Disclaimer: This article is intended for informational and educational purposes only and should not be considered as financial advice. The views expressed are those of the author and are not intended to serve as a replacement for professional financial advice. Individual financial circumstances vary, and we recommend consulting with a qualified financial advisor to discuss your specific situation.

Key Learnings

- Debt Fundamentals: Debt can impact financial health significantly, so understanding the fundamentals is critical

- Types of Debt: Distinguishing between good debt (investment and business loans) and bad debt (high-interest, depreciating assets) is crucial.

- Expert Perspectives: Overview of two financial experts offering contrasting perspectives on debt, from advocating a debt-free lifestyle to using strategic debt for wealth building.

- Debt Management Strategies: Effective debt management involves comprehensive financial reviews, budgeting, and strategic engagements with creditors.

- Leveraging Debt for Wealth Building: Strategic use of debt can aid in wealth building, but comes with inherent risks.

"Is debt a merciless trap, or a stepping stone to prosperity?" That's the million-dollar question many grapple with in their financial journey.

Welcome back to the Wealth Intelligence Academy, where we're about to tackle one of the most misunderstood and yet pivotal aspects of personal finance – debt. Even financial experts disagree on how to manage it (more on that later!).

But what if I told you that debt, when understood and managed correctly, could be a powerful ally?

Debt is the avocado of personal finance – often vilified, yet potentially nutritious for your wealth. There are more myths floating around about debt than there are conspiracy theories about the moon landing.

In our upcoming session, we're going to unravel the intricacies of debt, from the basics of what it truly means to its impact on your financial health. We'll delve into the nuances of good debt versus bad debt, and how each plays a role in your journey towards financial empowerment.

Debt can be a slippery slope, no doubt about it. It is a double-edged sword and it requires a careful blend of knowledge, strategy, and a healthy dose of reality checks. But it's also a tool that, if wielded wisely, can carve a path to wealth and stability. It's about shifting our perspective from fear to strategic understanding, and building the right mindset for this shift (we'll tackle this as well).

So, are you ready to shed light on the true nature of debt, debunk the myths, and harness its potential intelligently?

I. What is Debt and How Does it Affect Your Financial Health?

So what is debt?

Simply put, debt is money that you borrow and must pay back, almost always with interest. It's a financial obligation where you agree to return the borrowed amount over a specified period, and in most cases, pay a little extra for the privilege of using it.

It's like borrowing a book from a friend. Only in this case, the 'book' is money, and unlike your friend, the lender expects some extra 'pages' in return.

Sounds straightforward, right? But here's where it gets as complex as your favorite coffee order. Not all debts are created equal, and understanding this is key to managing your financial health.

Debt directly impacts your financial health. It influences your cash flow, which is the money coming in and going out of your pocket. This means you need to manage it - and manage it well!

Picture your finances as a garden. Properly managed debt can be the water that helps your financial garden flourish. It can enhance your credit score, give you access to necessary funds for significant life events, and even help in wealth building. However, mismanaged debt is like a thunderstorm flooding your garden – it can drown your cash flow, strangle your savings, and choke your investment potential.

Effectively, your financial flexibility depends heavily on how you manage your debts.

Types of Debt: A Brief Overview

Before we delve deeper into this world of mystery, we must understand some basic concepts and terminology:

- Good Debt: This type of debt is when you borrow money for an investment that grows in value or generates long-term income. Examples include education loans or mortgages. It can positively influence credit history when managed well.

- Bad Debt: Debt incurred for purchases that don't increase in value or enhance financial growth. Common examples are high-interest credit card debts used for non-essential spending. This can negatively affect credit history if not managed properly.

- Secured Debt: Debt backed by collateral, such as a car loan or mortgage. If the borrower fails to make payments, the lender can seize the asset to cover the debt.

- Unsecured Debt: A loan not backed by collateral. Examples include credit cards or personal loans. Higher risk for the lender usually means higher interest rates for the borrower.

- Credit History: A record of a borrower's ability to repay debts and manage credit responsibilities. It includes details of credit card usage, loans, repayment history, and credit limit.

- Credit Limit: The maximum amount of credit a lender allows a borrower to use. It applies to products like credit cards or lines of credit and is usually applied in a revolving debt setup where a lender allows a borrower to continually borrow money and pay it back as long as their account is in good standing.

- Installment Debt: A loan repaid over time with a set number of scheduled payments, such as an auto loan or mortgage. Each regular payment (e.g. monthly payment) requires you to pay interest owed and a portion of the principal amount.

- Consumer Debt: Debt incurred for personal, as opposed to business, needs.

- Private Debt: Debt owed to private lenders, as opposed to government or bank loans. Companies often use this form to source funds rather than banks or bank-led syndicates.

- Equity: The difference between the value of an asset and the amount of debt owed on it. For example, if a house valued at $300,000 has a mortgage of $200,000, the homeowner's equity is $100,000.

II. Types of Debt: Good Debt vs. Bad Debt – What’s the Difference?

As mentioned earlier, there is a strong general myth about debt being the big bad wolf out to eat your wealth-laden grandma, but for you to commence your financial education journey with the right mindset and literacy level, it's crucial to understand all facets of debt and how they are used. Understanding this can significantly influence your wealth-building strategy.

As we covered briefly with the definitions, the distinction between good and bad debt hinges on how borrowed money is used and its potential to enhance your financial future.

Good debt, like a student loan leading to a high-paying job, can be beneficial. However, it can turn into bad debt if not managed well. Conversely, bad debt can be transformed into good by being strategic in its utilization [1].

Good Debt: The Strategic Player

When we talk about 'good debt,' we're focusing on a type of debt that’s more like an investment rather than a burden. Good debt has the potential to increase your net worth or enhance your life in a significant, tangible way.

It's characterized by its ability to generate long-term income or growth. This kind of debt is like a seed you plant today, expecting it to grow and bear fruit over time.

Let's dissect this further with some examples:

- Educational or Federal Student Loans: These are typically classified as good debt because they're an investment in your future earning potential, potentially leading to a job where you're not working the graveyard shift at Baskins & Robbins (unless that's a passion of yours, then no judgment). Imagine Sarah, a young professional who aspires to be a software engineer. She takes out a federal student loan to finance her computer science degree. Fast forward a few years, Sarah lands a job at a top tech company, earning a six-figure salary. The loan that once seemed burdensome now appears as a wise investment, catapulting her into a high-earning career.

- Mortgages: Mortgages are a commitment, but they finance a property – an asset that historically appreciates over time. Consider John and Linda, a young couple eyeing their first home. They secure a mortgage for a property in a burgeoning neighborhood. As the area develops, their home's value skyrockets. A decade later, they're sitting on a goldmine, with a property worth far more than they owe. Here, their mortgage was their ticket to substantial asset appreciation.

- Business Loans: Business loans can also be good debt, as they provide the capital needed to start or expand a business. This type of debt generates additional income, making it an investment in your entrepreneurial ventures. Take the example of Alex, who dreams of opening a cafe. He opts for a business loan, and his cafe quickly becomes the local favorite. The loan enabled Alex to materialize his entrepreneurial vision, leading to a thriving business that not only pays off the debt but also generates a steady income.

Bad Debt: The Hidden Trap

On the flip side, bad debt is the type that can drag your finances down. It’s typically used to purchase depreciating assets or things that don’t provide a return on your investment. It’s like buying a boat in the desert – it might look cool, but it's not going anywhere profitable.

Bad debt is often associated with high-interest rates and can lead to a dangerous cycle of debt accumulation.

Let’s delve deeper into this with illustrative examples:

- Credit Card Debt: Credit card debt is a prime example of bad debt, especially when it’s used for non-essential purchases. Such expenses don't add value to your financial portfolio, instead, they depreciate and leave you with high-interest debt and payments.

- Emily's story is a cautionary tale. Her love for designer clothing leads her to accumulate significant credit card debt. The immediate pleasure of her purchases soon turns sour as she grapples with high interest rates, disrupting her financial stability. This scenario illustrates how credit card debt, especially for non-essential items, can quickly evolve from a source of joy to a major financial burden.

- High-Interest Personal Loans: These loans can be easy to obtain, making them a tempting solution for immediate financial needs. However, they come with high-interest rates and can lead to a cycle of debt if not managed carefully.

- Tom's decision to fund a lavish vacation with a high-interest personal loan serves as another example. While the holiday provides temporary delight, it leaves a lasting dent in his finances. The exorbitant interest rates strain his budget and damage his creditworthiness. Tom's experience sheds light on the dangers of high-interest loans, particularly for discretionary spending, and their detrimental long-term consequences.

The key difference between good and bad debt lies in their potential to either improve your financial standing in the long run or drag it down with no substantial return.

Sounds pretty clear-cut, right? Yes and no.

There are experts out there who don't like debt at all - and this might be a good mentality for certain kinds of people at a specific stage of their life. Discovering your own financial personality will dictate which side of the fence you can sit on. Let's take a look at two contrasting views from known experts, followed by my own thoughts.

Expert Perspectives: A Tale of Two Philosophies

Let's consider the perspectives of two financial gurus, Dave Ramsey and Robert Kiyosaki, to paint a clearer picture.

Dave Ramsey’s Debt-Free Doctrine:

Dave Ramsey, a well-known personal finance expert, author, and radio show host, champions a conservative approach towards debt. Renowned for his "Total Money Makeover" philosophy, Ramsey advocates for a debt-free lifestyle.

His mantra? If debt were a snake, he'd be the mongoose.

His method, the 'Debt Snowball Method that we covered previously in the WIA series,' is like a financial cleanse, focusing on eliminating debts from smallest to largest, regardless of interest rates. This approach aims for quick wins, boosting your morale as you see debts disappear one by one.

Ramsey's stance is clear: avoid debt like a plague. He perceives that attempts to consolidate debt are a temporary bandage that fails to address the underlying issue - spending habits.

His advice is straightforward: adjust your lifestyle to live within your means and steer clear of debt to achieve financial peace.

Source (QEOZ)

Robert Kiyosaki’s Leveraging Logic:

Contrasting Ramsey's approach, Robert Kiyosaki, author of the best-selling book "Rich Dad Poor Dad," adopts a more opportunistic stance on debt. Kiyosaki differentiates between 'good debt' and 'bad debt,' advocating the strategic use of 'good debt' as a tool for wealth accumulation.

According to him, 'good debt' is a catalyst that can propel one towards financial growth, provided it's used wisely, such as in real estate or business investments.

Kiyosaki's method is about understanding the nuances of financial markets and using debt to one's advantage. This approach involves a higher degree of financial savvy and risk tolerance.

It's not about shunning all debts but about harnessing the potential of strategic borrowing to enhance one's financial position.

Source: The Rich Dad Channel

By examining these two contrasting perspectives, we can appreciate the broad spectrum of strategies available for managing debt. Whether you align more with Ramsey’s conservative approach or Kiyosaki’s strategic use of debt, understanding these viewpoints can empower you to make more informed decisions in your financial journey.

So, where does my compass point?

My Take:

While I appreciate Ramsey's cautionary stance, especially for those new to financial planning or those with lower risk tolerance, I personally align more with Kiyosaki's outlook based on my risk tolerance and the strategies (this is an important basis).

Leveraging debt strategically can propel your financial growth as I have successfully done, turning liabilities into lucrative assets. However, this requires a solid grasp of financial literacy and a careful assessment of risks - which can take time.

It's not about recklessly diving into debt, but about intelligently and patiently navigating it to reach your financial goals.

The insights from these experts offer valuable perspectives but remember, the path you choose should align with your financial situation and goals. You need to be aligned with your strategy and your risk level at all times.

III. Strategies for Managing Debt Effectively: From Budgeting to Debt Consolidation

Debt management is a journey that requires patience, understanding, and strategic planning.

Without effective strategies, you're like a sailor navigating turbulent seas without a compass – you might stay afloat, but you're at the mercy of the currents.

Let me break it down for you.

Effective debt management is crucial because it's about controlling your money instead of letting it control you. It's about making informed choices, understanding the implications of each debt, and steering clear of pitfalls that can derail your financial goals.

Now, I get it. For a lot of you and the majority of the people who work with me, talking about debt can bring a sense of dread. And I'll tell you what I tell them: there are always options, and knowledge truly is power.

If you're feeling overwhelmed by debt, remember you're not alone in this. There's a whole community out here – including myself – dedicated to empowering you with the education and tools you need.

I am particularly passionate about this topic because this is the one (along with mindset) that can derail anyone if not managed properly. Debt can spiral out of control, leading to increased stress, strained relationships, and limited financial growth. However, with the right approach, you can turn things around, paving the way for a brighter, more secure financial future.

So, if you're struggling with debt, don't lose hope. Start with small steps, educate yourself, and remember, this journey is about progress, not perfection.

The "wealth goal" I am trying to paint for you with the Nexus Framework is not just about numbers in a bank account, it's about your peace of mind, your future, and your ability to enjoy life without the burden of financial stress weighing you down.

So what can you do?

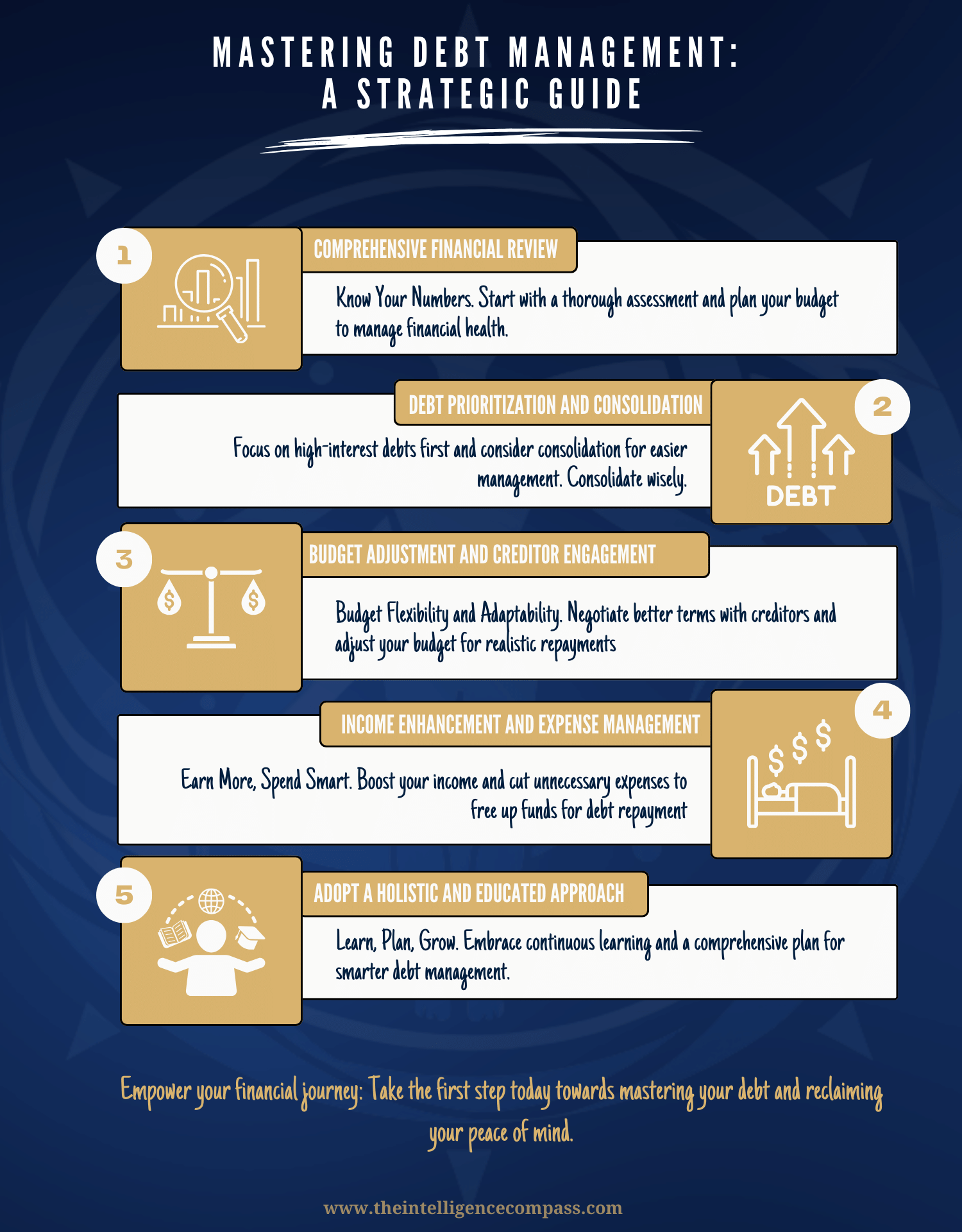

- Comprehensive Financial Review and Budgeting:

- Start by taking stock of all your debts, including their interest rates, and check your credit report for accuracy.

- Create a realistic and practical budget by tracking your income and expenses - follow our guide in the Budgeting module. Identify essential and discretionary spending, and find areas where you can cut back. Redirect these funds towards debt repayment.

- Be honest about your spending habits and adjust your lifestyle to live within your means.

- Strategic Debt Prioritization and Consolidation:

- Focus on prioritizing high-interest debts first, as they cost more over time. Utilize methods like the debt snowball or avalanche to maintain motivation and make efficient progress.

Source: Dave Ramsey

- Explore opportunities to consolidate multiple high-interest debts into a single debt consolidation loan with a lower interest rate, but be mindful of potential impacts on federal loan forgiveness programs. [2]

- Active Engagement with Creditors and Budget Adjustment:

- Negotiate with creditors to possibly lower interest rates or extend payment terms. Creditors may be more accommodating than you think, and this can lead to more manageable repayment plans. [3]

- Determine how much you need to pay monthly, including any consolidated payments, and adjust your budget accordingly. If the total exceeds your current budget, contact lenders to discuss alternative arrangements.

- Income Enhancement and Expense Management:

- Increase your income through additional jobs, freelancing, or monetizing hobbies. Simultaneously, reduce unnecessary expenses to free up more funds for debt repayment. I know you will roll your eyes here, but gaining additional income is easier than you think if you apply yourself - the internet is a wonderful place to upskill if you know where to look! If you're struggling, reach out to me - more than happy to help.

- Adopting a Holistic and Educated Approach:

- Seek professional guidance from debt management agencies or financial advisors for tailored strategies and support. Set up a debt management plan, or DMP, which is a service offered by nonprofit credit counseling agencies. With a DMP, unsecured creditors (mainly credit card providers) and credit counselors work together to create a plan for you to pay off your debts within a specified time period [4].

- Build an emergency fund to avoid the need for additional borrowing in unforeseen circumstances. Regular WIA readers should already be familiar with this one.

- Continuously educate yourself about personal finance and debt management, and adopt a positive mindset shift regarding your financial journey (I'll take care of this for you right here)

A Case Study: Emma and Chris - From Overwhelmed to Overachievers

Let me tell you about Emma and Chris (*names changed to protect the innocent), a couple of family friends who bravely volunteered as guinea pigs for my financial wisdom. When they first came to me, they were neck-deep in debt, and with a baby on the way, the stress was almost palpable.

Chris, the local hardware store's favorite son, and Emma, a part-time graphic designer who could make a rock look pretty online, were the quintessential young couple typical young professionals who'd found themselves in a financial quagmire, unable to escape.

Their issue wasn't uncommon: credit card debt, auto loans, and a personal loan for a holiday that felt like a ball and chain. Chris, in his typical male-take-control manner, was looking for a quick fix. He wanted to "sort the debt out" and move on.

But as I often say, dealing with debt is not just about strategy, it's about a mindset shift as well. If you don't do it right, you will soon return to the same spot because the underlying behavior has not changed (Dave Ramsey will love me for saying that).

Through a series of caffeine-fueled strategy sessions (and a few beers for good measure), I walked them through the essentials of debt management - not giving them specific advice, but educating them on concepts and helping them shift their perspective towards the long term.

They started by getting their budget in order, cutting back on non-essentials, and focusing on high-interest debts first. The real challenge was in Chris's mindset. The guy had to learn that quick fixes in finance are like Band-Aids on a broken leg – utterly pointless in the long run in avoiding a repeat scenario.

Slowly but surely, he came around - I'd like to take credit, but it was all Emma. They built an emergency fund, a concept they initially scoffed at but soon realized its critical role.

Fast forward to today, and Chris has taken the leap into entrepreneurship, running his successful landscaping business. This wasn't just a transformation in their personal finances but also in how Chris approached the business's financial health.

He applied the same principles of debt management, budgeting, and emergency funds to his company, laying a robust foundation for sustainable growth.

Emma and Chris's journey is a testament to the power of financial literacy and mindset.

I merely taught them to fish - they then mastered the seas of their financial ocean.

It's a reminder that with the right knowledge and a shift in perspective and resilience, anyone can turn their financial situation around if they are equipped with the skills and tools to navigate their financial journey independently.

And that's what The Intelligence Compass is all about - empowering you to take control of your financial destiny.

So, as you ponder over these strategies, ask yourself: How can you adapt these methods to fit your financial scenario?

IV. How to Leverage Debt for Wealth Building

Transitioning from our exploration of managing debt, we now dive into a fascinating aspect: leveraging debt for wealth building – sounds a bit like financial gobbly gook, right? It's really simple actually.

This shift from defense to offense in the financial game can be thrilling, yet it demands savvy and understanding.

It is about using borrowed money strategically to enhance your wealth. The idea is not just to borrow, but to invest in options that will yield returns greater than the cost of the debt.

For example, let's say you take a loan to buy a rental property. The rental income covers your loan payments and, over time, the property appreciates in value (not a guarantee, but history will tell you it is a high probability...unless you bought a haunted house, then all bets are off).

Eventually, you sell it for a profit that surpasses what you initially borrowed and paid in interest. This is leveraging debt smartly – using borrowed funds to create a cash flow and asset appreciation.

Let’s go deeper with some numbers.

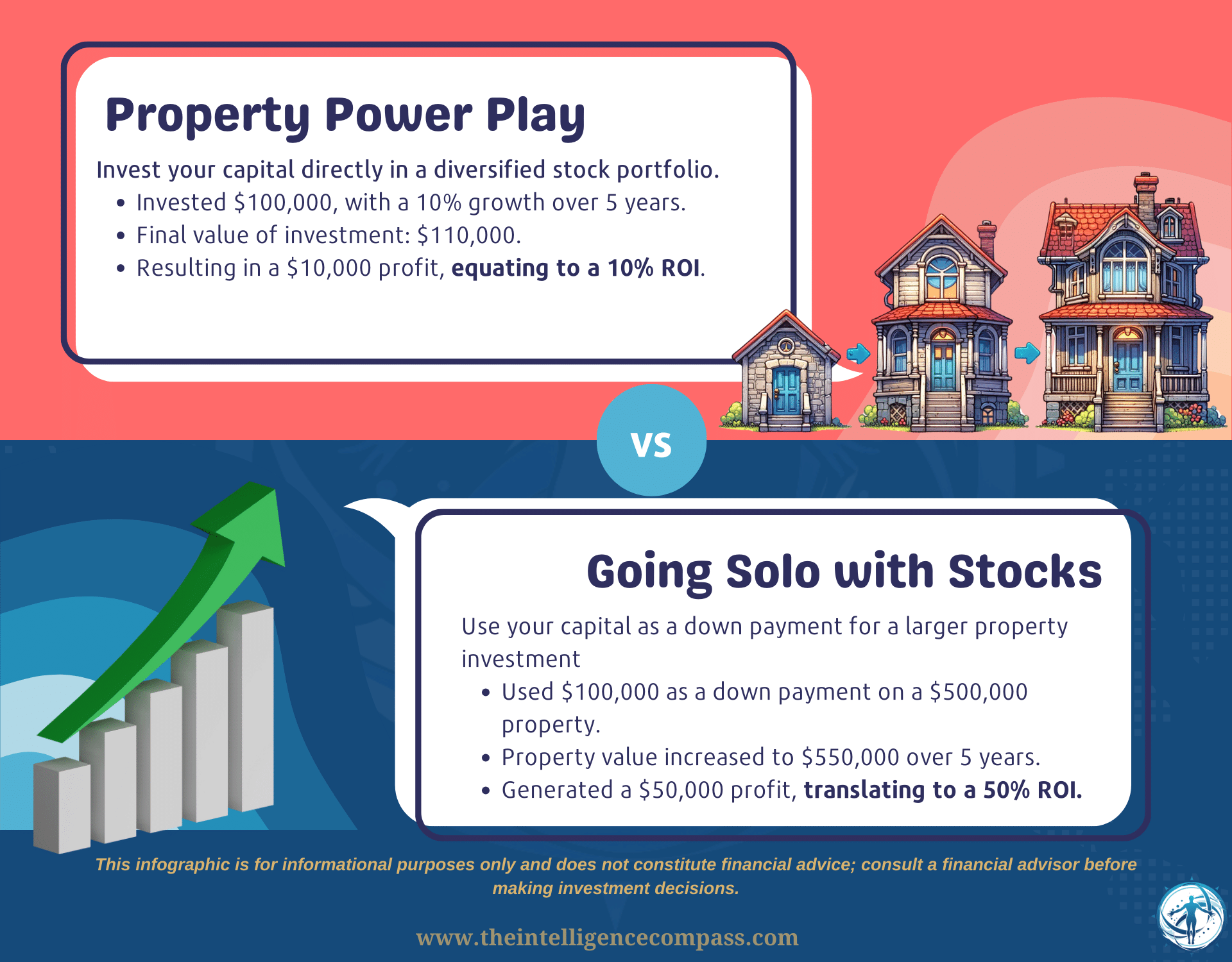

Let's say you have $100,000 cash. You're at a crossroads with two distinct investment options: One path leads to investing this directly in stocks, while the other involves using this sum as a 20% down payment on a $500,000 house.

Option 1: Going Solo with Stocks

- You invest the entire $100,000 in a diversified stock portfolio.

- Over 5 years, let’s assume your portfolio does well and appreciates by 10%.

- Your stock investment is now worth $110,000.

- Your profit: $10,000.

Not bad, right? A neat $10,000 profit - hello, new Chanel bag/Tag Heuer watch (I have to cater to everyone here, don't judge me!)

Option 2: The Power Play with Property

- You use the $100,000 as a 20% down payment on a $500,000 house, and borrow the remaining 80%.

- Assume the real estate market also grows by 10% over the same period.

- The house is now valued at $550,000.

- You decide to sell the house at this increased value.

- After paying off the remaining mortgage, your profit from the house sale is not just 10% of your initial $100,000 investment, but 10% of the entire $500,000 value of the house. That’s $50,000.

Analyzing the Outcome:

- In both scenarios, your investments appreciated by 10% and in both cases where you used only $100k of your own cash.

- However, the return on investment (ROI) is significantly different. In the stock scenario, your ROI is 10% ($10,000 profit on a $100,000 investment).

- In the real estate scenario, your ROI is 50% ($50,000 profit on a $100,000 investment), due to the leverage used in purchasing a more valuable asset with the same initial investment.

This example illustrates the power of leveraging debt in wealth building. By using your $100,000 to secure a loan for a $500,000 property, you magnify the potential returns. The key lies in the fact that the appreciation rate applies to the total value of the asset, not just your initial investment.

But, as with any exciting game, there are risks to consider. Leveraging increases your potential rewards, sure, but it also magnifies the risks (more on this below).

Implications for Long-Term Financial Planning

Leveraging debt is like adding spice to your financial curry – it can enhance the flavor but also make it too hot to handle if you’re not careful.

It plays a significant role in shaping your credit score, which in turn affects your borrowing capacity. A solid credit score, built through responsible debt management, can open doors to better interest rates and more favorable borrowing terms in the future.

Moreover, the way you handle debt can significantly impact your retirement planning. Mismanaged debt can eat into your retirement savings, while smartly leveraged debt can help in building a more robust financial nest egg.

Expert Insights: Robert Kiyosaki’s Perspective

As we've already touched on in Section II, Robert Kiyosaki, in his book "Rich Dad Poor Dad," (one of my favorite books) champions the concept of using debt as a tool for wealth building [6].

He's like the cool uncle who teaches you how to play poker while everyone else is playing Go Fish. His mantra? Use 'good debt' to buy assets that make money while you sleep.

Kiyosaki’s approach involves using 'good debt' to finance investments, like real estate or business ventures, that generate income or appreciate over time.

This approach, however, requires a solid understanding of market dynamics and a well-thought-out strategy. It's not about recklessly accumulating debt but about leveraging it to create more wealth.

Risks and Rewards of Leveraging Debt

When diving into the world of leveraging debt for investment, it's crucial to understand the delicate balance between risk and reward.

Exploring the Rewards:

- Greater Return Potential: Leveraging debt can significantly boost your potential returns. If your investment appreciates in value, the returns are calculated on the total asset value, not just your initial investment. This can lead to substantial gains, far exceeding what you could achieve with your funds alone.

- Strategic Asset Accumulation: Leveraged investments allow you to acquire larger or more valuable assets than you could with cash alone. This can be particularly advantageous in real estate, where owning a more valuable property can lead to higher rental incomes or greater capital gains.

- Low-Interest Rate Opportunities: In periods of low-interest rates (i.e. not now in 2024), the cost of borrowing is reduced, making it an opportune time to leverage. If the return on your investment is higher than the interest rate on your loan, you benefit from the spread, effectively growing your wealth faster.

Understanding the Risks:

- Financial Liability: The most glaring risk in leveraging debt is the obligation to repay the loan, irrespective of your investment’s performance. If your investment value drops, not only do you lose on the investment, but you also remain liable for the loan repayment.

- Magnified Losses: Leveraging amplifies the impact of market fluctuations on your investment. For instance, if you borrow to invest in a property or stocks and their value decreases, your losses are not limited to your initial investment but extend to the full value of the asset. This can lead to a situation where you owe more than the asset's worth.

- Interest Rate Fluctuations: While you might borrow at a low interest rate, rates can change. If they rise, the cost of your debt increases, which could eat into your investment returns or even turn a profitable investment into a loss

As with all financial decisions (and in life in general), it is a balancing act of risk and reward (something you will get used to when reading this blog). It demands intelligent informed decisions, a cool head, and a solid grasp of risks.

Here are three key items to consider:

- Informed Decision-Making: The key to successful leveraging lies in making informed decisions. Understanding the market, the asset you're investing in, and your own risk tolerance is essential. There's no side-stepping this one - you will have to research and up-skill yourself.

- Risk Management: Employing sound risk management strategies, like diversifying investments and regularly reviewing your portfolio, can help mitigate potential losses.

- Mindset Shift: Embracing leveraging debt for investment purposes requires a mindset shift. It's about viewing debt not as a burden, but as a tool for wealth creation, used judiciously and strategically.

My Personal Journey with Debt

Ah, debt. My old frenemy. There was a time when I viewed debt like a black hole in my financial universe – mysterious, terrifying, and something to be avoided at all costs.

I remember once grandly declaring to my wife (and our perplexed toddler) that my debt limit was a cool million. Why a million? No idea. It sounded impressive, a sign of great "risk management" I thought.

Fast forward through a saga of books, podcasts, and some late-night Googling, and my relationship with debt started to change. It was like going from thinking all spiders are deadly to realizing some can actually take out the pesky flies in your house (hello George the spider in our alfresco!)

My journey involved shifting from a fear-based mindset to one where I understood and respected the power of calculated leveraging.

You see, there is no such thing as "too much debt" if you have already assessed your risk and it is aligned with your overall strategy. And it is a matter of perspective. Mr Kiyosaki might have debts in the millions, which is not too much for him, but it is for your neighbour (who hopefully is not Kiyosaki or a multi millionaire).

I started small, with investments that felt like ordering the mild hot sauce at Nando's instead of the regular. I dipped my toes into the world of rental properties, using loans that were less 'leap of faith' and more 'carefully calculated hop'.

Sure, there were hiccups along the way (one of my properties is still below the price I bought it at, ten years later) but hey, even baseball players don't bat a thousand. My strategy was that it just needed it to work 75% of the time for us to reach our wealth goals. And I haven't regretted this approach.

In conclusion, leveraging debt for wealth building is a nuanced art. It demands a careful evaluation of the risks and rewards, a solid understanding of the investment landscape, and a mindset attuned to strategic risk-taking.

As always, the key is education and understanding. By grasping the principles and weighing the risks and rewards, you can turn debt into a powerful ally in your journey to financial success.

While leveraging debt can be a powerful tool for wealth accumulation, it's crucial to acknowledge the psychological dimensions it brings.

V. Coping with the Emotional and Psychological Impact of Debt

Navigating from the strategic world of leveraging debt to the often-overlooked emotional landscape it creates, let's address a crucial aspect of debt management: the psychological impact.

The Psychological Weight of Debt:

Debt isn't just a financial challenge, but an emotional and psychological hurdle as well. My personal experiences, growing up in a family grappling with debt and unable to manage it, have shown me how deep these challenges can run. It's about the impact on every facet of life, from your mental well-being to your relationships and work performance.

The interplay between financial stress and mental health is complex and profound. Research by the Money and Mental Health Policy Institute reveals a stark reality: nearly half of those struggling with debt also battle mental health issues.

Furthermore, individuals with mental health concerns are 3.5 times more likely to find themselves in problematic debt [7]. This data underscores the vicious cycle where debt and mental health issues feed into each other, exacerbating the problem.

The emotional toll of debt manifests in various ways. It can trigger a spectrum of feelings – from denial and anger to depression and anxiety. These aren't transient emotions, but elements that can significantly affect your cognitive abilities, including learning and decision-making skills.

More troublingly, they can lead to harmful behaviors such as compulsive spending, impaired judgment, strained relationships, and substance abuse [9]. These reactions are often subconscious methods of coping with the stress and turmoil caused by financial difficulties, and all the outcomes you don't want when trying to orchestrate your wealth journey.

So what can you do? If you find yourself among the many bearing the psychological brunt of debt, it's crucial to explore effective strategies for dealing with these challenges.

Strategies for Emotional and Psychological Coping

- Recognize and Address Emotional Responses: Acknowledging these emotional responses and addressing them head-on is the first step. Replace negative behaviors with positive ones. Instead of compulsive spending, focus on activities that promote mental well-being, like meditation or physical exercise, or engaging in hobbies can help alleviate stress. These activities not only provide a mental break from financial worries but also boost your overall well-being.

- Seeking Professional Help: For those facing severe anxiety or depression due to debt, consulting mental health professionals for counseling and support is crucial. Remember, it's okay to seek help. You're not alone in this journey.

- Financial Counseling: Sometimes, the best way to tackle emotional stress from debt is by addressing the root cause. Working with financial advisors or counselors can help you create a realistic budget, explore debt management options, and develop a plan to get back on track [8].

- Open Communication: Discussing your financial concerns with family and friends can provide emotional support and reduce feelings of isolation. A problem shared is a problem halved, and you might be surprised at how understanding and supportive your loved ones can be. If you're completely lost, contact me and whilst I can't provide direct financial advice, I can educate and lend an ear if that's all you need (admin@theintelligencecompass.com).

- Mindset Shift: Changing your perspective on debt is crucial, as mentioned here a few times. Instead of viewing it as a perpetual burden, consider it a challenge to overcome, a step in your journey toward financial literacy and freedom. Practice the art of meditation. Celebrate small victories and keep your eyes on the goal. If you're not quite there yet, focus on steps 1-4 first.

Psychological Resilience in Debt Management:

I do want to focus on number five above a little bit more because the mindset is a key pillar in my wealth framework.

Building psychological resilience is key in handling debt. This involves not just managing your finances but also nurturing a positive mindset. Understanding that debt is often a part of life's journey, and developing the resilience to face it head-on, can transform your approach to debt management.

This shift in mindset is critical. It's about empowering yourself to take control of both your financial and emotional health.

Remember, your journey to becoming debt-free is about holistic well-being, encompassing both financial and mental health. By addressing the emotional and psychological impact of debt, you lay a solid foundation for not just financial stability, but a happier, healthier life, as well as ensuring that any future setbacks (and they will happen!) will be dealt with appropriately and will not cause you to detour.

Key Takeaways

Given the importance of the link between debt and mental health, I do want to summarise the key points here:

- Recognize the link between debt and mental health, and don't underestimate the emotional impact of financial stress.

- Employ practical steps like self-care and professional guidance to manage the stress associated with debt.

- Embrace a mindset shift towards viewing debt as a manageable aspect of your financial journey, not an insurmountable obstacle.

- Remember, overcoming debt is not just a financial victory, but also a significant step towards psychological resilience and overall well-being.

As we wrap up this section, it's important to reflect on these key takeaways. They serve as crucial reminders that managing debt is not just about numbers and strategies, but also about handling its emotional repercussions. This holistic approach is essential for not just overcoming debt, but also for ensuring a healthier and more balanced life.

Closing Thoughts

And there you have it – an expedition in answering the key question of "what is debt?". From understanding its nature to mastering strategies for managing and leveraging it, we've covered significant ground.

- We started with understanding what debt is – a financial obligation that, when managed well, can be a tool rather than a burden.

- We explored the types of debt, distinguishing between good and bad debt, and how each influences your financial health. Remember, not all debt is created equal, and differentiating between them is critical in shaping your financial strategy.

- We then navigated through effective debt management strategies, emphasizing the importance of budgeting, consolidation, and smart repayment plans. We've seen real-life examples like Emma and Chris, who transformed their financial narrative through education and strategic planning.

- Moving into leveraging debt for wealth building, we discussed how debt, when used intelligently, can amplify your financial growth. Remember the example of using $100,000 to either buy stocks or as a down payment for a property? That's the power of leveraging at work, illustrating how debt can work in your favor.

- But let's not forget the psychological aspect. Debt isn't just a financial concept, but an emotional and mental challenge too. Building psychological resilience and maintaining a positive mindset are paramount in your debt management journey.

As we close this chapter on debt management, remember, you're not just a bystander in your financial story, you're the lead actor. The journey with debt – understanding it, managing it, and sometimes leveraging it – is a path to mastering your financial destiny. It's about turning what often feels like a financial foe into a friend that helps you build the future you dream of.

Don't forget to share your experiences, your victories, and even your challenges and questions with debt management with our community. Your insights and stories are not only valuable to your own journey but could be the guiding light for someone else in their financial path.

Stay tuned for our next deep dive in the Wealth Intelligence Academy series, where we'll unravel the mysteries of banking and how banks work. It's another crucial piece in your puzzle of financial literacy, yet often remains shrouded in mystery.

In the meantime, if you're bored, check in below with our favourite financial adventurers in the latest hard to believe financial plot developments in the Nexus Saga.

As always, I'm here to guide you, to offer insights and lessons from my journey, and to help you avoid the pitfalls I once stumbled into.

Let's transform knowledge into power, and power into prosperity.

Please note: The information provided in this article is intended for educational and informational purposes only. It does not constitute professional financial advice. Financial decisions should be made based on your individual circumstances and goals. We recommend consulting with a qualified financial advisor to obtain advice tailored to your specific situation

References

- Khan Academy. (n.d.). Debt and its causes. [Link]

- TIAA. (n.d.). Seven steps to more effectively manage and reduce your debt. [Link]

- TreeTop Financial. (n.d.). 5 expert strategies for effective debt management. [Link]

- Achieve. (n.d.). Debt management plan. [Link]

- Consumer Financial Protection Bureau. (n.d.). How to reduce your debt. [Link]

- Kiyosaki, R. T. (2017). Rich Dad Poor Dad (2nd ed.). Plata Publishing.

- Debt.org. (n.d.). Emotional effects of debt. [Link]

- Mental Health Foundation. (n.d.). Debt and mental health. [Link]

- Soomin Ryu and Lu Fan. (2022). "The Relationship Between Financial Worries and Psychological Distress Among U.S. Adults". NIH, 44(1), pp.16-33. [Link]

- New York Fed. (2023, November 7). [Total Household Debt Reaches $17.29 Trillion in Q3 2023; Driven by Mortgage, Credit Card, and Student Loan Balances]. [Link]

- CNBC. (2023, November 9). [Average credit card balances top $6,000, a 10-year high, as delinquencies rise]. [Link]

- Investment Executive. (n.d.). [Equity, debt market activity up in 2023]. [Link]

Nexus Saga