "why." How can I find my own "why" for financial success?

Answer: Great question! Finding your "why" is about digging deep into what truly motivates you. It’s not just about money—it’s about what money allows you to do. Start by asking yourself what financial success looks like to you. Is it peace of mind, freedom to travel, or maybe ensuring a secure future for your family? Reflect on past experiences and emotions tied to money. Journaling can help, or even talking it out with a trusted friend or mentor. Your "why" should be something that resonates deeply and keeps you focused, especially when the going gets tough.

4. You mention diversification in your investment strategy. How diversified should my portfolio be, and what should I include?

Answer: Diversification is like the financial equivalent of not putting all your eggs in one basket. It helps manage risk by spreading your investments across different assets. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and perhaps some mutual funds or ETFs. The exact mix depends on your risk tolerance, financial goals, and investment horizon. If you're not sure where to start, check out our Investment Principles article in WIA Module 8

5. I understand the importance of emotional intelligence in managing finances, but how can I improve it?

Answer: Improving emotional intelligence is like going to the gym, but for your brain. Start by becoming more aware of your emotions, especially those triggered by money. Do you feel anxious checking your bank account? Do sales make you giddy? Once you’re aware, practice self-regulation. This might mean waiting 24 hours before making a big purchase or setting strict budgeting rules. Also, work on empathy—try to understand others’ financial behaviors and feelings, which can offer new perspectives on your own. Mindfulness practices and stress management techniques, like meditation or exercise, can also boost emotional intelligence over time.

REFERENCES

- Housel, M. (2020). The psychology of money. Harriman House.

- Capable Wealth. (n.d.). The psychology of wealth building and how it has changed me. Retrieved from https://www.capablewealth.com/the-psychology-of-wealth-building-and-how-it-has-changed-me/

- Cruze, R. (2016). Love your life, not theirs. Ramsey Press.

- Gourguechon, P. (2019, February 25). The psychology of money: What you need to know to have a (relatively) fearless financial life. Forbes. Retrieved from https://www.forbes.com/sites/prudygourguechon/2019/02/25/the-psychology-of-money-what-you-need-to-know-to-have-a-relatively-fearless-financial-life/?sh=44e79f92dfe8

- Hogan, C. (2019). Everyday millionaire. Ramsey Press.

- Psych Times (December 2023). The Psychology of Money: How Your Mindset Shapes Your Financial Health. Retrieved from https://psychtimes.com/psychology/the-psychology-of-money-how-your-mindset-shapes-your-financial-health/

- Valiant CEO. (2023). The Psychology of Financial Success: Understanding Your Money Mindset. Retrieved from: https://valiantceo.com/the-psychology-of-financial-success-understanding-your-money-mindset/